1/ Consider becoming a supporter, if you're not already. You get full archive access and premium notes.

2/ Know someone who might like to read this? Share it with them via the links at the bottom of the newsletter.

Four things today, and, as usual, send me a note if you see something that you want me to see.

- Battery metals exploration is at record highs worldwide

- Record number of research papers retracted

- The Canadian real estate bubble unbubble-ing

- How drought created modern skateboarding

01. Battery metals exploration records all-time high

Given the global growth in electric vehicle demand, the ardor for batteries-related metals continues unabated, especially lithium, with myriad consequences. Ongoing projects are attracting growing attention, both because of their scale and their environmental consequences.

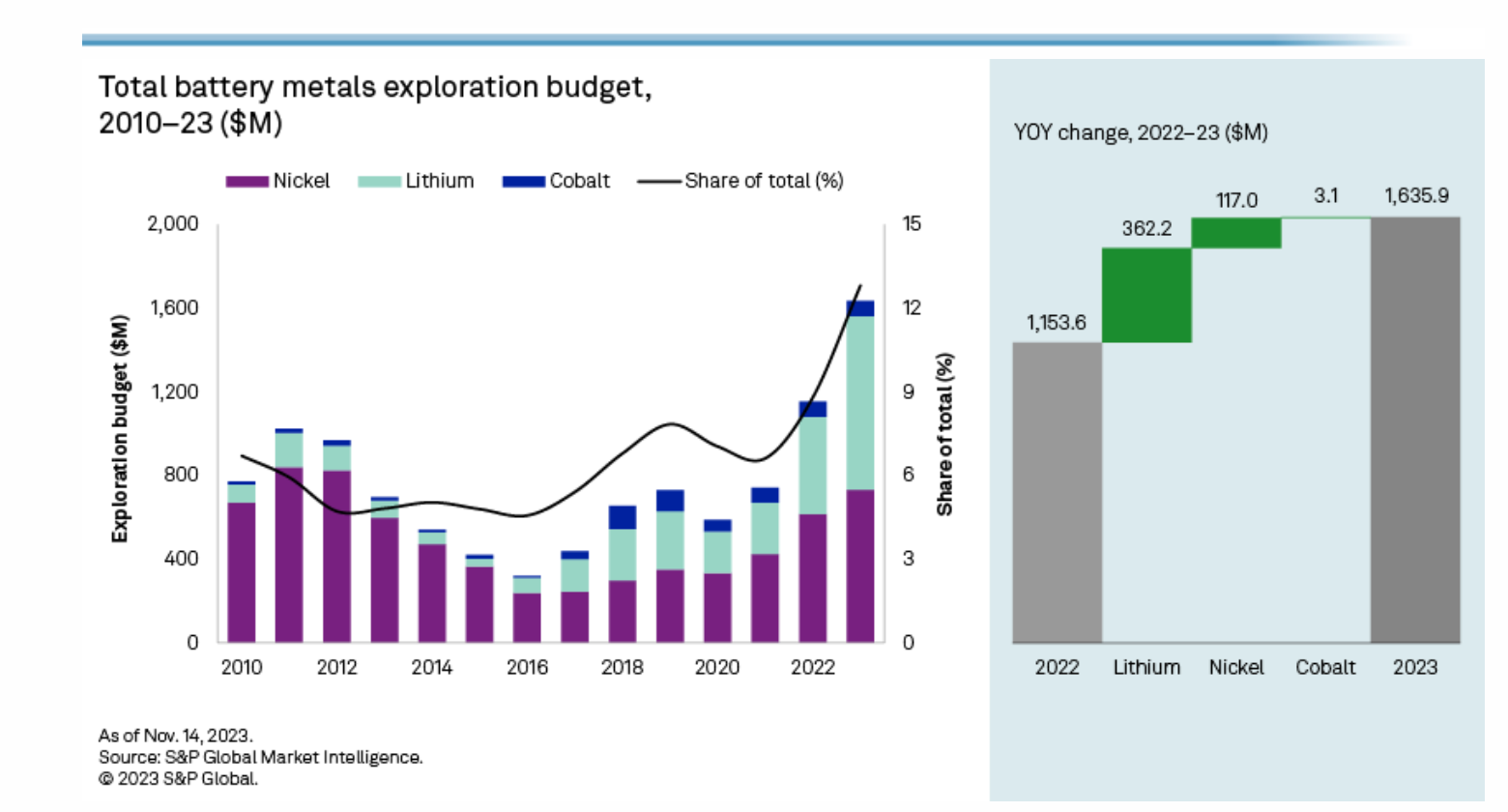

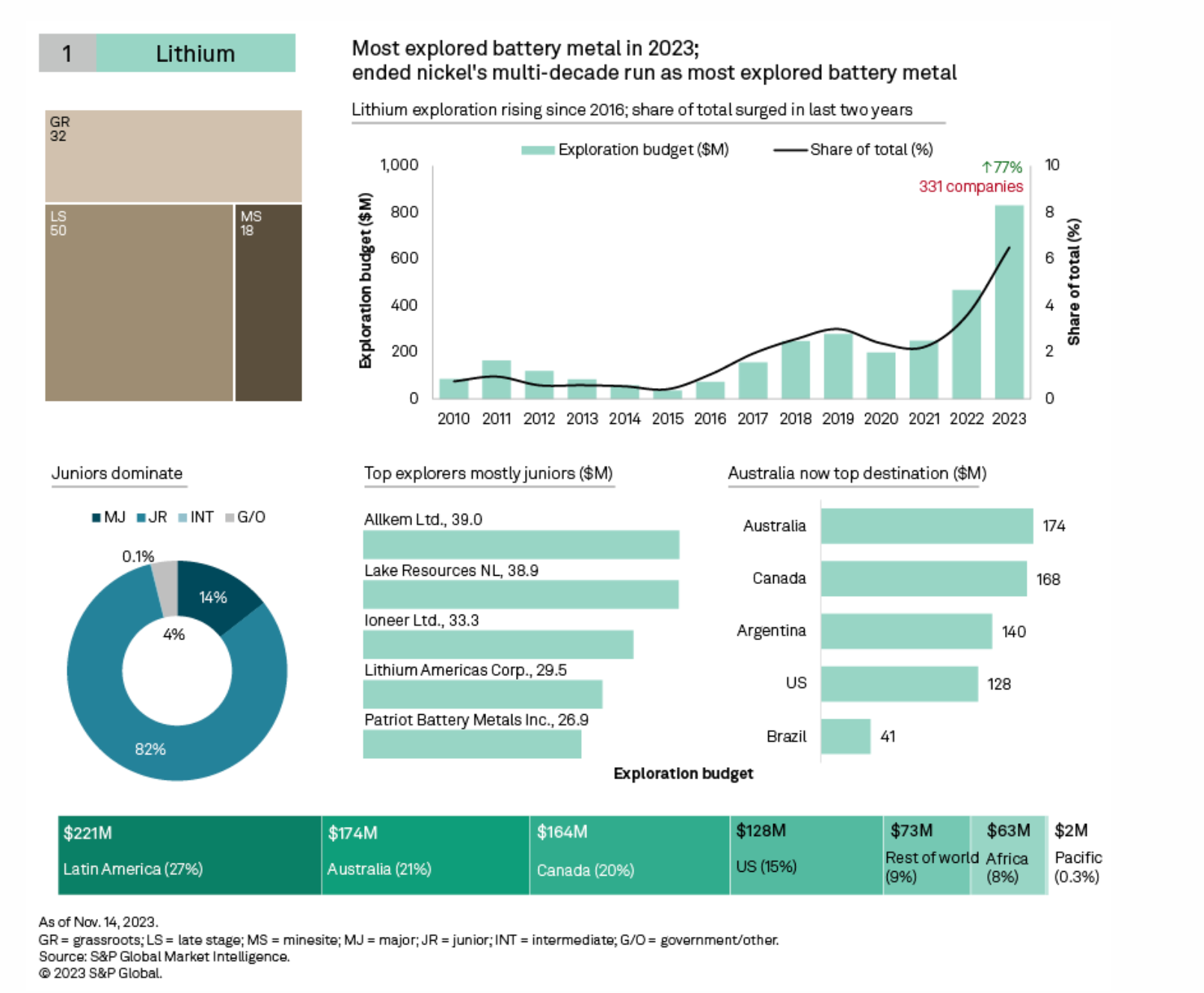

Before turning to one project in particular, a quick look at the metals exploration fervor. As you can see in the following S&P figure, total global metals-related exploration spending is at record levels, nearly double its 2011 peak. While lithium gets most of the attention, 2023 will have been the first year that more money was spent searching for lithium than for nickel, the next most explored-for metal.

Looking closer at lithium exploration, the most active companies are mostly what are called in the industry "juniors", which are smaller companies, not the largest extraction companies. Their main geographic targets are Australia, Canada, and Argentina, followed by the U.S. (and more on that in a moment). Driven by market demand and higher prices, exploration has surged in recent years, with previously less appealing supplies becoming more attractive.

A good example of this is the recent fervor over a new report showing larger-than-expected possible lithium reserves in California's Salton Sea. A landlocked sea created by Colorado River irrigation runoff, and saltier than the Dead Sea, the Salton Sea has been described as California's greatest ecological catastrophe. And it's not far off, given that it is not natural, nor can it be allowed to dry up, given the vast impact on everything from nesting birds to dust-related air quality all the way to Los Angeles and San Diego.

But its salty waters hide lithium and lots of it. Sort of. Because it's complicated. The report, from the Lawrence Berkeley National Laboratory, suggests multiple reasons for high amounts of lithium in a subsurface brine reservoir at the location, including Colorado River sediments, weathering of local ranges, and lithium-rich volcanic and igneous rocks from historical geological events. Whatever the source, or sources, various processes, including the evaporative concentration of lithium-bearing waters, may have enriched the brine's lithium content over time.

Extracting this lithium—estimated at over 18 million metric tons, or enough to produce 382m (non-Rivian) electric vehicles—is not straightforward. There are both environmental and geological considerations.

First, expanding geothermal energy production and lithium extraction will impact water availability in the region, with estimates that around 3% of the historically available water supply would be required for these operations. Of course, that is a moving target, given long-term drought conditions in the western United States will affect water availability to the region, given its reliance on declining Colorado River flows.

Second, moving fluids within the subsurface, which is part of the lithium extraction process, could impact subsurface pressures and stresses and potentially trigger seismic activity, as we have seen with fracking in the past. Given the proximity of the San Andreas fault, this is a material concern.

Finally, the process will likely cause regional emissions of various pollutants, including particulates, hydrogen sulfide, ammonia, and benzene. While no worse than in other industrial settings, the scale will vary with the scale of operations, and it will occur in a region that is already prone to regional air quality problems, given sand from the drying sea itself.

Given all of this, that the project is still being seriously considered takes as back the original discussion of the rapid expansion of lithium mining around the world. And, at the same time, it is worth noting that the supply is very elastic, depending on price (which will make more of the deposit viable), and technologies, which must stand up to a harsh salt and desert environment. A more realistic estimate of the total lithium supply might be closer to 4.1 million metric tons, less than a quarter of the claimed total.

02. Record Number of Research Papers Retracted

One of the misunderstood aspects of modern science is that findings are cumulative and equivocal, and subject to revision. That is not the same thing, however, as retraction: the actual withdrawal of a published paper. The latter is much more worrisome, implying that something is wrong with the process of research that produced and published the paper.

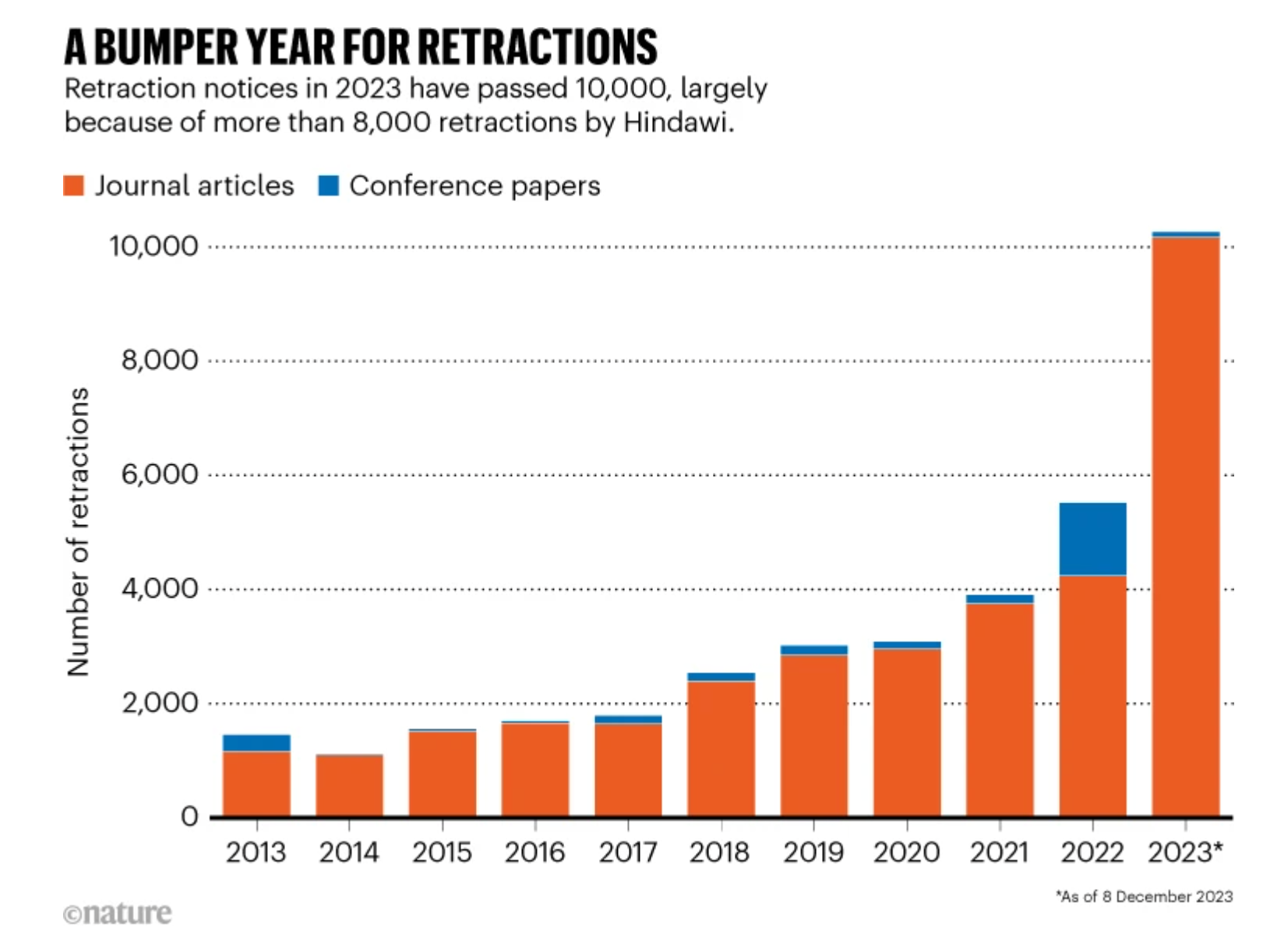

That is why the following graph from Nature is so striking: This year has seen a huge spike in the number of retracted papers, reaching record levels.

The immediate thought most will have is that this must have something to do with AI-generated papers. And while there have been those, and they are a growing issue, this explosion in retractions is almost entirely due to a single, high-volume Indian publisher, Hindawi, and its practices with respect to editing and producing special issues.

Without getting too deeply into the weeds, the gist is that the publisher built a business wherein it made money without being too particular about how papers were refereed or edited. Researchers, desperate for more publications to fill out their CVs, were happy to get things published, and academic departments were happy to see their researchers getting things out there, and so it went—until it became obvious that many of the papers were dubious at best, and outright fraudulent at worst.

While that problem is now being resolved via retractions, it adds to the changing reputation of academic publications just as AI is coming on the scene. We will almost certainly see waves of AI-related retractions in the future. This is just the beginning.

