SEPTEMBER 28, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

The C.E.O. Who Spends All Day Thinking About Sleep (NY Times) … Russia oil output (WSJ) … Unexpected Critics of Trump’s Attacks on Wind Energy: Oil Executives (NY Times) … The rise of America’s young socialists—From the 2008 financial crisis to Mamdani (WSJ) … EU Unveils $638 Million Package to Scale Up Renewables in Africa (Bloomberg) … The Weekend Essay. How tech lords and populists changed the rules of power (FT) … Jaguar Land Rover Ltd (FT) … Jaguar Land Rover Gets UK Guarantee for £1.5 Billion Loan (Bloomberg) … US soyabean farmers squeezed as China blocks imports and stockpiles rise (FT)

TWO GRAPHS:

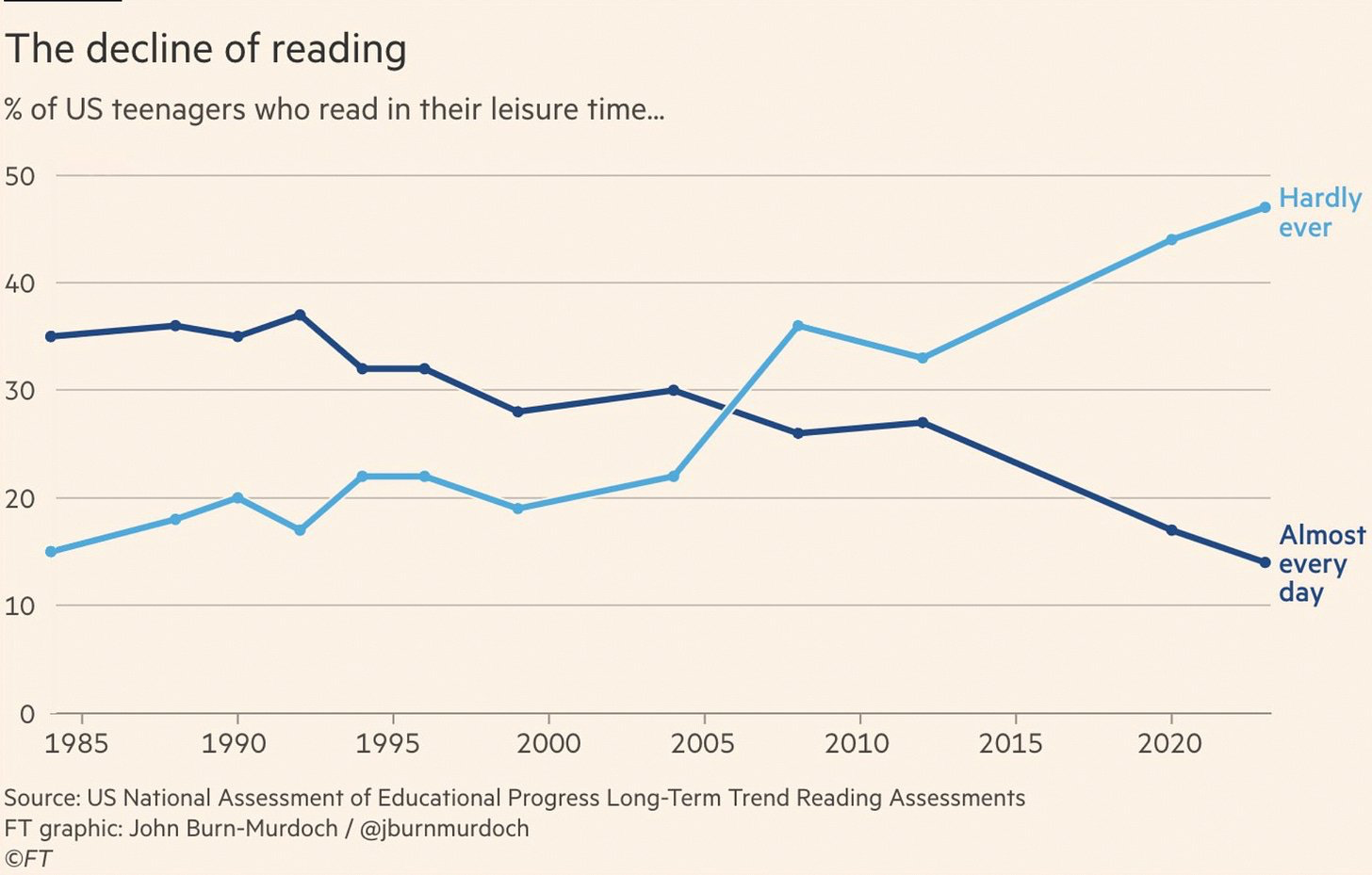

In 2020, only 10% of U.S. teenagers read daily in their leisure time, while 45% hardly ever read. This marks a significant shift from 1985 when these figures were nearly reversed. This change highlights a substantial decline in daily reading habits among teenagers over the past 35 years.

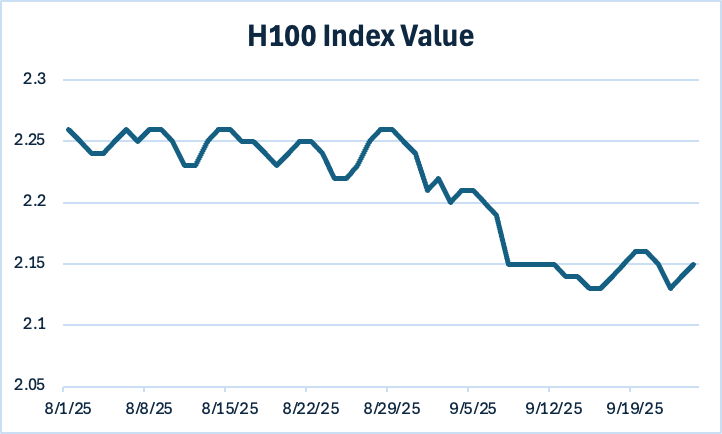

The H100 Index shows a significant decrease from approximately 2.27 to 2.13 between early August and mid-September 2025. This decline highlights potential market instability or external economic challenges, indicating a 6% drop impacting investor confidence and financial strategies.

THE IDEAS:

Mentions: FT, CNBC, Bloomberg, Macrobond, Oxford Economics

01. Geoeconomics influences global trade partnerships

