the tl;dr

- The U.S. economy is undergoing a fundamental shift from over 3% average annual growth to "life under two": at or below 2% annually.

- This slowdown underlies rising populism, fiscal strain, anti-immigrant sentiment, and distrust in institutions.

- The shift from abundance to scarcity is altering political, economic, and psychological frameworks across American life.

- The U.S. could accept this shift, and adjust accordingly, but there is an outlier chance it avoids it altogether

This is mostly about GDP and economics, so let's get something important out of the way first:

Economics is boring as fuck.

Again:

Economics is boring as fuck.

It just is. People who pretend others are generally undersocialized (if bright) young males who like to play Settlers of Catan more than is healthy. So ... economists.

But the following topic is too important to be left to economists.

The Crackup

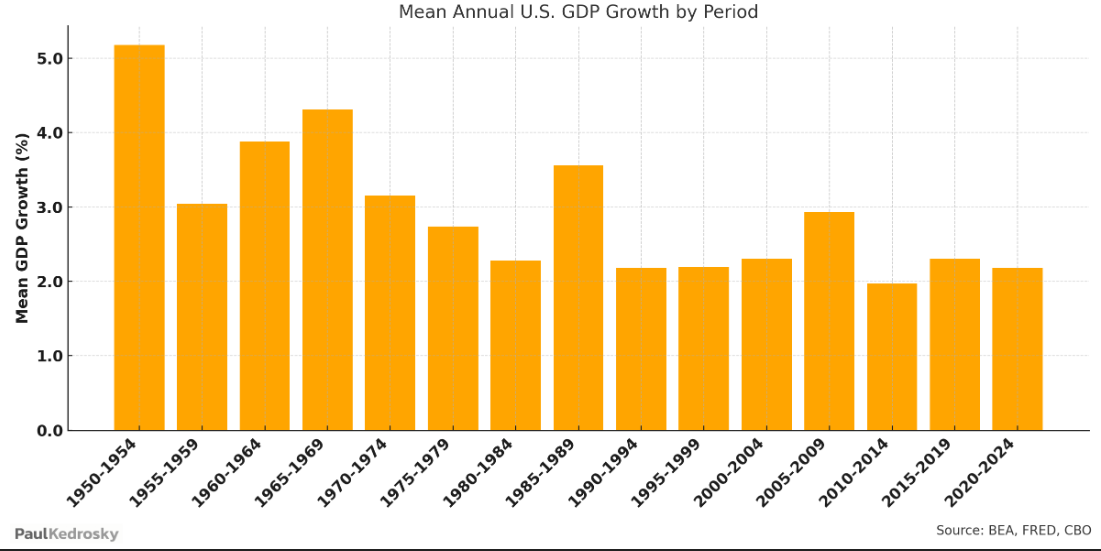

The American economy is facing a quiet crackup that's behind much of the frustration and anger among its citizens. For decades, the United States averaged GDP growth rates above 3% annually. Today, 2% growth—or less—is more likely, now and in the near future.

