AUGUST 17, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

Canada Directs Labor Board to End Strike at Biggest Airline (Bloomberg) … Blackwater’s Erik Prince muscles back into the mercenary business, touting Trump allies (WSJ) … SpaceX gets billions from the government. It gives little to nothing back in taxes. (NY Times) … Echo Investment Unit Inks €565 Million Polish Real Estate Sale (Bloomberg) … For Gen Z, ‘little treats’ are worth going over budget (NY Times) … C.E.O.s want their companies to adopt A.I. but do they get it themselves? (NY Times)

TWO GRAPHS:

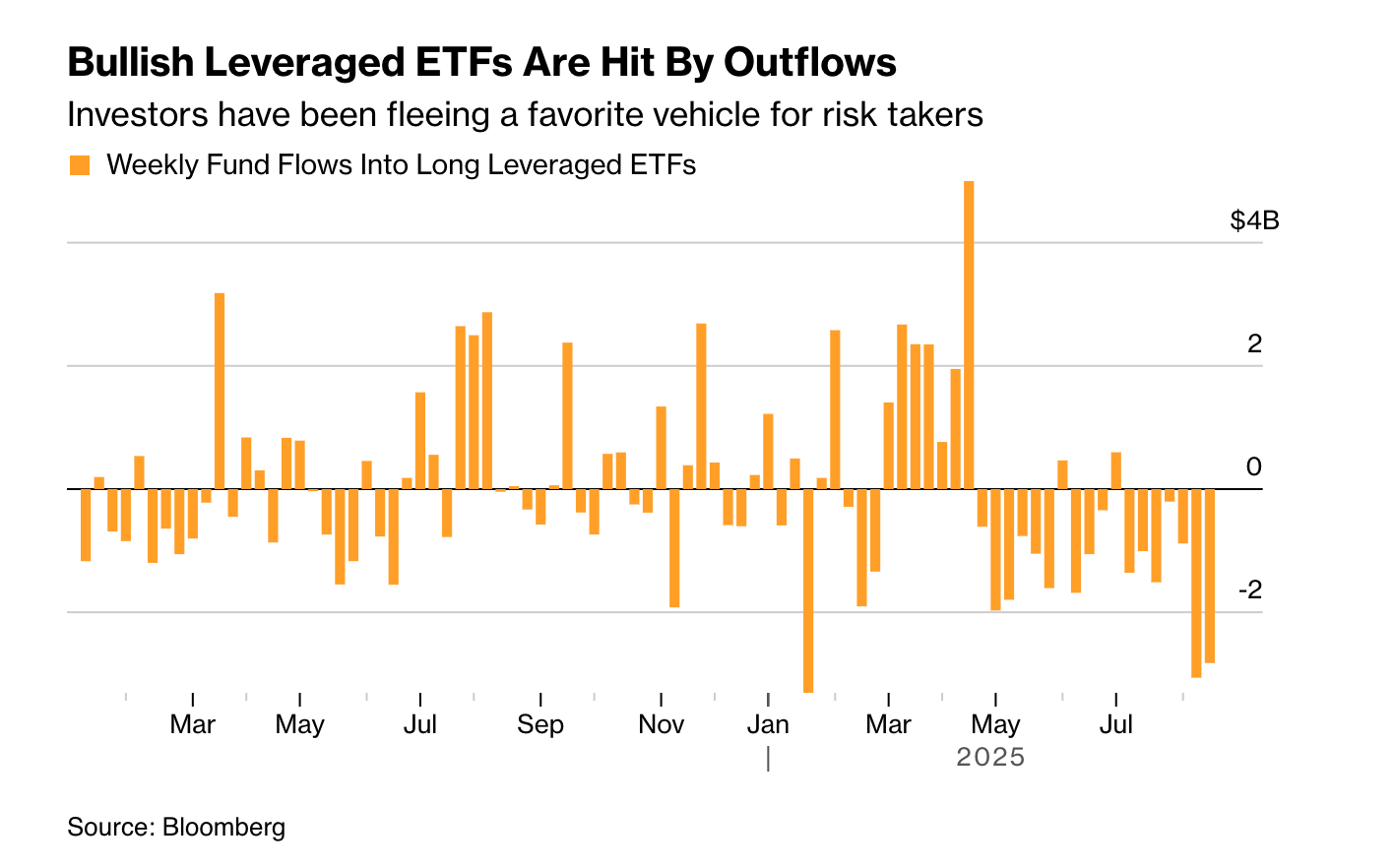

Significant outflows from bullish leveraged ETFs around June 2025 reached nearly $3 billion, contrasting with previous inflows. This shift signals a notable change in investor sentiment, raising concerns about market volatility and risk management strategies.

