AUGUST 03, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

Norinchukin Bank (FT) … After a Lag, Consumers Begin to Feel the Pinch of Tariffs (NY Times) … Berkshire’s Quarterly Earnings Drop on Insurance Results, Currency Moves (WSJ) … Why Even Basic Airline Seats Keep Getting More ‘Premium’ (NY Times) … Tequila, Drugs and Torture: The Spending Binge of Two Crypto Bros That Ended Behind Bars (WSJ) … Chocolate cartels: the rise of cocoa smuggling (FT) … Joby Said to Weigh Deal for Helicopter Ride-Share Operator Blade (Bloomberg) … Triangles, Crescents, Slivers: Can Odd-Shaped Lots Help Ease the Housing Crisis? (NY Times) … Codelco Finds Human Remains in Blow to Chile Mine Rescue Efforts (Bloomberg)

TWO GRAPHS:

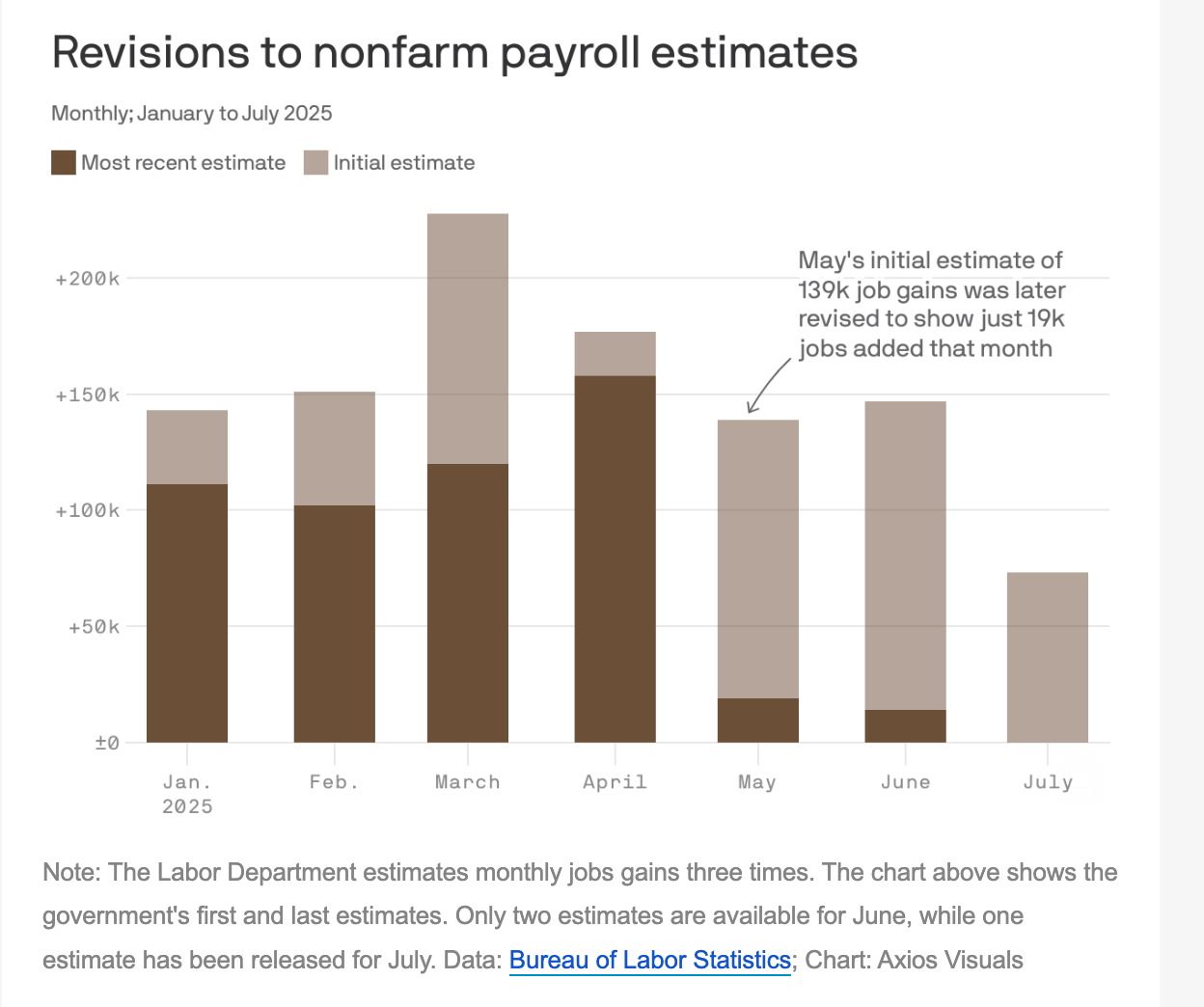

May's job growth estimate was drastically revised from 139k to 19k, a decrease of 86%. This significant revision highlights potential volatility or initial inaccuracies in economic data reporting, impacting economic planning and policy decisions.

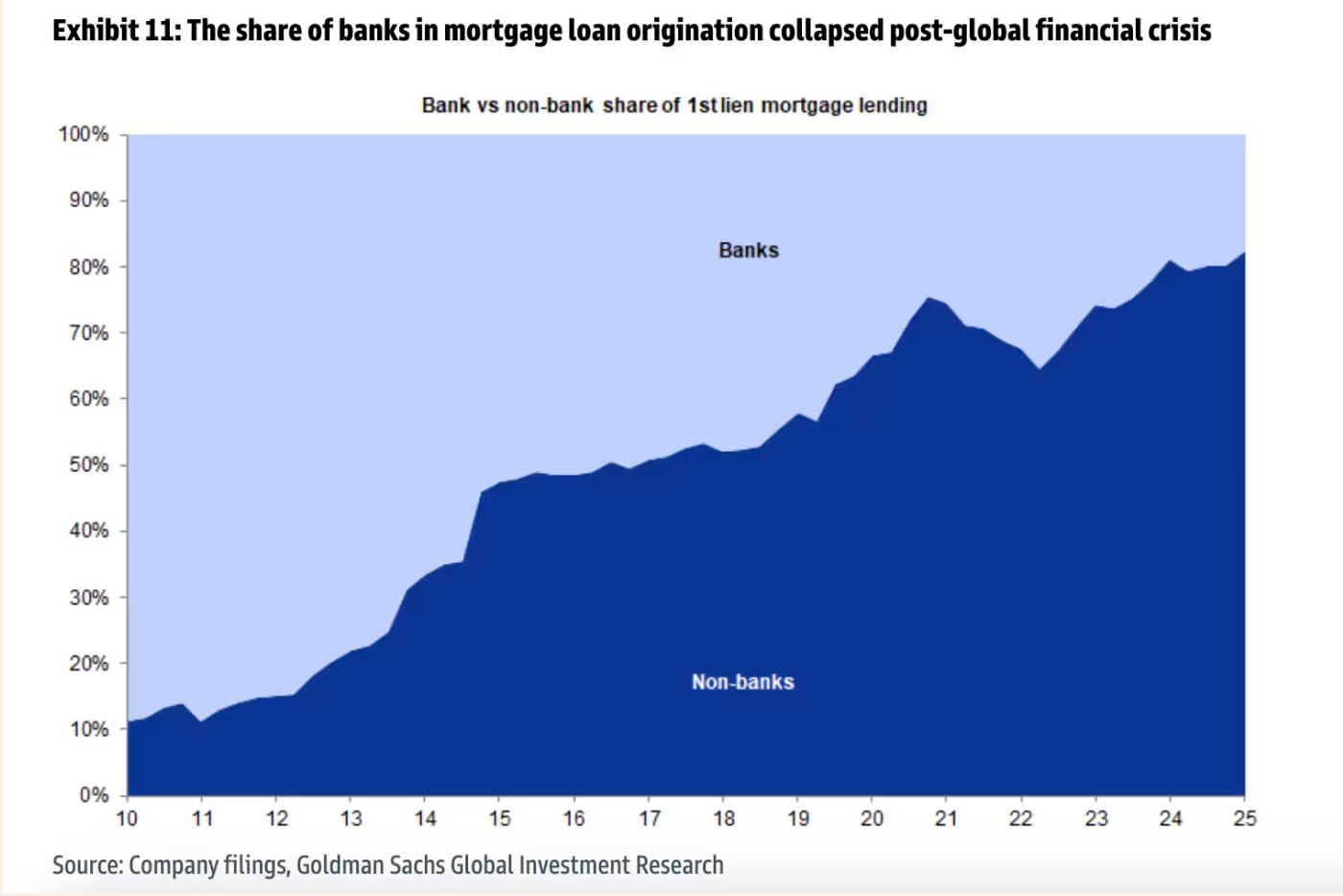

Non-bank mortgage origination rose from under 10% in 2010 to over 70% by 2020, reflecting a significant market shift post-financial crisis. This change highlights increasing reliance on non-bank lenders, reshaping the mortgage landscape and influencing regulatory and financial stability discussions.

THE IDEAS:

Mentions: GOOGL, PYPL, AMADY, SPCE, MAR

01. AI tools redefine travel booking strategies

AI tools integrated into travel booking systems are significantly changing how consumers plan and manage trips. By collaborating on AI tools, companies like Google and Amadeus are streamlining travel booking processes, potentially increasing booking efficiency and customer satisfaction. Over the next 6-24 months, expect an uptick in AI adoption across hospitality and travel-related sectors.

Related reading:

Skift: Booking Trends, AI Tools, and the New Rules of Travel Planning

02. AI boosts cross-border payment innovations

AI is increasingly crucial in revolutionizing cross-border payment systems. Emerging tech-enabled solutions aim to reduce transaction costs and improve speed, indicating a strategic shift toward more integrated and efficient global payment networks. These innovations are likely to influence stakeholders including financial firms and create new geopolitical and economic dynamics.

Related reading:

Financial Times: The race for the future of cross-border payments

03. Hospitality sector integrates local experiences

The hospitality industry is increasingly valuing local expertise alongside global operational frameworks. This trend highlights the importance of local knowledge in delivering customized and engaging guest experiences, which could drive demand for localized service offerings and partnerships with local businesses, enhancing revenue streams.

Related reading:

Hospitality Net: Global Vision, Local Knowledge: Why One Can’t Succeed Without the Other

04. Space economy drives technology investments

Growth in the space economy is attracting increased investments in aerospace technology and satellite services. With a market now valued at $613 billion, sectors from telecommunications to Earth observation are likely to see significant advancements, fostering innovation and creating new business opportunities over the next 24 months.

Related reading: