OCTOBER 12, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

Israel Approves Hostage Deal Setting a Cease-Fire in Gaza (WSJ) … The 11th-Hour Campaign to Land Trump a Nobel Peace Prize (WSJ) … A Mystery C.E.O. and Billions in Sales: Is China Buying Banned Nvidia Chips? (NY Times) … TSMC, Samsung in Spotlight as US Pressure Grows in Chip Sector (Bloomberg) … Copper Declines After China-Led Rally as Supply Cuts in Focus (Bloomberg) … Intel’s Big Bet: Inside the Chipmaker’s Make-or-Break Factory (NY Times) … Vingroup Seeks $500 Million Private Credit for EV Charging Ports (Bloomberg) … Inside Intel’s big bet to save US chipmaking — and itself (FT) … A.I. Video Generators Are Now So Good You Can No Longer Trust Your Eyes (NY Times)

TWO GRAPHS:

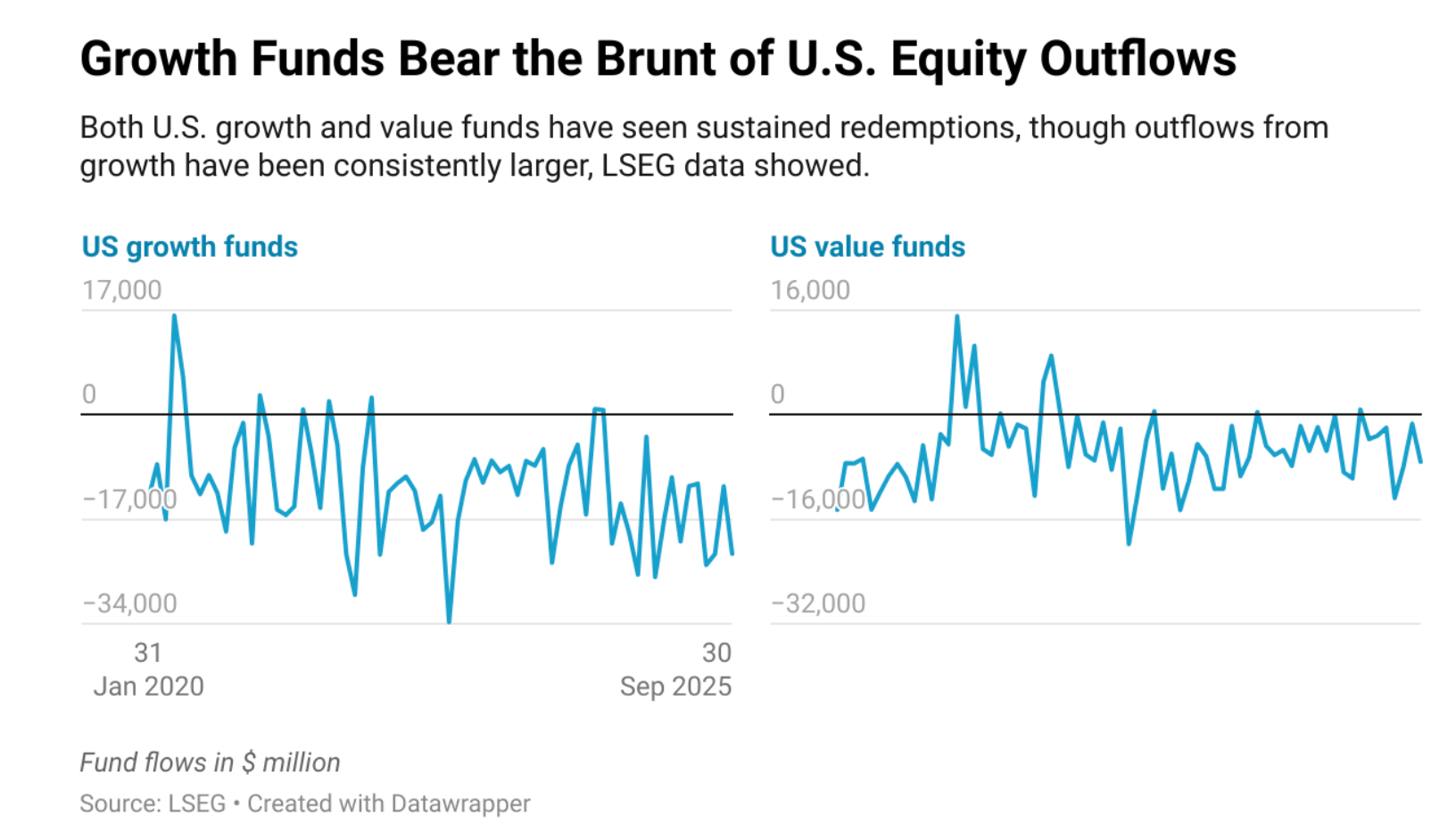

U.S. growth funds experienced outflows nearly twice as substantial as value funds, peaking around $34 billion compared to $16 billion. This reflects investor preference volatility, significantly impacting growth-focused portfolios and potentially influencing market strategies.