03. The Canadian Real Estate Bubble

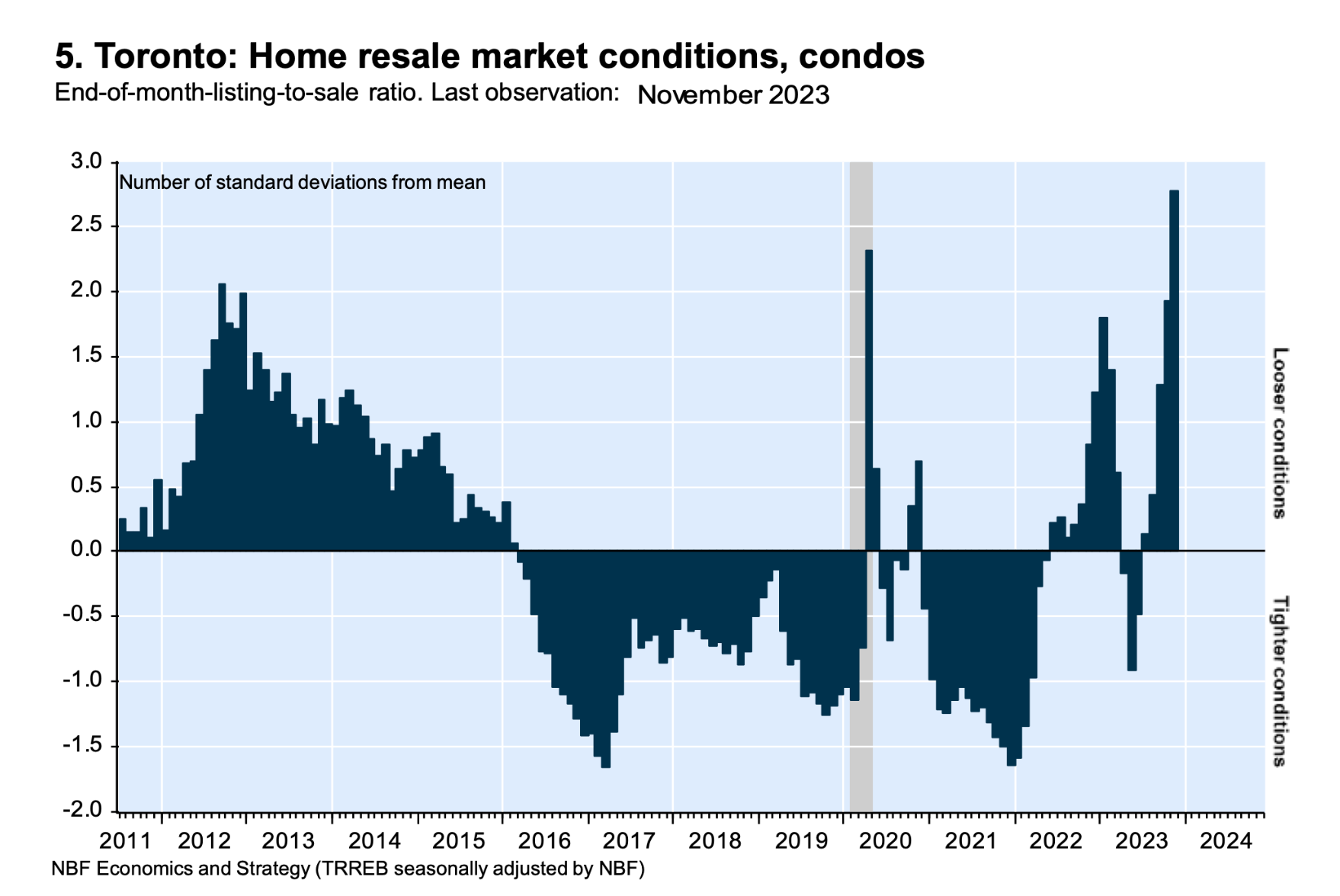

I have written here various times about the ongoing Canadian real estate bubble, the largest and longest-standing such bubble in the world. It is showing signs of slackening lately, largely driven by high prices by newly higher rates taking affordability to among the lowest levels in decades.