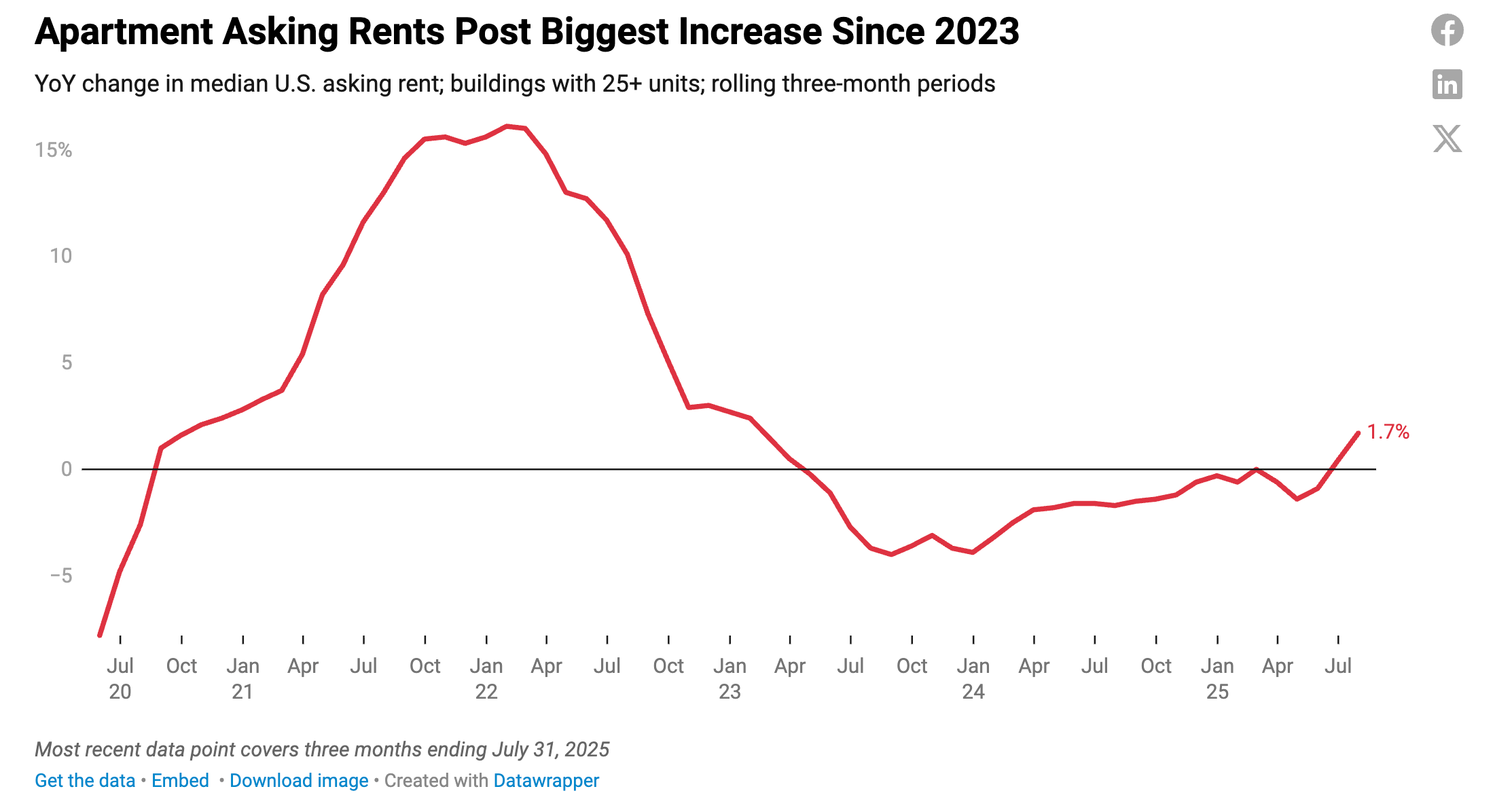

U.S. median apartment rents increased by 1.7% after a period of decline, marking the largest rise since 2023. This shift indicates a potential rebound in the rental market, affecting housing affordability and demand dynamics.

THE IDEAS:

Mentions: AAPL, MSFT, FTSE, INTC, XOM

01. AI tools revolutionizing operational efficiencies

Generative AI is sweeping across industries, impacting operational efficiencies and consumer expectations. This will lead to competitive advantages for companies adopting AI early, impacting sectors from tech to hospitality. Broader implications include cost reductions and acceleration of innovation cycles.

Related reading:

CNBC: An AI 'pick-and-shovel' play and signs that the market rally is broadening

Twitter: As generative #AI sweeps across industries and the #consumer landscape

02. Geostrategic shifts reshaping trade routes

Geopolitical shifts are changing traditional trade dynamics. The US-China relationship is no longer driven solely by cost and efficiency, creating opportunities for new trade alliances. Second-order effects include changes in supply chain strategies and long-term economic dependencies.

Related reading:

Financial Times: Strategic interdependence is rewiring the global economy

FreightWaves: McKinsey: Geopolitical partners trading more with one another, less with rivals

03. Intangible assets gaining strategic focus internationally

The valuation of intangible assets abroad is increasingly significant, necessitating strong oversight for maximizing potential. This trend holds substantial implications for multinational corporations aiming to leverage these assets, boosting competitiveness and innovation.

Related reading:

Phys.org: Unlocking the value of intangible assets abroad requires strong board oversight, new study finds

04. Tech companies adjusting to Washington's new climate

The shifting political climate in Washington demands tech companies to adapt their strategies. Companies that navigate these policy changes effectively can benefit from favorable conditions, while others risk falling behind due to eroding geopolitical relationships.

Related reading:

Twitter: Tech companies must adapt to Washington’s new political climate or risk falling behind