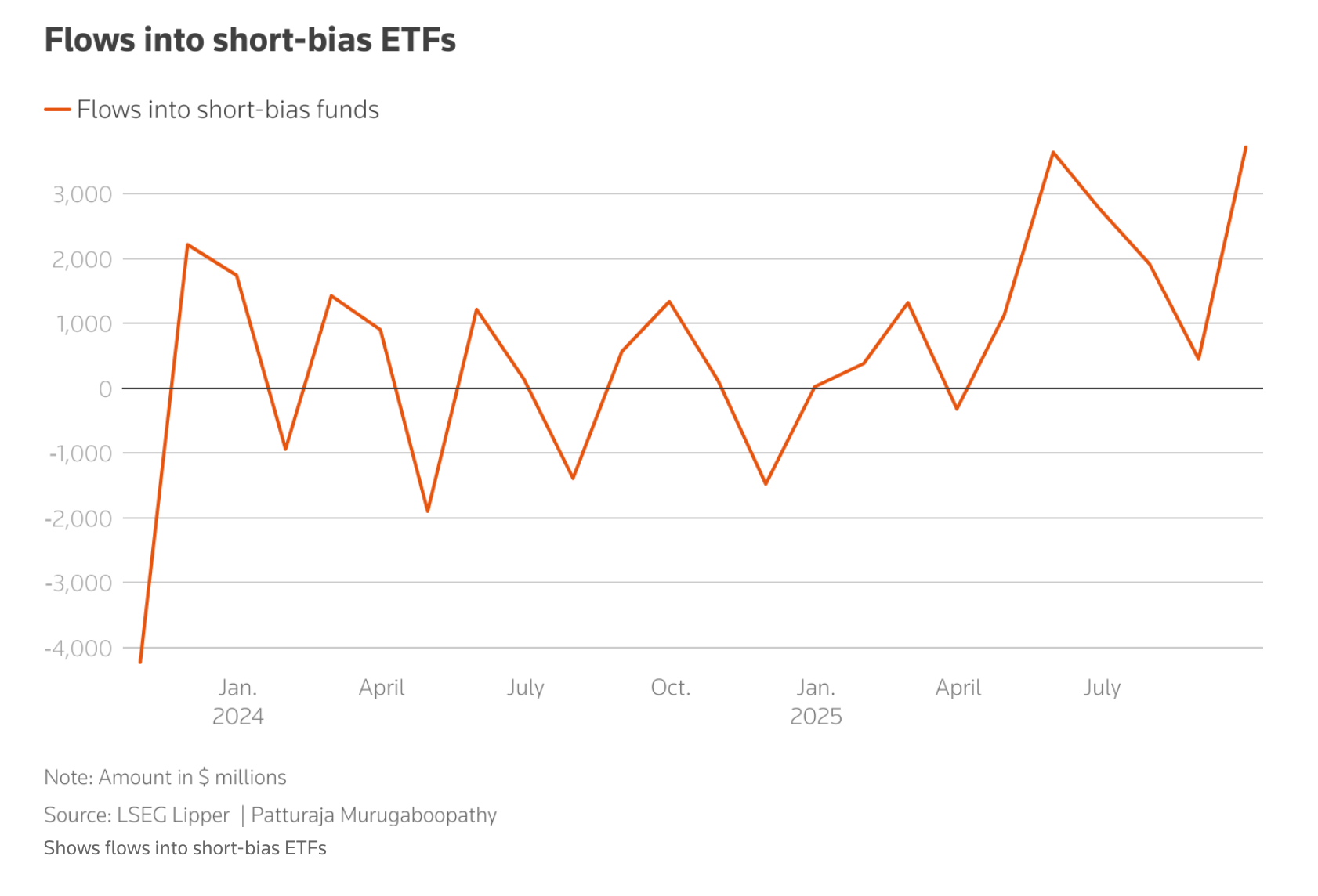

Short-bias ETF inflows peaked around mid-2025, reaching nearly $3,500 million, a significant rebound from the early 2024 dip below -$4,000 million. This shift indicates a substantial change in market sentiment or investor strategy, potentially reflecting increased anticipation of market downturns.

THE IDEAS:

Mentions: NVDA, META, SPGI, FT, McKinsey

01. Geoeconomics reshaping market and political dynamics

Geopolitics' influence on financial markets is rising, blending national security concerns with economic decisions. This trend could lead to shifts in trade policies and realignments in stock markets as countries prioritize strategic partners over cost-efficiency.

Related reading:

02. Cross-border payments become geopolitical tools

Innovation in cross-border payments is not just technical but also strategic, potentially altering the balance of power in global finance by reducing reliance on traditional banking systems and aligning with political interests.

Related reading:

FT: The race for the future of cross-border payments

YouTube: Global economy in uncharted territory from tariff impact

03. AI adoption accelerates amidst geopolitical scrutiny

With McKinsey limiting China-focused AI work and increased geopolitical tension, AI adoption faces regulatory scrutiny, changing which firms lead in technological advancements and affecting global technology partnerships.

Related reading:

FT: McKinsey bars China practice from generative AI work amid geopolitical tensions

Twitter: As generative #AI sweeps across industries and the #consumer landscape...

04. Industrial growth rebounds from prolonged weakness

After years of stagnation, industrial sectors are regaining momentum due to strategic investments and policy shifts, leading to regional economic growth and job creation, especially in future manufacturing hubs.

Related reading:

Oxford Economics: Industry Key Themes 2025: Industrial landscape at a critical juncture

Oxford Economics: Industrial Hubs: Finding opportunity amid the challenges