NOVEMBER 10, 2024—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Apple issues cautious forecast amid China slowdown (Bloomberg)

- Boeing offers to end machinists strike (WSJ)

- Ares set to raise over $80bn (FT)

- US factory comeback possible after 'China shock' (NY Times)

- US jobs added despite storms in October (WSJ)

- Boeing gains as union backs new strike-ending offer (Bloomberg)

- Health care costs to rise next year (NY Times)

- Mars boss acquires unhealthy snack brands (FT)

TWO GRAPHS:

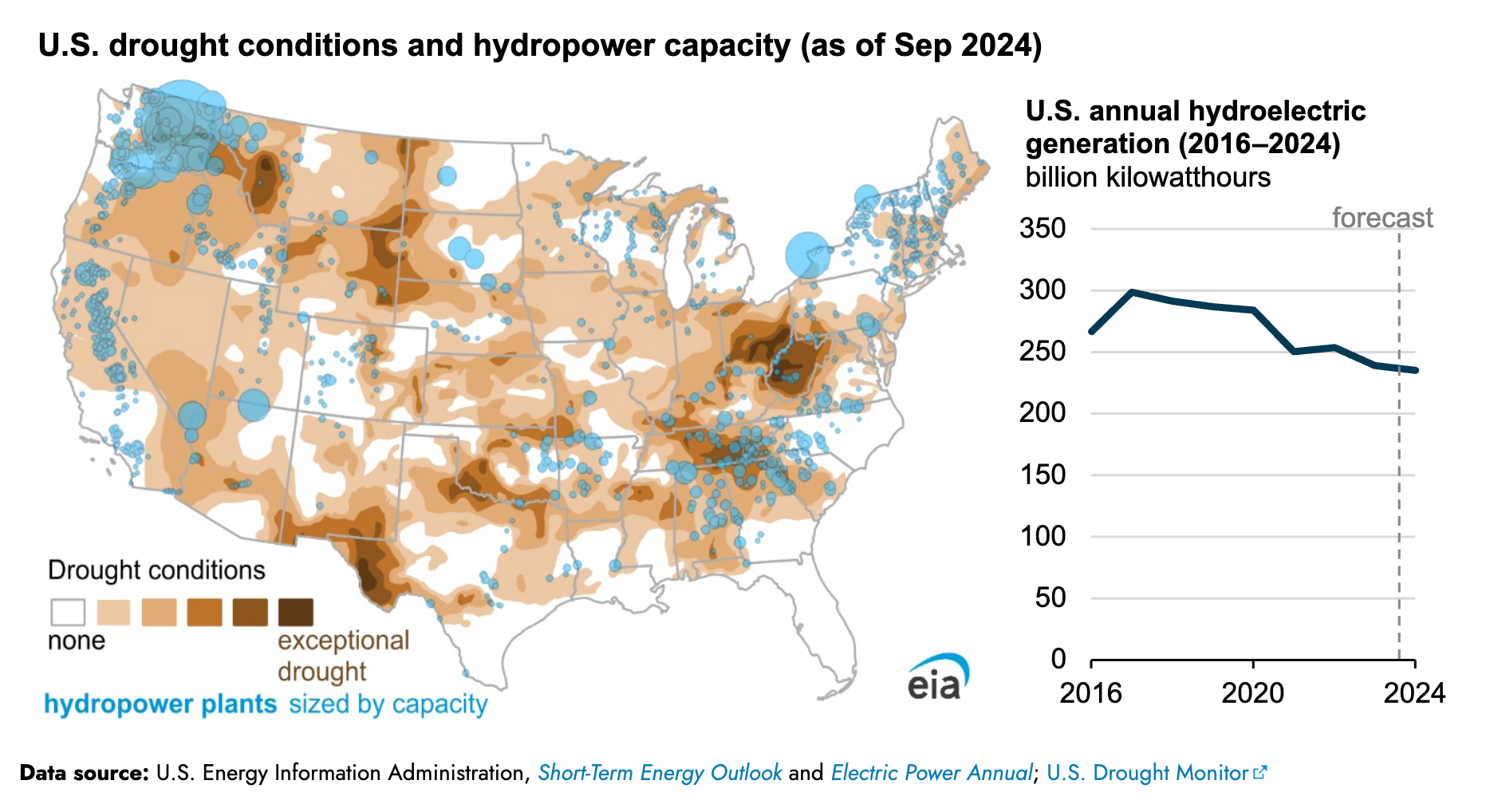

Persistent drought in the western U.S. correlates with a forecasted 20% decline in hydropower generation from 2016 to 2024. This significant decrease underscores vulnerabilities in water-dependent energy sources and highlights the need for diversification in renewable energy strategies amidst climate change.

