NOVEMBER 03, 2024—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Mars boss acquires more unhealthy snacks (FT)

- Ares set to raise over $80bn (FT)

- Germany softens reluctance on international bailouts (NY Times)

- Apple concerns over weak forecast and China issues (Bloomberg)

- US Payrolls rise slightly due to storms and strikes (Bloomberg)

- Boeing rises as union endorses offer to end strike (Bloomberg)

- Texas judge battles over cake in court (NY Times)

GRAPH(S) OF THE DAY (GOTD):

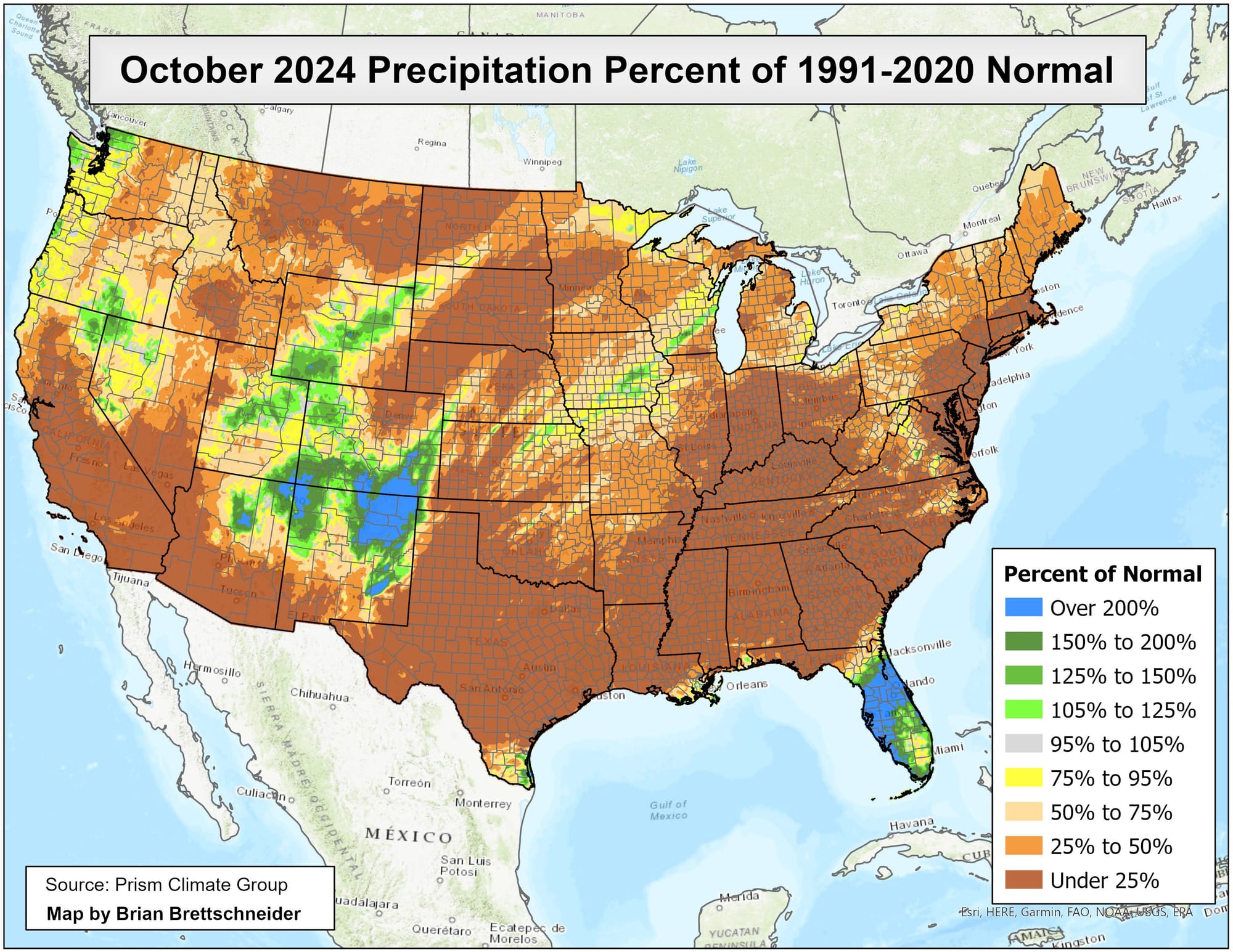

October 2024 saw widespread below-normal precipitation across the U.S., with significant drought conditions, except parts of the Southwest and Florida, which experienced substantial rainfall increases.

