SEPTEMBER 21, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

Trump's $100,000 H-1B visa change sparks chaos at tech companies (Bloomberg) … Seeing Through the Reality of Meta’s Smart Glasses (NY Times) … The Weekend Essay. The truth about immigration (FT) … Deutsche Bahn to appoint Evelyn Palla as CEO, officials say (Bloomberg) … Wall Street Bets Rates Will Drop Much More Than Fed’s Forecasts (WSJ) … What to Know About Jimmy Kimmel’s Show Being Suspended (NY Times) … Investors turn to derivatives for US corporate bonds as issuers can't keep up (Bloomberg) … At the Airport, There’s a Fancy New Lounge Everywhere You Look (WSJ) … Trump's new H-1B visa fee prompts emergency guidance from companies (FT)

TWO GRAPHS:

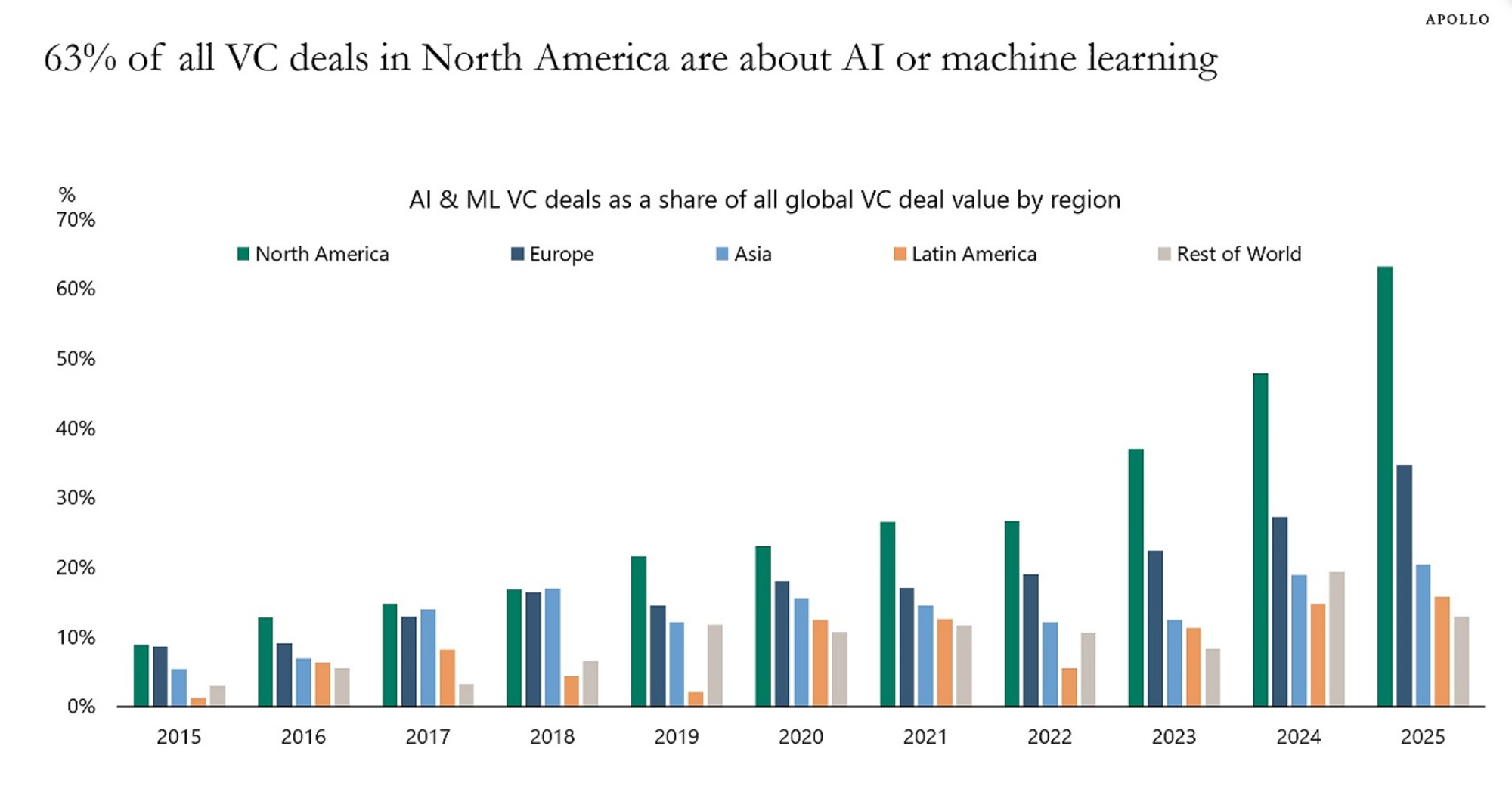

AI and machine learning VC deals in North America are projected to reach 63% in 2025, significantly surpassing other regions. This illustrates a striking dominance compared to Asia’s 18% and Europe's 15%, underscoring North America's leadership and potential innovation advantages in AI technology investments.

