NOVEMBER 17, 2024—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Powell says no need to hurry rate cuts (Bloomberg)

- China's economy stabilizes, retail sales exceed forecasts (Bloomberg)

- The Onion buys Infowars out of bankruptcy (NY Times)

- Dollar strengthens despite preferences for weaker currency (NY Times)

- Goldman Sachs faces China venture power struggle (FT)

- Zhuhai rocked by China's largest mass killing in decade (FT)

- US may expand nuclear weapons force (WSJ)

TWO GRAPHS:

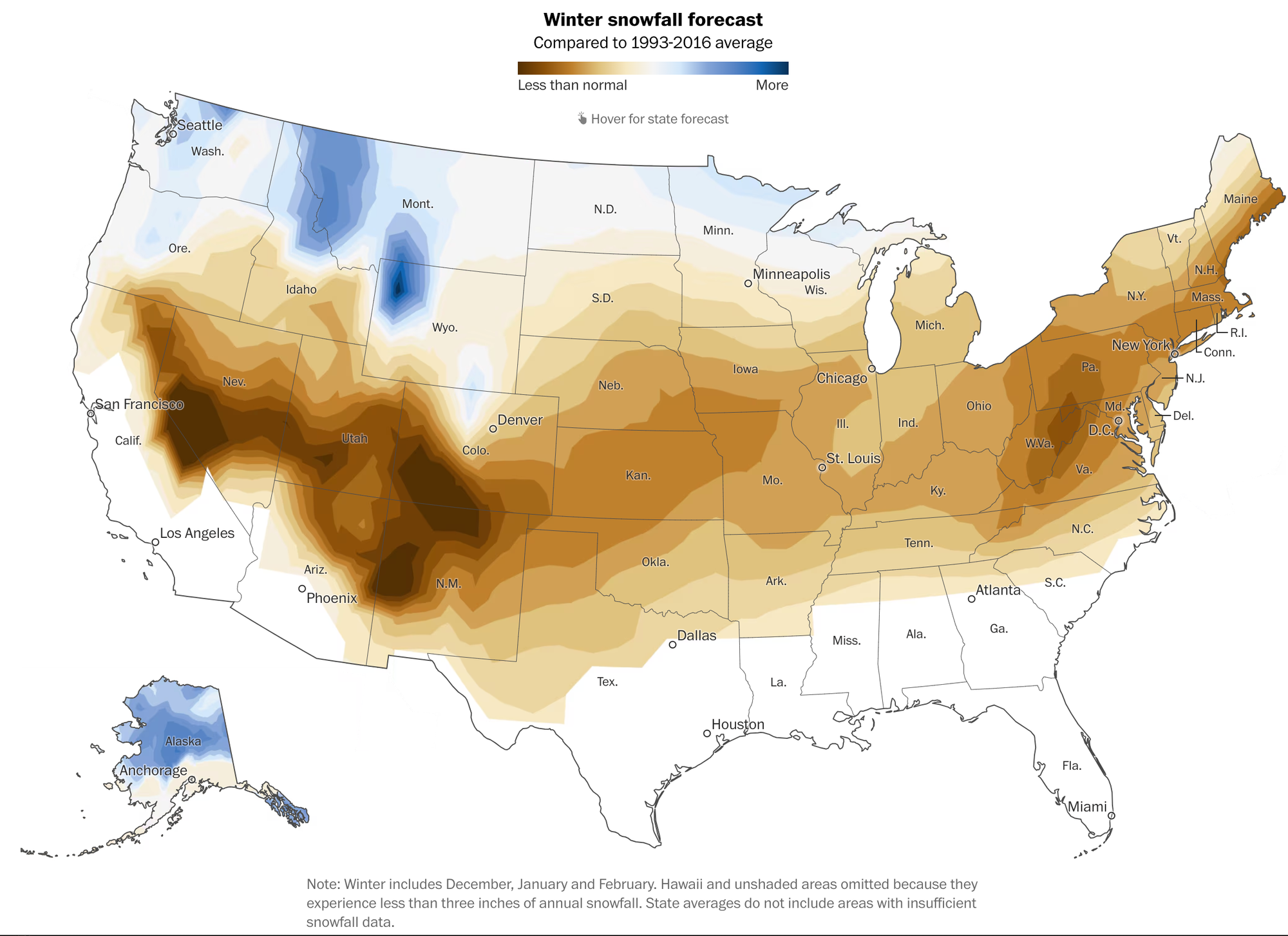

The forecast predicts significantly less snowfall than average across much of the western U.S., contrasting sharply with above-average predictions for the northern Great Plains and upper Midwest. This shift in snow patterns could impact water resources and winter recreation industries.