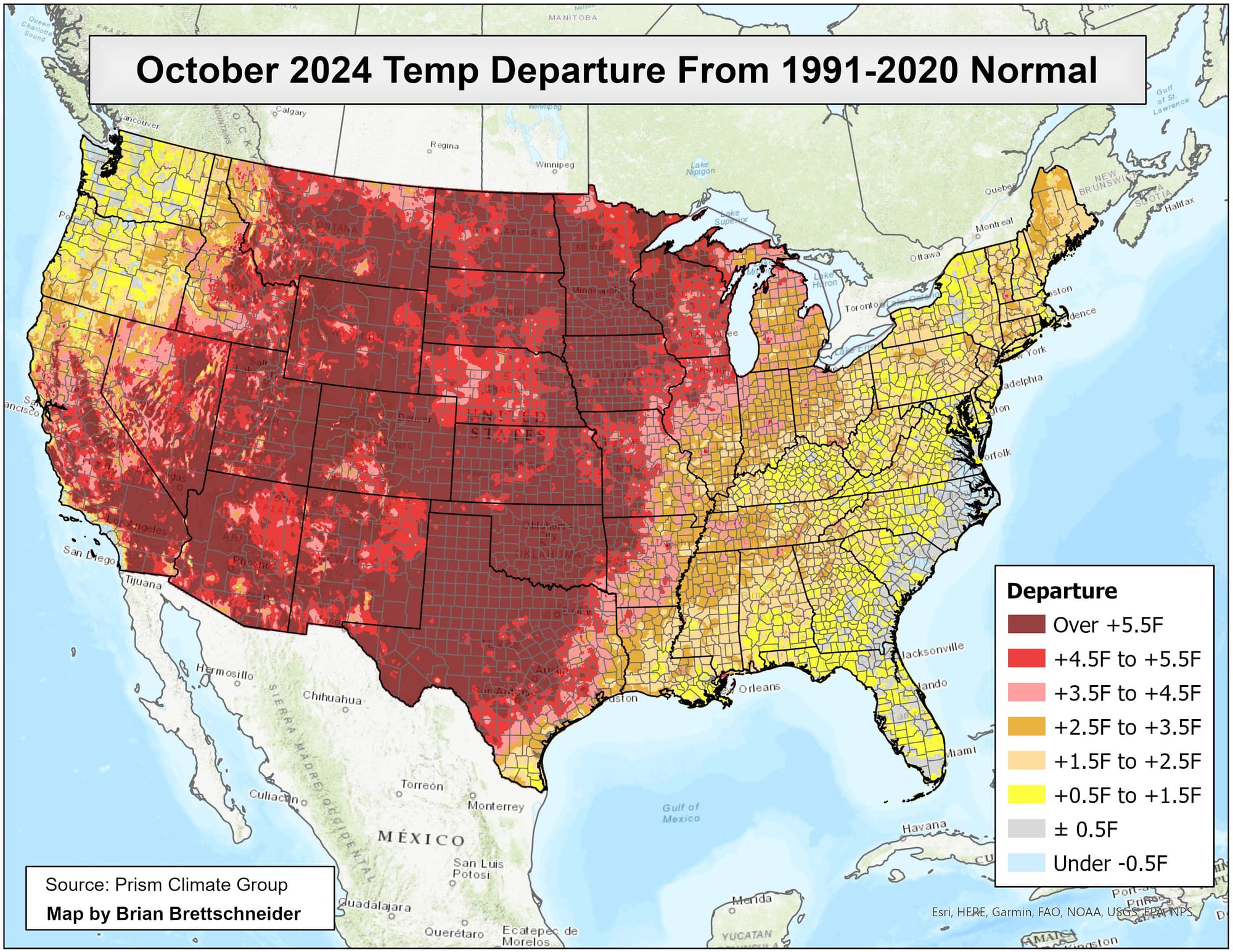

October 2024 saw record-high temperature deviations across the central United States, exceeding 5.5°F above the 1991-2020 average, signaling significant climatic shifts.

THE IDEAS:

Mentions: GOOG, RL, BKNG, WERN, OPEC

01. AI's role in economic resilience

AI investments are showcasing overdue rewards for megacap tech companies amid geopolitical risks and offer a positive outlook during global governance challenges. Companies like Google are key players in leveraging AI for sustainable growth and competitive advantage.

Related reading:

CNBC: What Wall Street learned from the week's Big Tech earnings flurry

Eurasia Group: Despite the geopolitical recession, a new Global Digital Compact shows that multilateral cooperation is still possible.

02. Growth in Asian travel markets

Strength in room nights, rentals, and flights in Asia, coupled with growing interest in travel experiences, indicates rising demand in Asian travel markets. Companies like Booking Holdings are poised to benefit from this regional focus.

Related reading:

Skift: Booking Holdings Points to Strength in Room Nights, Rentals, Flights, AI and Asia

Skift: The Rise of Travel Experiences: 4 Key Insights From Industry Decision Makers

03. Commodities' nuanced outlook impacts energy

A nuanced outlook for the commodities market highlights energy security risks and market dynamics driven by factors such as OPEC policies and natural gas dependencies, especially in regions like India.

Related reading:

Oxford Economics: Five key commodity trends to watch for in 2025

CNBC: CNBC's Inside India newsletter: India's deepening ties with natural gas

04. Evolving cross-border trade trends

Evolving cross-border trade dynamics are influenced by geopolitical shifts and economic growth in regions such as India, affecting logistics and transportation companies like Werner.

Related reading:

Freight Waves: Navigating the evolving cross-border environment with Werner