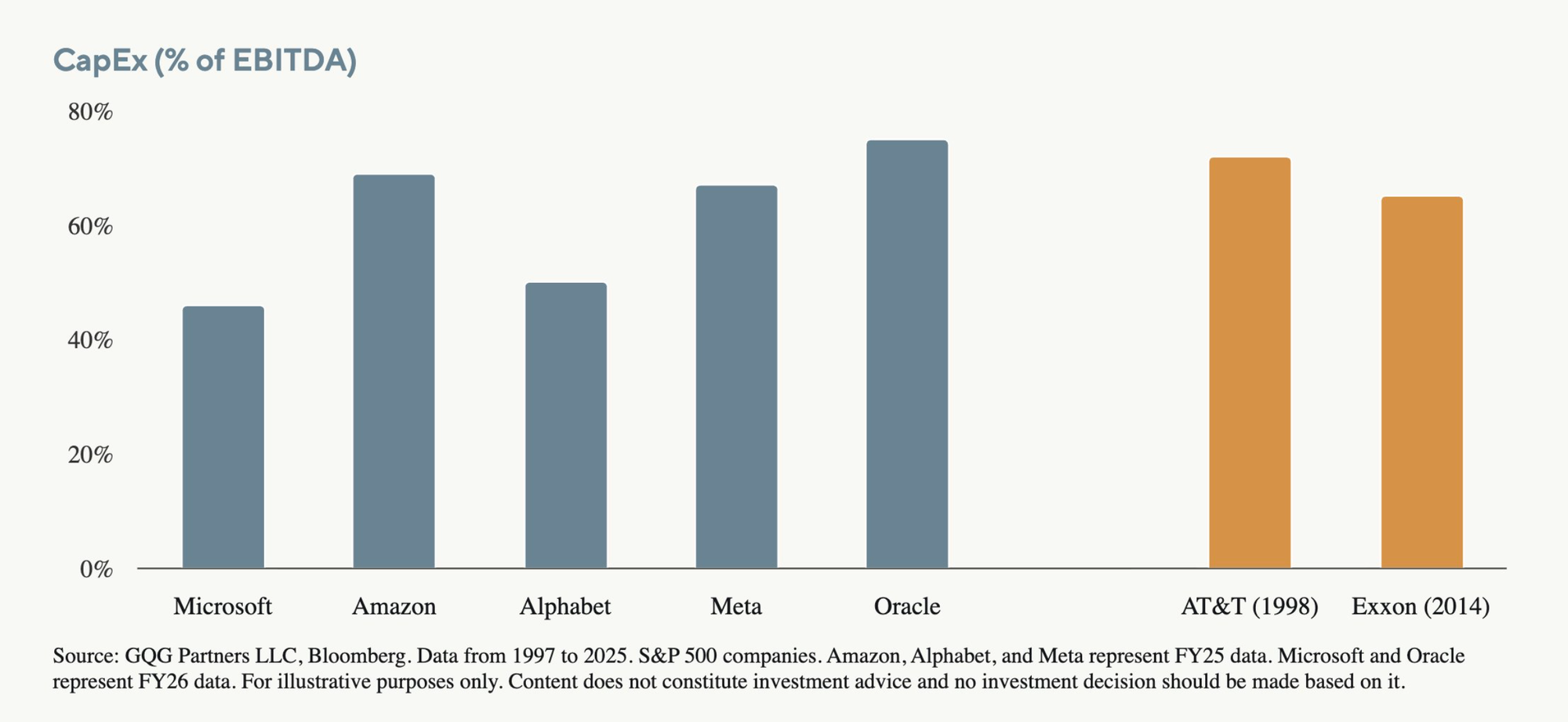

Amazon's projected CapEx as a percentage of EBITDA for FY25 is unusually high, exceeding 60%, rivaling AT&T (1998) and Exxon (2014). This signals substantial investment needs, highlighting Amazon's aggressive expansion strategy in contrast to peers, reflecting significant focus on growth and infrastructure development.

THE IDEAS:

Mentions: SPGSustainable1, x.com/elerianm, cnbc.com, oxfordeconomics.com, ft.com

01. Generative AI reshaping consumer and business landscapes

Generative AI tools are increasingly being adopted across industries, transforming consumer interactions and business processes. This trend is driven by high demand for AI-driven solutions and sustained interest from businesses in innovation. This could lead to growth opportunities for tech companies specializing in AI and sectors rapidly integrating these tools.

Related reading:

Twitter: @SPGlobal: As generative #AI sweeps across industries...

Carrier Management: The Evolving P/C GenAI Journey...

02. Geopolitical dynamics influencing trade partnerships

Strategic interdependence is reshaping global trade, emphasizing partnerships among geopolitical allies over rivals. This shift affects sectors reliant on international trade and urges companies to reassess supply chain strategies, potentially benefiting firms in countries with strong geopolitical ties.

Related reading:

Freight Waves: McKinsey: Geopolitical partners trading more with one another...

Financial Times: Strategic interdependence is rewiring the global economy

03. Emerging markets gaining traction in global equity flows

Investors are increasingly favoring emerging market equities, driven by better valuations and growth potential compared to developed markets. This trend could foster economic growth in emerging markets and attract further investments, benefiting sectors like consumer goods and technology.

Related reading:

X (formerly Twitter): Bloomberg: U.S. dollar shorts concentrated against EM currencies...

04. Industrial growth set for resurgence post-weakness

After years of stagnation, the industrial sector is experiencing a rebound. This resurgence is seen in key regions and is driven by investments in technology and infrastructure, providing opportunities for firms involved in manufacturing and industrial goods.

Related reading:

Oxford Economics: Industry Key Themes 2025: Industrial landscape at a critical juncture