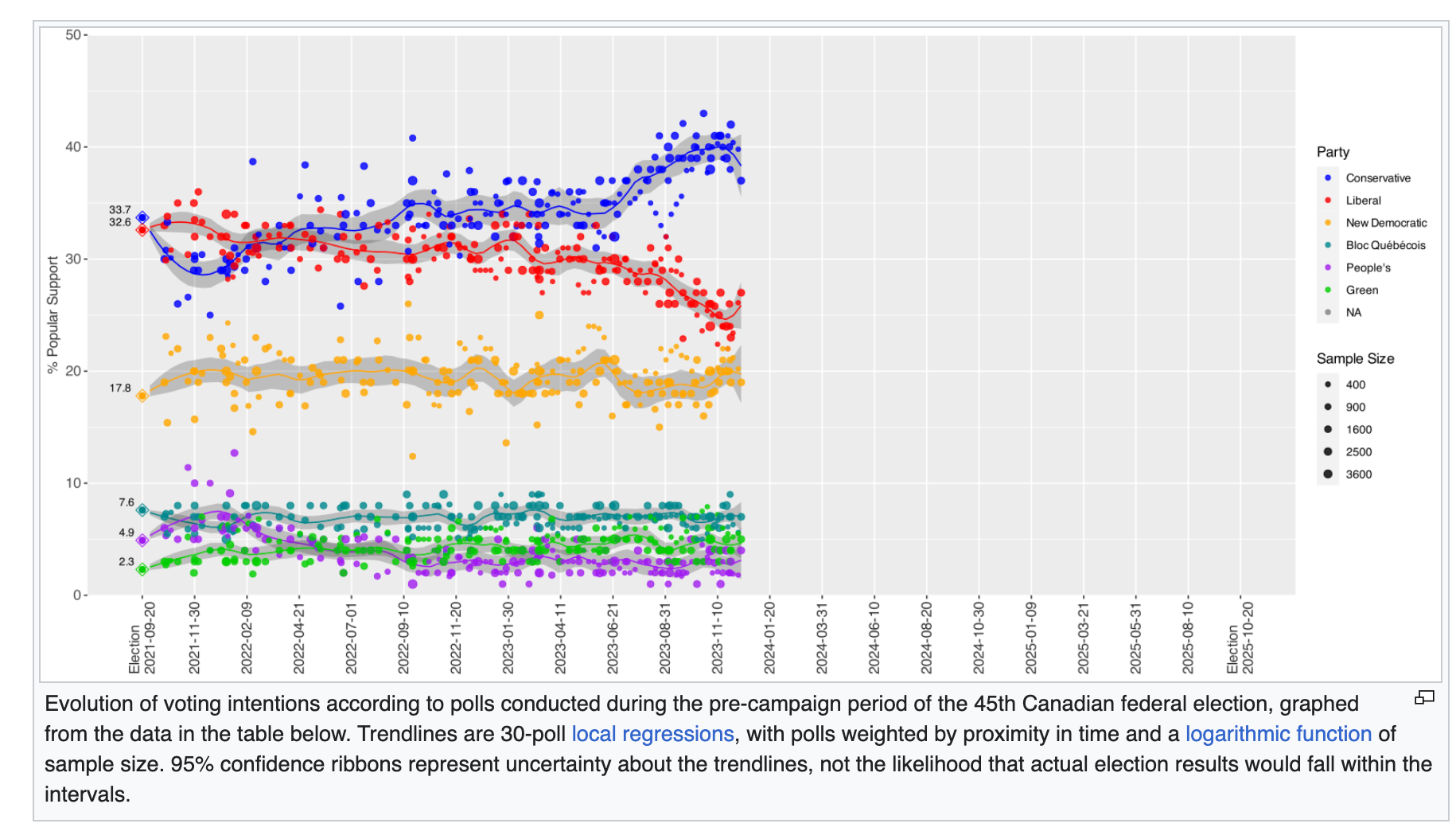

Voter anger about housing prices has been a central factor driving discontent with the current Trudeau government. Were an election—due by 2025—to be held today, it would lose power to a Conservative majority government, polling suggests. Voters are angry about interest rates, but they have even become unhappy about record-high immigration, long a factor in driving housing prices up given that the Canadian approach skews to monied applicants, many of whom immediately compete with current Canadians for properties.

To try and turn sentiment around, the government, reluctant to reduce immigration levels—in part because of how quickly the country is aging, is trying other strategies. Among them is, announced this week, a return to a post-war policy of the mass production of standardized homes. This was done decades ago to give returning soldiers and their families somewhere to live, but now is being done to try and deal with the perception that high real estate prices are a function of insufficient homes being built.

There is no question that supply is part of the problem. While rates play a role, especially given how they were for so long, research in this area finds that rates play only about one-fifth of the role. The rest is an amalgam of things, including demographics, economic growth, recent price appreciation, and immigration, the latter of which is a huge factor in Canada. But recent price appreciation plays a role too, as high and rising housing prices cause, like in most bubbles, people to worry that they are missing out, or will be priced out of the market, which causes them to overbid for the asset, whether it's a dot com stock, a cryptocurrency, or a home.

This latest attempt to solve the Canadian housing problem via a vast increase in supply seems likely to finally crack that country's real estate bubble. As the old saying goes in commodity markets, there is no cure for high prices like high prices, given how, if prices get high enough, supply responds—and sometimes does so in a dramatic way.