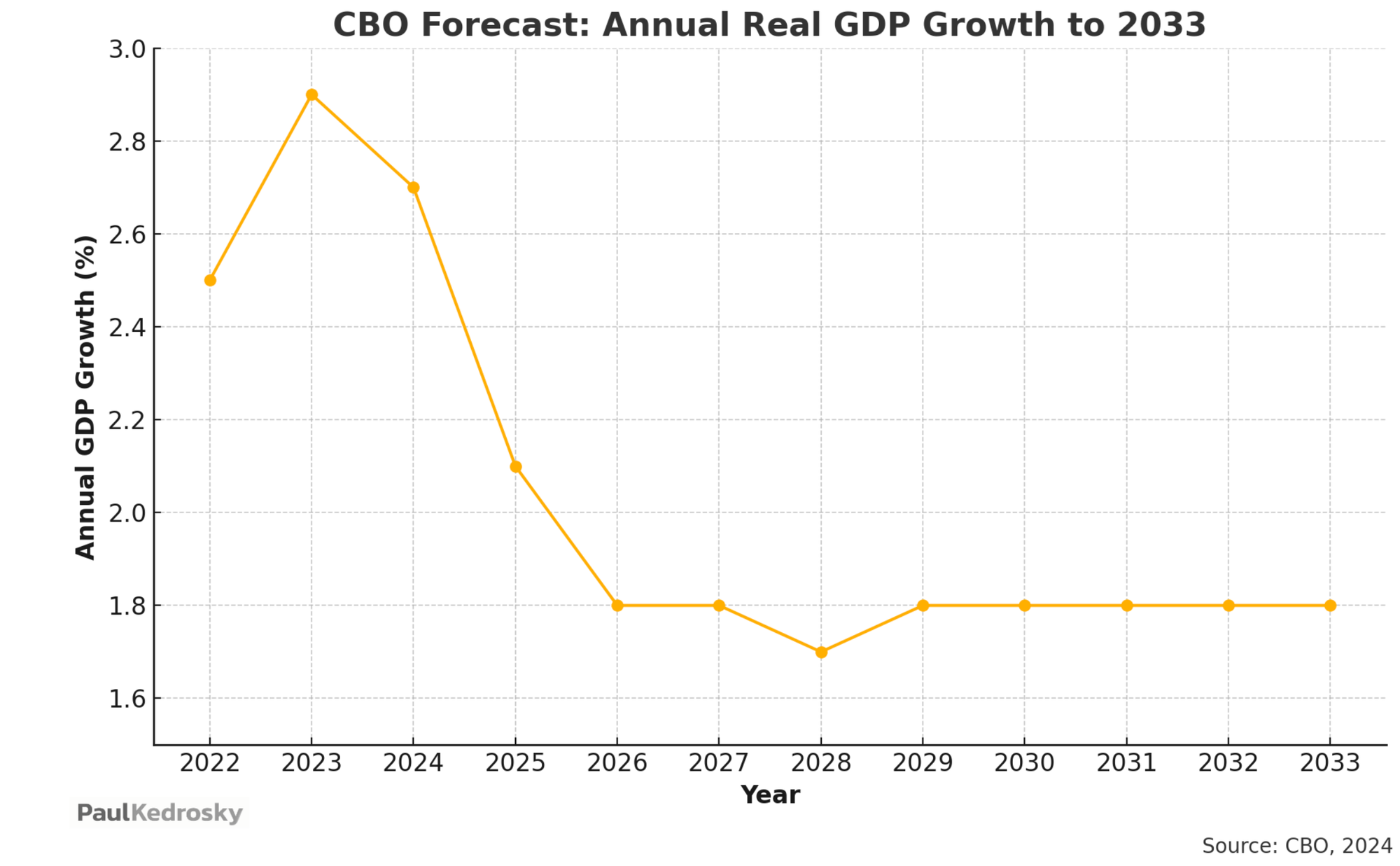

The Congressional Budget Office projects similar GDP growth over the next decade.

This shift from robust to modest growth affects ... everything. It is behind, in large part:

- The rise of populism

- Anti-immigrant sentiment

- DOGE

- A return to tariffs

- Soaring U.S. deficits and debt

The Psychology of Slower Growth

The difference between 3% and 2% annual growth is stark. At the higher rate, over ten years, you have:

- $3.36 trillion larger economy

- $3.7 trillion more in tax revenue

- 6 million more jobs

- Significantly higher real incomes

The gap directly affects opportunities, wage growth, tax revenue, social services, health care, solvency, and optimism about the future. Growing quickly and being awash in income makes people optimistic about the future; the opposite does ... the opposite.

Americans built their self-image and expectations around decades of strong growth, trusting each generation would surpass the previous one. Sub-2% growth erodes this assurance, shifting psychology from abundance toward scarcity, and even zero-sum thinking. When people don't see abundance they stop sharing. And Americans have stopped sharing.

Zero-sum thinking: A general belief system about the antagonistic nature of social relations, shared by people in a society or culture and based on the implicit assumption that a finite amount of goods exists in the world, in which one person's winning makes others the losers, and vice versa ... a relatively permanent and general conviction that social relations are like a zero-sum game. People who share this conviction believe that success, especially economic success, is possible only at the expense of other people's failures. More.

Spending Cut Theater

Lower growth explains rising political polarization. When growth was strong, expansive revenues funded both new programs and tax cuts. Rising wages benefited workers and shareholders alike, making immigration economically beneficial.

Under slower growth, policies become inherently competitive. Tax cuts reduce funding for public programs. Wage increases for some imply job losses for others. Immigrants are seen as competition for jobs, even when they are not.

Populist movements reflect this zero-sum thinking. Frustrations over trade, immigration, and government spending stem from the palpable sense that the economy isn't working the way it once did.

DOGE could only be theater

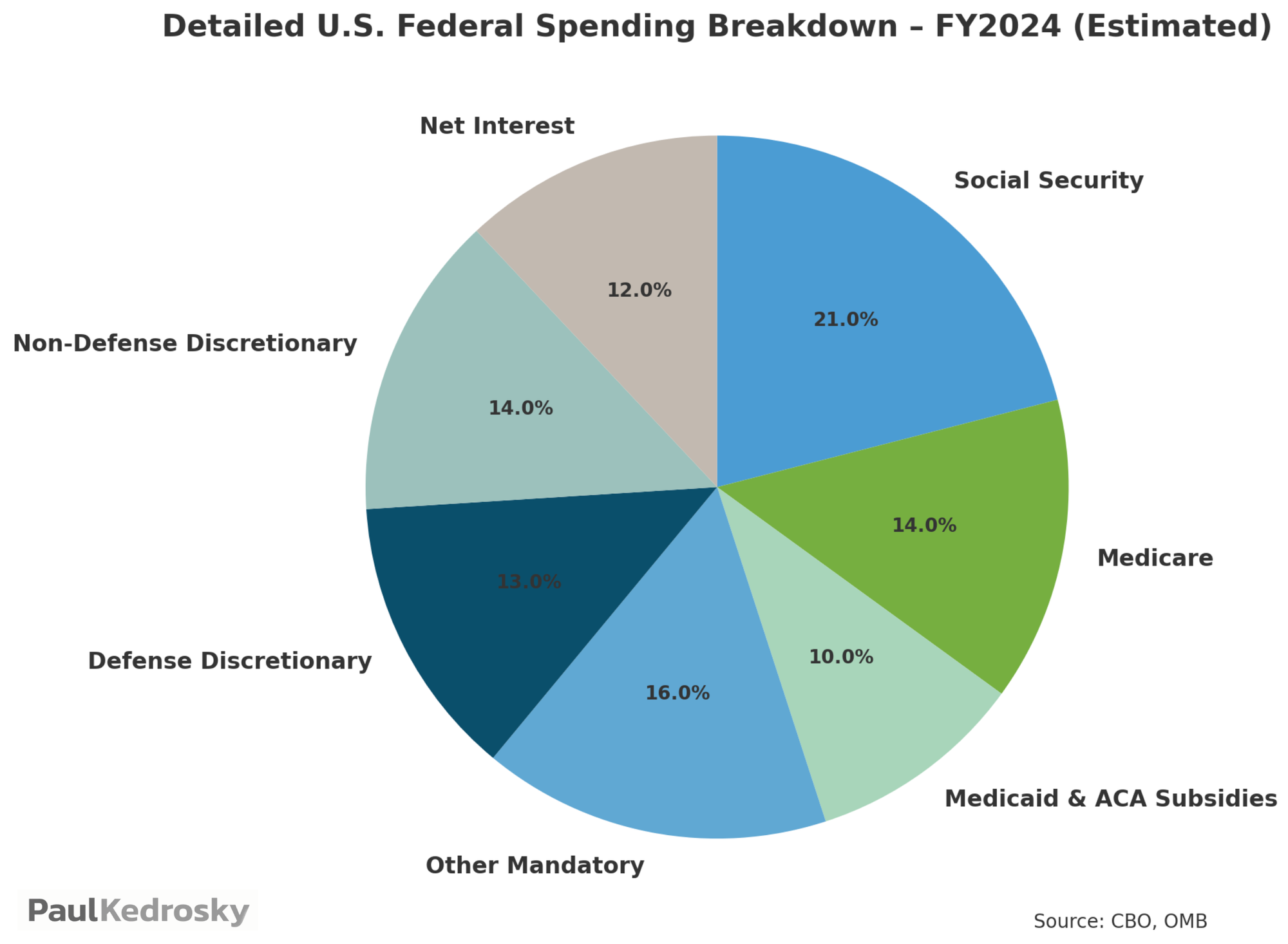

Creating DOGE was one response to slow growth. After all, lower growth demands less government spending. But given that most U.S. spending is statutory—it cannot simply be cut—DOGE could only be theater.

Consider the following graphic of U.S. federal spending. What should be clear is that given mandatory spending and defense, you can only touch about 14% of the budget. And, just for the sake of argument, even if you cut that to zero—trimming $800 billion (which is impossible)—the U.S. would still be running a deficit.

While the instinct to cut costs is understandable, and perhaps even logical, there is no way for the U.S. to cut its way to break-even. Any serious effort to reform spending would have to involve defense, healthcare, and social security, and all of those have immense and well-funded constituencies, most of whom vote. Unserious efforts that don't touch those line items are just theater—but they tap into the unease of life in a sub-2% world, so many people don't care.

Tariffs and Immigration in a Slow-Growth World

Restrictions also gain appeal in a low-growth economy. With rapid expansion, foreign competition and immigration offer benefits. Displaced domestic workers can easily transition to new sectors, and immigrants fill labor shortages.

But once growth falters, everything goes into reverse. Losing one's job and hoping that the economy can handle it feels like a bad bet. Workers displaced by trade struggle to find comparable opportunities. Communities undergoing rapid demographic shifts feel resource pressure. Immigration restrictions and higher tariffs become politically attractive means to maintain existing conditions. They are zero-sum responses to scarcity, predictable during Life Under Two.

Immigration restrictions and tariffs are predictable, zero-sum responses to scarcity

But cutting immigration and expelling illegals has immense consequences, which I will return to in an upcoming note.

Lotteries and Non-Economic Thinking

It should come as no surprise the rise on non-economic thinking predicated on lottery assets, like crypto. Unlike orthodox financial instruments, they don't represent a claim on productive output. They are, if anything, the negation of orthodox claims, a repudiation of the old way of doing things, pure price reflexivity.

This is understandable in a world where people have lost faith in economic growth. Why wait? Find things that go up and chase after them. We see this in the rise of crypto, of sports betting, of YOLO-ing meme stock-chasing Reddit bros, and more. What they have in common is impatience in the orthodox system ever working for them. And having lost faith in the system itself, institutional distrust becomes a baked-in feature of what they lust after.

Crypto as ironic commentary on Life Under Two

You can think of them as a kind of ironic commentary on Life Under Two itself. Instruments are increasingly divorced from the system, acting almost as jokes in a surrealist play about what happens when nothing economic can happen anymore. They are what happens when money seeks returns divorced from economic foundations, turning inward on itself. We should expect even more of this kind of behavior.

End-Running the Reform Challenge

Slower growth makes reforms harder. There is less room to maneuver. Healthcare costs, for example, continue to rise faster than economic growth, making them an ever-larger chunk of spending just by standing still. Social Security and Medicare do the same. Infrastructure needs investment, yet raising taxes or reallocating spending don't happen in a zero-sum world.

Other countries whose growth has slowed have made difficult choices about taxes, entitlements, and economic structures. The United States hesitated, hoping growth would rebound to historical levels, which it has not. And there are virtually no examples in economic history where a major economic power has had a multi-year slowdown, and then returned to growth.

There are virtually no examples in economic history where a major economic power has had a multi-year slowdown, and then returned to growth

