I really and 100% truly wasn't planning anything today—and I do still have something coming tomorrow—but I couldn't let this Bloomberg piece pass without comment. It gives me a chance to untangle the many confused claims made about margins on data centers, while reminding people that increasingly opaque financing now accounts for over half the market.

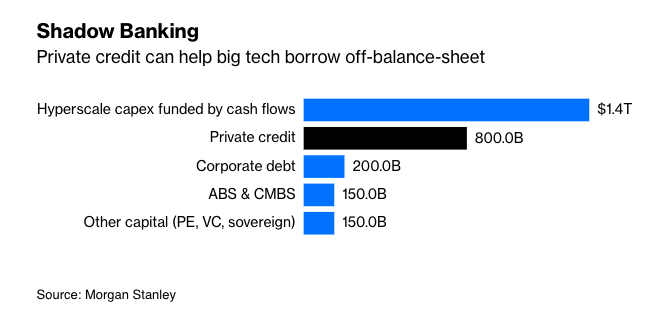

Let's start with this graph, which shows that private credit now accounts for over half of the funding for data centers and growing. It has among its "advantages", as I've written, that public companies can build and control data centers without it affecting their credit rating, usually via partnerships (sic) with private credit.

This remains something that should be watched closely, given its role in making untangling total spending more difficult, as well as making it more difficult to understand the structural risks companies are taking on.

Now, let's turn to a specific paragraph in the piece:

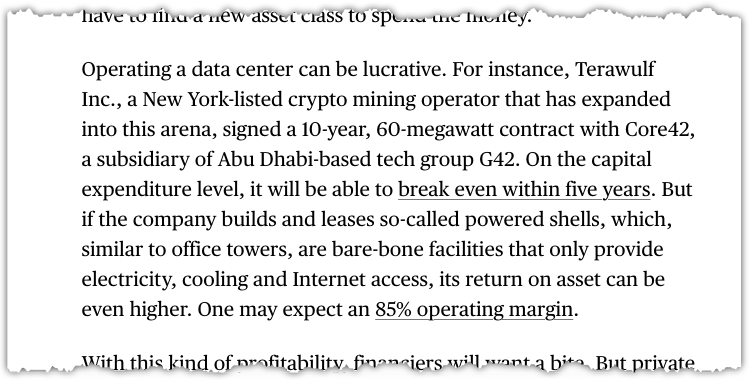

This is problematic in so many ways, some of which are tedious and accounting, but others are deeper.

Here is a short list:

1. Mixing Capex Payback With Operating Margins

- The argument jumps from capex break-even in 5 years to 85% operating margins without showing how the two relate. They may be related, but ... they may not.

- A high operating margin on a powered shell lease doesn’t automatically imply rapid payback or strong return on assets (ROA), because margins are on revenue, not on invested capital. The capital intensity, usage risk, and cost of financing matter more.

2. Mischaracterizing “Powered Shells”

- Powered shells are not like crypto mines: they’re more like laser tag facilities with more impressive power and cooling hookups. Sure, you could put a data center in there, but not cheaply.