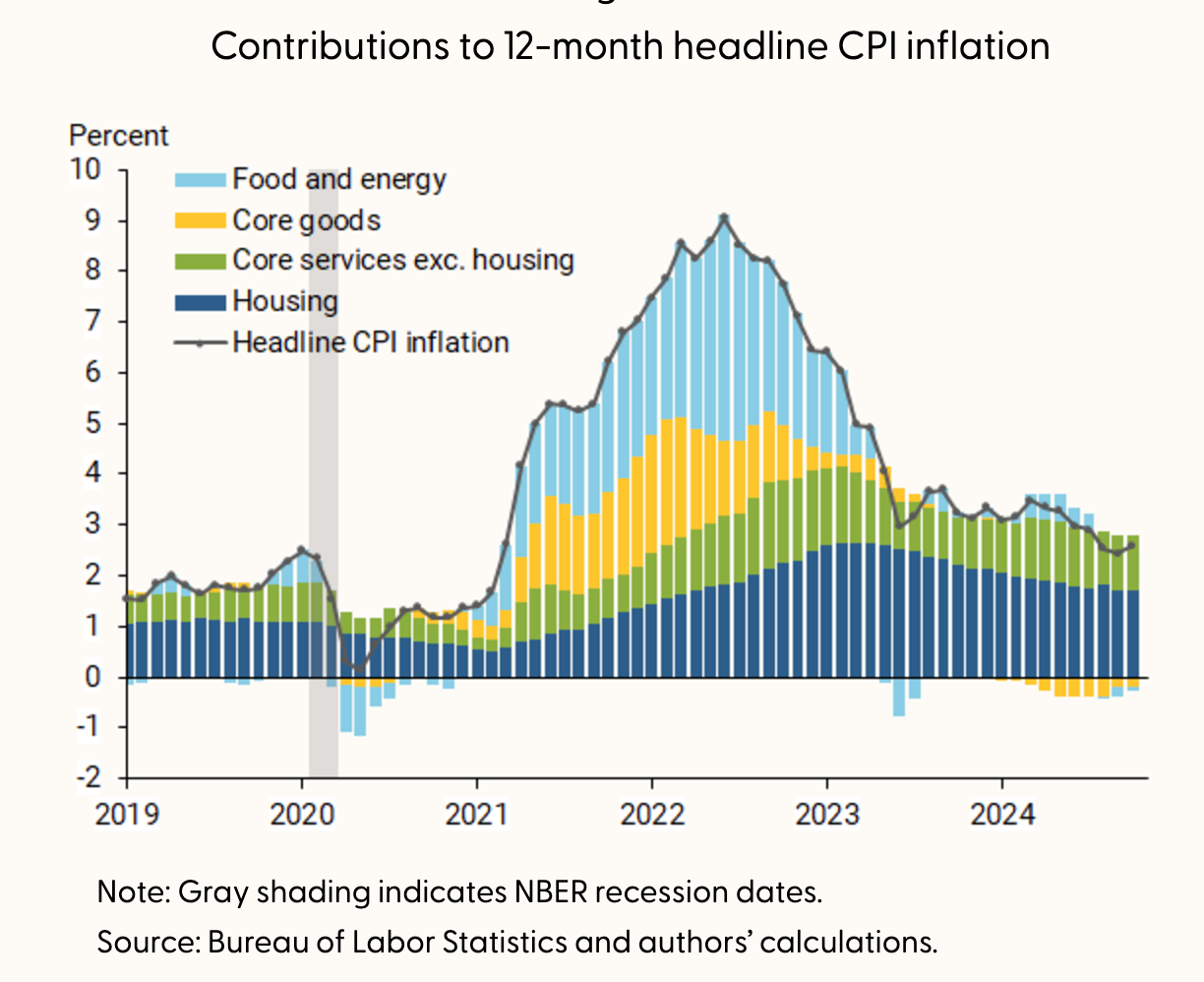

Headline inflation soared to a near 40-year high of 9% in mid-2022, driven primarily by skyrocketing food and energy prices and housing costs. This sharp rise contrasts with previous years and reflects the significant impact of supply chain disruptions and geopolitical events on consumer prices.

THE IDEAS:

Mentions: META, NVIDIA, ORCL, AMZN, MSFT

01. AI adoption accelerates tech-driven sectors resilience

The rapid expansion of AI capabilities is transforming tech sectors, creating resilience against economic fluctuations. Companies emphasizing AI are enhancing operational efficiency and competitive edge, as indicated in the investment trends and AI’s integration into businesses, potentially leading to increased valuations over the next 24 months.

Related reading:

arxiv: Data Analysis in the Era of Generative AI

Carrier Management: The Evolving P/C GenAI Journey: Three Ways the Technology Is Impacting P/C

Insurance Journal: The Chief Artificial Intelligence Officer: Leading AI Innovation and Risk Management

02. Emerging markets gain traction as growth engines

Emerging markets are attracting significant investor interest spurred by favorable macroeconomic conditions and market positioning. This trend suggests increased capital flow and market activity in these regions, impacting global financial strategies over the next two years.

Related reading:

Bloomberg: GLOBAL INSIGHT: Three Takeaways on Emerging Market Outlook

Financial Times: Emerging markets are having a moment - Financial Times

YouTube: African Global Power Dynamics at Crossroads | Africa Amplified 11/01/2024

03. Geopolitical shifts enhance global economic volatility

Ongoing geopolitical tensions are triggering market volatility globally. Investors face increased uncertainties affecting asset valuations and strategic positioning. Understanding and navigating these shifts are vital for maintaining economic stability and preparing for potential disruptions.

Related reading:

Insurance Journal: Geopolitical Conflict Could Cost Global Economy $14.5 Trillion Over 5 Years: Lloyd's

Macrobond: Geopolitics' impact on gold, U.S. economic challenges, and Japanese consumer sentiment

Macrobond: Navigating shifts in global and regional financial trends

04. Energy sector transformation attracts investor focus

Significant transitions in the global energy sector, driven by sustainability and technological advancements, are reshaping the investment landscape. Companies investing in innovative and clean energy technologies are positioned for growth, appealing to investors seeking sustainable investment opportunities.

Related reading:

CNBC: The power sector is 'transforming,' Morgan Stanley says, naming global stocks set to rise 40%

The Economist: Commercial ties between the Gulf and Asia are deepening