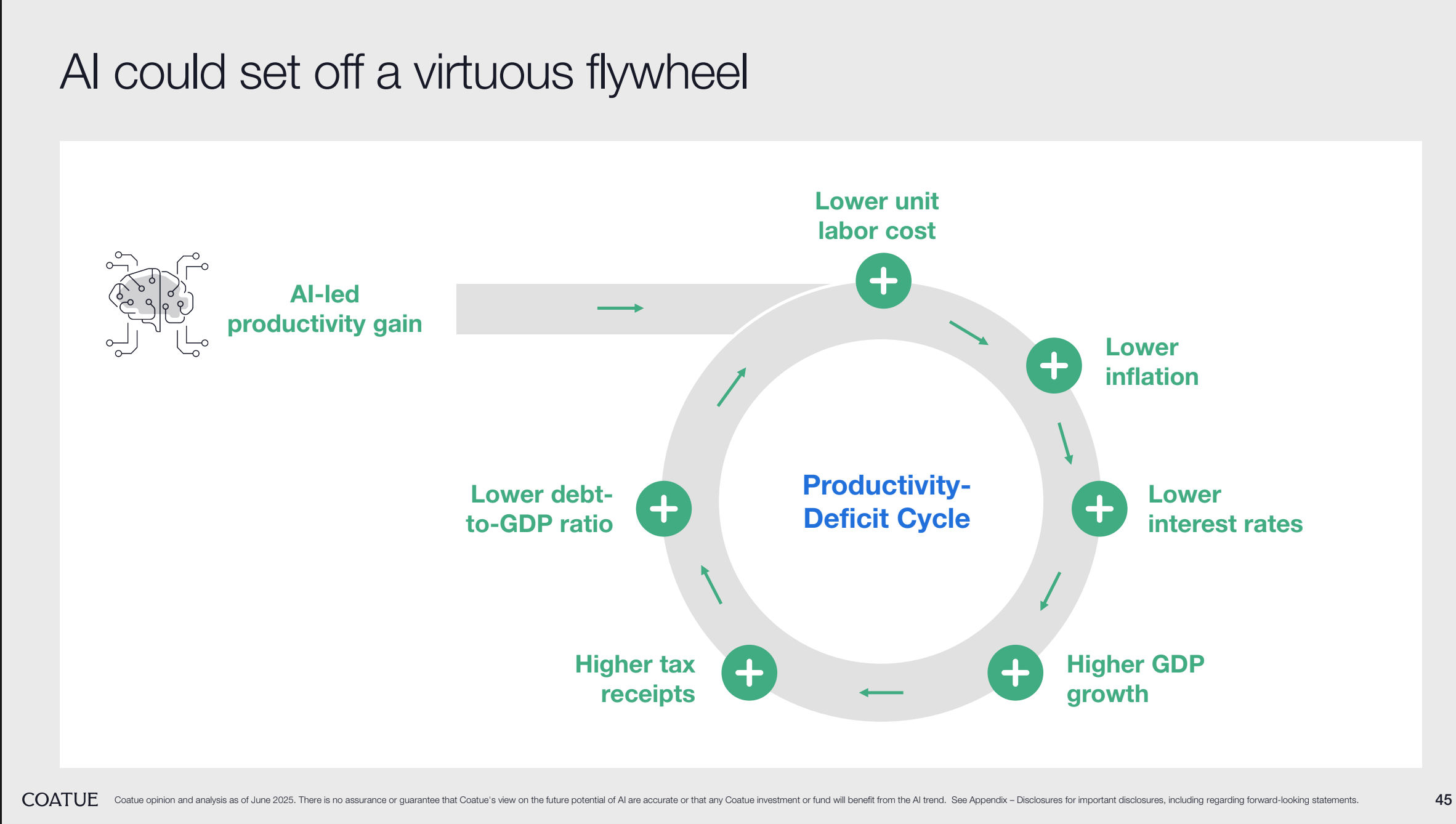

But "virtually no" examples is not "none". The U.S. did it once before during the dot-com period, when a wave of technology innovation and productivity briefly brought the country back to growth. So, while, unlikely, it's not impossible, and it would cause current sovereign finance forecasts to be badly wrong.

The Future(s)

There are two divergent ways of thinking about the future of the U.S. in this cracup context. One more pessimistic and linear, and one more optimistic, non-linear, but still fraught.

Scenario 1: Rationality and Limits

First, a slower-growing U.S. might be a better global citizen, less central and less convinced of its own rectitude. A multi-polar world could be a safer world, less of an economic, cultural, and security monoculture. The country will struggle with this, convulsing as it attempts to reconcile its beliefs in its own exceptionalism with the reality of lower growth and limits.

Under this view, the US would, in a series of stop-start waves, cut spending and reform its obligations, aiming for what has been called the 3% target for deficits as a percentage of GDP. It will be wrenching, with the waves rippling back and forth from politics, to fiscal and monetary policy, and back to politics again.

