SEPTEMBER 14, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

How the journal analyzed more than one million FAA reports (WSJ) … Used E.V. Sales Take Off as Prices Plummet (NY Times) … Australia to Invest $8 Billion in Aukus Defense Hub (Bloomberg) … AI-controlled drone swarms set to transform combat on battlefield (FT) … They Had Money Problems. They Turned to ChatGPT for Solutions. (NY Times) … Wall Street Rides a $1 Trillion Money Wave as Fed Test Looms (Bloomberg) … Global 36-Hour Interest-Rate Spree Heralds First US Cut of 2025 (Bloomberg) … Toxic fumes are leaking into airplanes, sickening crews and passengers (WSJ) … French companies’ borrowing costs fall below government’s as debt fears intensify (FT)

TWO GRAPHS:

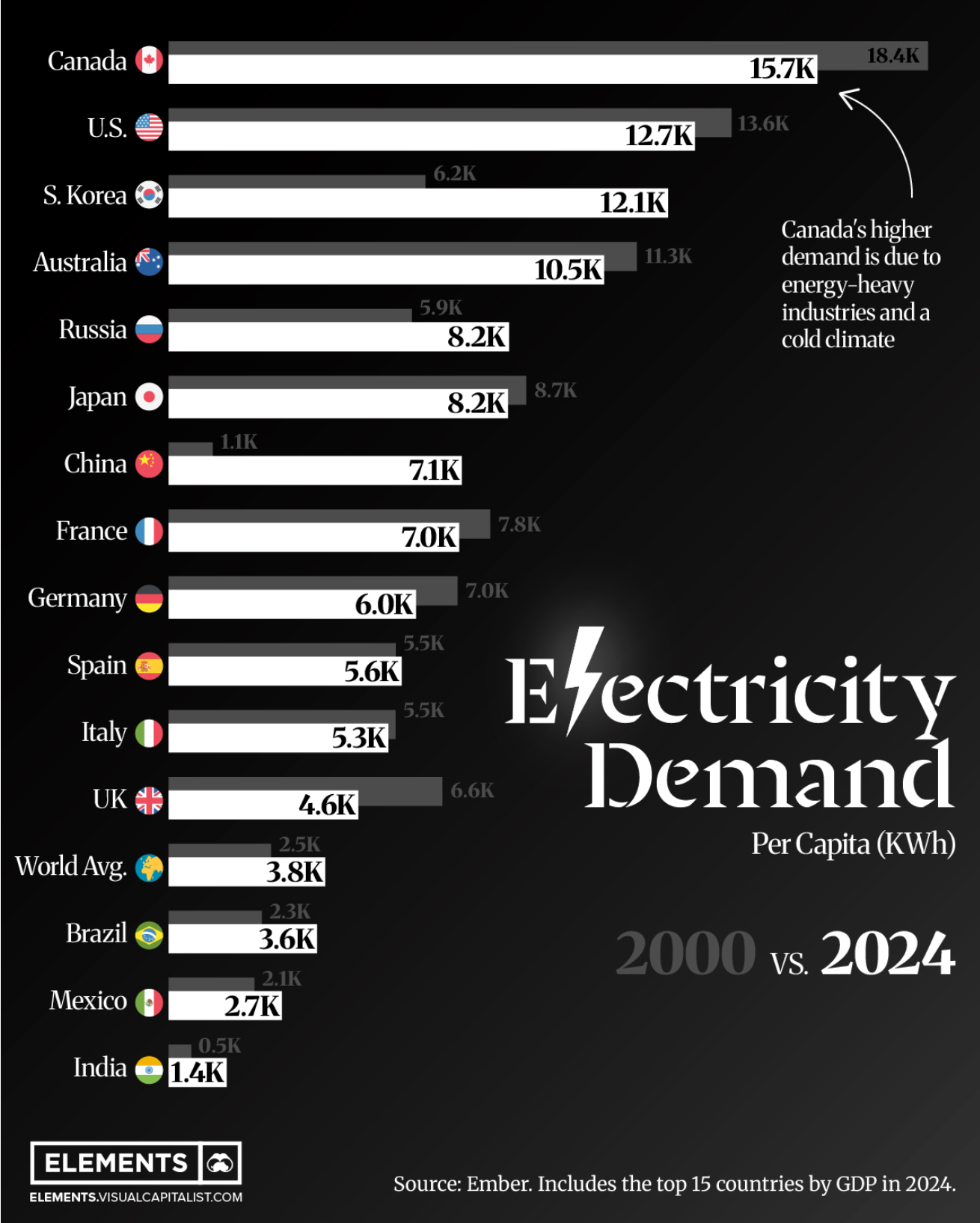

Canada's electricity demand is projected to reach 18.4 KWh per capita in 2024, significantly surpassing the second-highest, the U.S. at 13.6 KWh. This difference underscores the impact of energy-intensive industries and cold climate in Canada, influencing global electricity consumption patterns.

THE IDEAS:

Mentions: SPGI, MLIV, MDLZ, FT, CNBC

01. AI adoption boosts hospitality engagement and revenue.

AI enables hoteliers to deepen customer connections and improve revenue streams by personalizing experiences based on AI-driven insights. This trend transforms consumer interactions and has broader implications for customer-centric industries adopting similar technologies.

Related reading:

HospitalityNet: How hoteliers can create connections that drive revenue in an AI-driven world

02. Geoeconomics reshapes global trade relations.

As geoeconomic forces challenge traditional trade alliances, countries are reorienting partnerships. This shift creates opportunities to seize new trade ties while exposing vulnerabilities due to less predictable geopolitical landscapes.

Related reading:

FreightWaves: McKinsey: Geopolitical partners trading more with one another, less with rivals

Financial Times: Welcome to the new age of geoeconomics

03. Hidden climate risks are underestimated in portfolios.

With the market's limited understanding of extended climate risks, financial portfolios remain exposed. Proper assessment tools and ratings for climate risk could shift future corporate financial strategies and investor focus.

Related reading:

Oxford Economics: What is the ‘hidden’ climate risk in your financial portfolio?

04. Industrial growth gains momentum post-weak period.

Following several years of stagnation, industrial sectors show signs of resurgence, creating opportunities for investment and innovation. This momentum could stimulate broader economic activities, enhancing job markets and technological advancement.

Related reading:

Oxford Economics: Industry Key Themes 2025: Industrial landscape at a critical juncture

CNBC: This industrial giant could be about to break out, charts show