Strategic interdependence and geopolitical partnerships are redefining global trade, with countries reshaping alliances for economic advantage. This trend impacts trade flows and market dynamics, as evidenced by McKinsey and Mohamed El-Erian's analysis of geopolitical trading patterns.

Related reading:

FT: Strategic interdependence is rewiring the global economy

FreightWaves: McKinsey: Geopolitical partners trading more with one another, less with rivals

02. EM currency positions reflect economic convergence

Investors' move towards EM currencies, with a focus on valuation convergence and growth potential, is shifting global investment patterns. This trend is highlighted by Bloomberg's analysis of increased EM currency buying, influencing equities and broader economic activities.

Related reading:

03. Industrial reclamation amid global economic shifts

Industries are capitalizing on structural changes to drive growth, as noted by Oxford Economics. The evolving industrial landscape offers opportunities to adapt and thrive in shifting economic conditions, emphasizing strategic adaptation and growth.

Related reading:

Oxford Economics: Industry Key Themes 2025: Industrial landscape at a critical juncture

04. AI adoption strengthening economic recovery strategies

AI-led initiatives, particularly in China, are providing a confidence boost amid economic sluggishness and geopolitical tensions. AI is aiding economic resilience and opening opportunities, as seen with DeepSeek's growth initiatives.

Related reading:

CNBC: DeepSeek-led AI adoption offers China an opportunity to boost its sputtering growth