Scenario 2: Accidential Escape Velocity

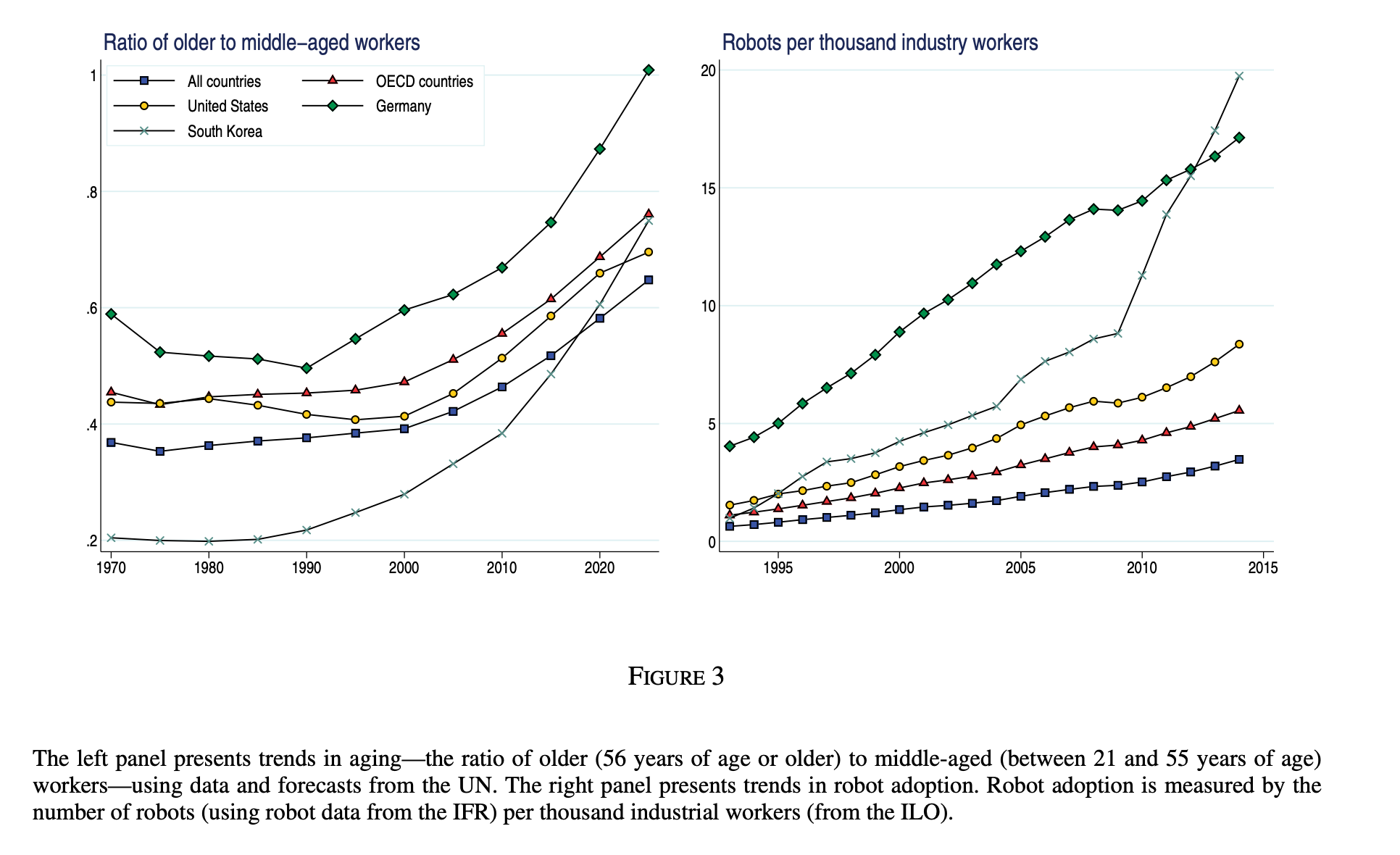

There is, however, a second, outlier possibility. There is recent scholarly work suggesting that aging, slowing societies are likely to be earlier at adopting AI and robotics. Faced with scarce and expensive labor, they jump straight to these new tools, not having the option of there being humans to do the work. It is analogous to developing markets that skipped over wired telecom and leaped straight to wireless.

And robots are improving much faster than is commonly understood. There is the potential for a labor explosion to rival the much-heralded AI intelligence explosion. The combination would explode models in unexpected ways.

Could it happen in the U.S.? It could, and in some sense, it is the de facto bet being laid. Americans and their politicians, by their theatrical inaction, are betting that something magic will happen that restarts growth, compensates for lost workers, and helps rebalance the budget.

This chance would be wrenching, putting pressure on everything from power grids, to social safety nets, likely requiring some form of universal basic income, and leading to a major restructuring of the workforce. But it is possible, and not properly discounted in most models.

Coda: Living with Less ... or Maybe a Lot More

Sustained sub-2% growth would mark a profound shift in American life, and it is already creating unease. It will not be easy for a country built on expanding frontiers, abundance, and growth.

The U.S. has configured itself such that normal doesn't adequately pay the bills, nor satisfy its psyche

Political movements—from populism to efficiency campaigns—are early reactions to this reality, however subconscious. There will be more. But life under 2% growth isn't necessarily worse. For most OECD countries it is ... normal. The trouble is that the U.S. has configured itself such that normal doesn't adequately pay the bills, nor satisfy its psyche.

The U.S. may have painted itself, completely by accident, into the very corner it needed to

But there is a chance, however remote, that the U.S. could paint itself completely by accident into the very corner it needed to. It is possible that, having denied itself access to labor, cut taxes to unsustainable levels, built huge tariff walls, and maintained outsized spending, the U.S. will once again be on the right side of a new growth wave, this time predicated on robotics and AI. This possibility is under-discounted, even if the change would be wrenching.