04. Skateboarding, Drought, and Innovation

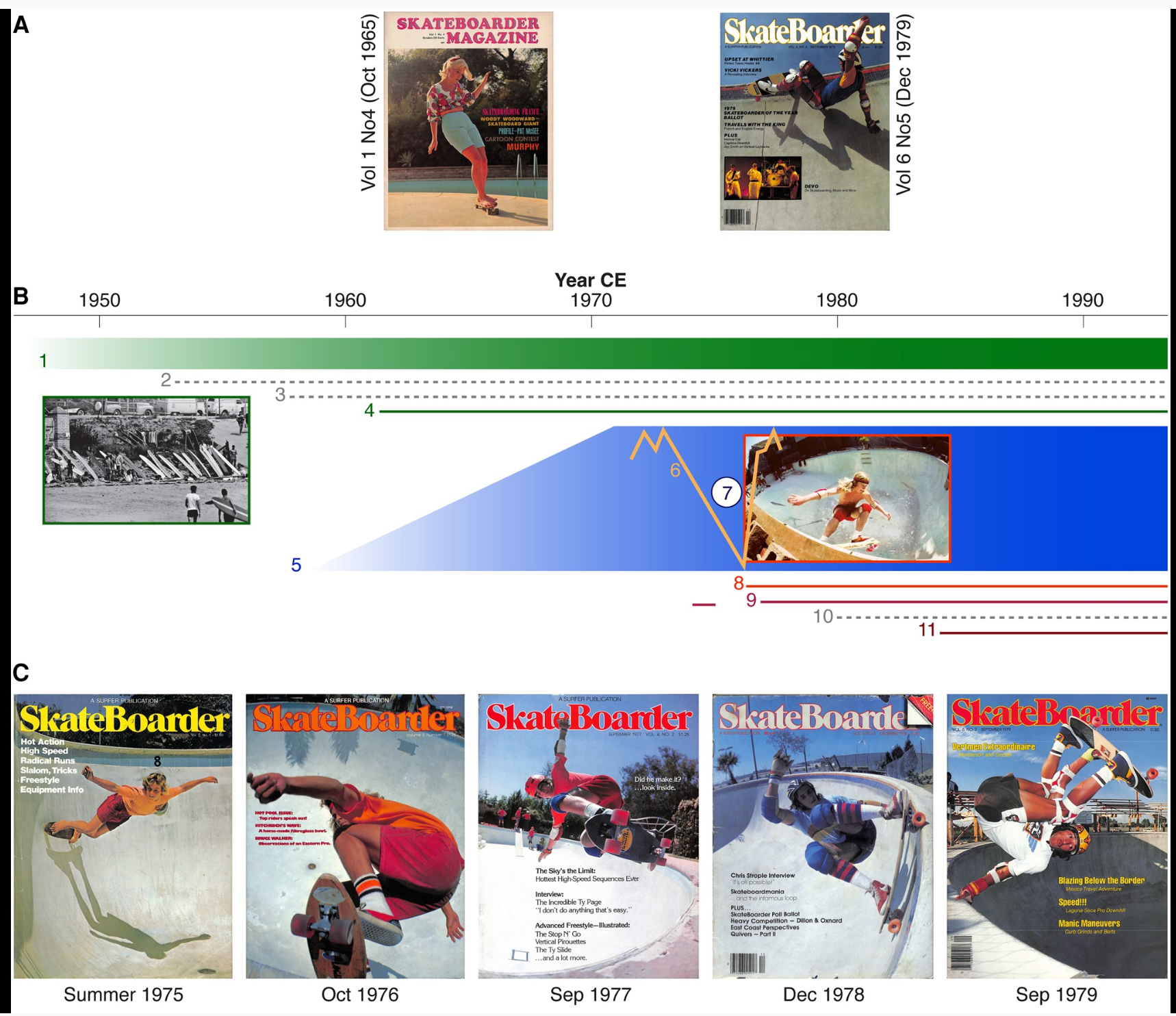

I'm going to return to this topic in a longer piece in the future, but there is a striking new paper on the origins of skateboarding. It shows how persistent drought in southern California in the 1970s caused the emptying of pools, giving rise to de facto urban skateboard parks. This, in turn, helped drive the rise of skateboarding companies, skateboard media, and an entire subculture that eventually became mainstream.

You can see some of this in a graphic from the paper, where early skateboarding magazine covers showed pools as filled and part of the built urban environment, while later covers turned skateboarding into something that happened inside the objects formerly known as pools.

Humans, it can be strongly argued, are products of scarcity, not abundance. We see this in everything from our metabolic response to fasting, to the rise of skateboarding in southern California. We are, to that way of thinking, living in a world, one of abundance, to which we are poorly adapted.