Updates and Erasures:

Earlier this week, I wrote about the credit risks of AI data centers becoming an asset class, and I had hardly hit Publish before I saw this II piece on how ... data centers would make a terrific new commodity. So, you know, the future comes at you fast.

Rough Notes:

On Taxes, Endowments, and Unintended Consequences

"Make no mistake, what’s going on with endowments in this country is equivalent to the financial crisis of 2008.”

University of California CIO Jagdeep Singh Bachher

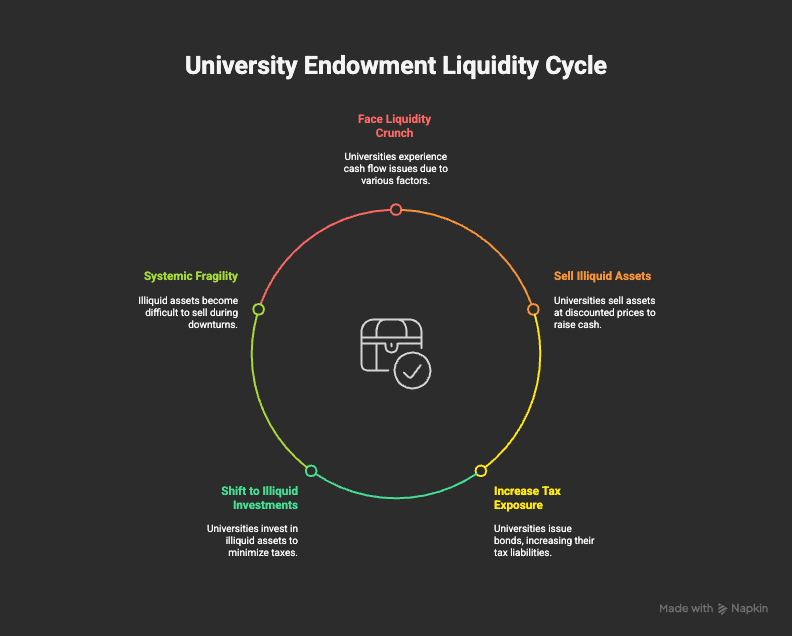

Many top U.S. universities, despite having multi-billion-dollar endowments, are now facing a liquidity crunch. Much like happened to banks in 2008, during the financial crisis, schools are being forced to sell illiquid assets, usually private equity and real estate, at lower-than-market prices. The reason? A massive loss of income from cancelled or delayed research grants from NIH and NSF, and the threat of higher taxes in the future.

This may turn out to be a dress rehearsal for a future, larger liquidity crisis. To understand why, consider the unintended consequences of the current Congressional spending bill. It would, among uncountable other things, increase the endowment tax from roughly 1.4% to rates as high as 21% for the largest institutions. That change would dramatically cut net income, making less available for operations.

In response, endowment managers are already trying to get liquid, which isn't always easy when you're holding illiquid private equity in huge amounts, 10% or more of many portfolios. The results "forced sale" discounts can be sharp. Yale, Harvard, and others are now selling private equity stakes at up to 13% off in some cases to raise money. It doesn't help that private equity overpaid for assets in the 2021-23 period, and can't exit and distribute cash to investors. As a result, managers are holding onto assets longer, starving investors for cash.

(This has, entertainingly, given rise to "continuation funds", where private equity managers create a new vehicle and then, in effect, sell the assets to themselves, thus giving investors some liquidity. I'm not kidding.)

With large portions of their portfolios in private equity and credit, endowments are becoming asset-rich but cash-poor. In addition to these forced sales of illiquid assets, many, for example, are issuing taxable bonds to meet capital calls and spending obligations, thus further increasing their tax exposure.

Of course, and perversely, schools that weren't as exposed to private equity as they might have liked are newly crowing about it. Suddenly not having the right contacts to put a few billion into a hot private credit fund doesn't seem as bad as it once did.

But now, along comes the new excise tax on larger endowments. By being exposed to higher taxes, guess what that will do? It will push them to less tax-exposed investments: away from hedge funds, index funds, and equity markets—and toward illiquid private equity, venture capital, and credit funds. Those private funds, given their longer hold times, are generally taxed at lower rates than their public market counterparts, and tax minimization is the new name of the endowment game.

But taxing endowment income more heavily doesn’t discourage risk—it redirects it. To preserve net returns, institutions shift deeper into illiquid private assets where after-tax outcomes look better. But this raises systemic fragility: in a downturn, as we're seeing with NIH cuts, these assets can’t be sold without steep discounts, forcing distressed sales at scale. Just like in 2008, liquidity vanishes precisely when it’s needed most. We’ve made the next crisis more likely, and we’ve hidden it in private markets.

Sketches:

Amazon now has more robots than people in its factories ... AI power consumption is outcompeting smelters ... Small groups of proto-humans kept migrating out of Africa, getting cut off, and going extinct ... Ukraine is inching towards robot-on-robot fighting ... The creativity of image general models is weirdly mathenatically explicable ... Hot hedge fund strategy built on insuring the catastrophes that insurers don't want to insure ... Earth's energy imbalance more than doubled in recent decades, far more than expected ... Subtle changes in how you ask AI chatbots medical questions—even typos or use of exclamations—dramatically changes the response