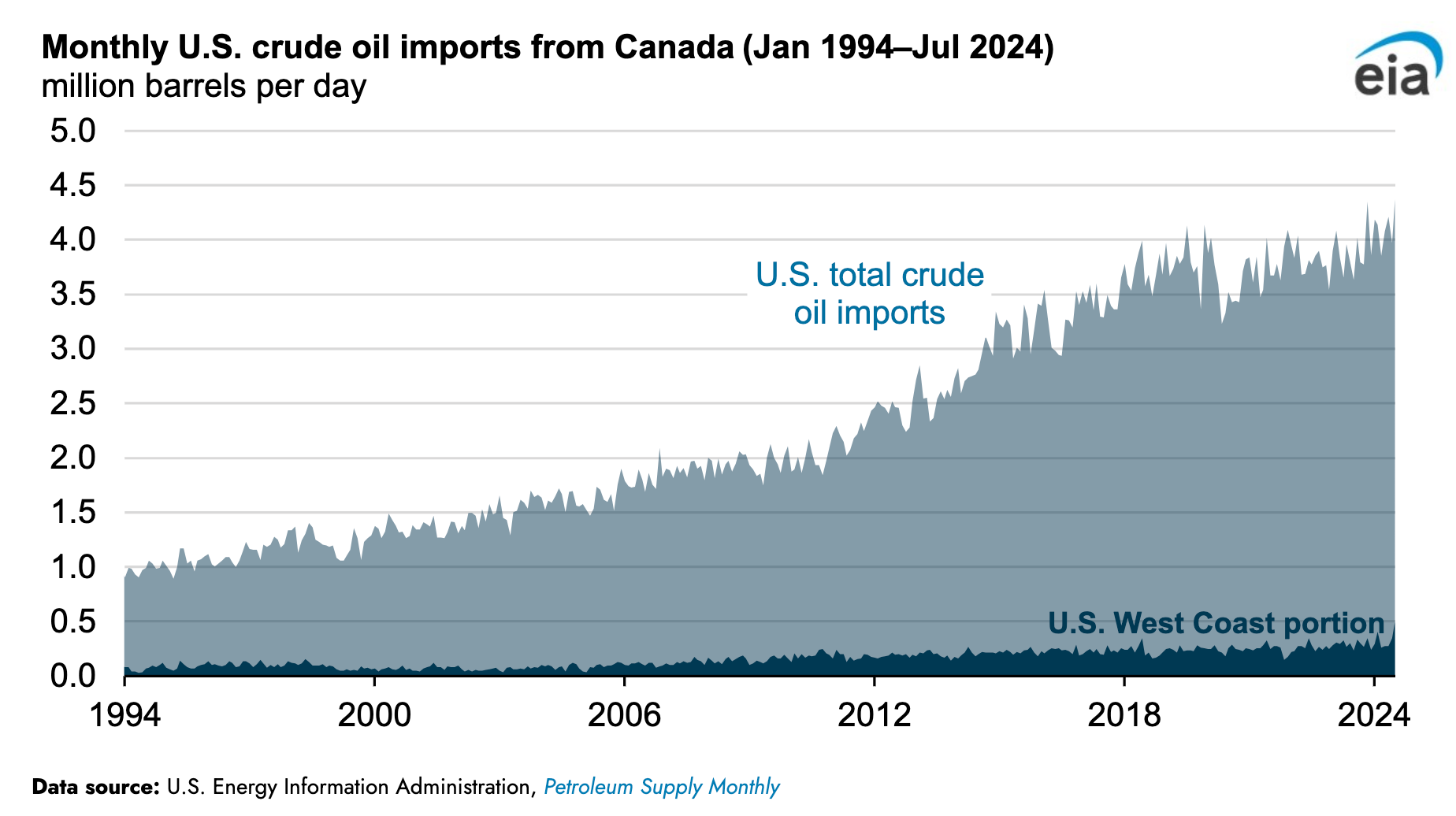

U.S. crude oil imports from Canada surged from under 1 million barrels per day in 1994 to nearly 4.5 million by 2024. This quadrupling highlights Canada's growing role in U.S. energy security, significantly reducing dependency on other countries. The West Coast portion remains minimal, underscoring regional differences in sourcing.

THE IDEAS:

Mentions: AAPL, MSFT, INTC, PINS, BRK.B

01. Insurers to offer AI risk coverage

As AI technology permeates various industries, insurers will increasingly prioritize policies that cover AI-related risks, such as data breaches and algorithm malfunctions, which could pose significant financial liabilities. This trend stems from the rising adoption of generative AI across sectors.

Related reading:

Insurance Journal: Viewpoint: Are You Covered for AI Risks?

Insurance Journal: The Chief Artificial Intelligence Officer: Leading AI Innovation and Risk Management

02. Enterprise tech spending to drive growth

The forecasted increase in enterprise tech spending, expected to exceed $9.8 trillion by 2032, indicates a significant opportunity for companies involved in cloud computing and IT infrastructure, suggesting sustained revenue growth in the tech sector.

Related reading:

Oxford Economics: Future of Global Growth: Enterprise Tech Spend

03. Emerging markets attract increased investments

Emerging markets are seeing a surge in investments due to favorable economic conditions and expansion opportunities. This trend is likely to impact global financial dynamics as investors seek diversification and growth in economies like BRICS nations.

Related reading:

Bloomberg: GLOBAL INSIGHT: Three Takeaways on Emerging Market Outlook

Financial Times: Emerging markets are having a moment - Financial Times

04. Informing shoppers reduces inequality

Providing shoppers with detailed product information can influence purchasing decisions and contribute to reducing inequality by promoting fairer market practices. This behavioral shift spurred by economics can positively affect consumer rights and business transparency.

Related reading: