JUNE 22, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Zuckerberg receives a macho-man makeover (FT)

- Tesla robotaxi ambitions face reality check (FT)

- Media industry clash unfolds at Cannes (NY Times)

- Tariffs raise can production costs (NY Times)

- Iran imagery reveals rush to export oil globally (Bloomberg)

- ICE raids scare workers from job sites (Bloomberg)

TWO GRAPHS:

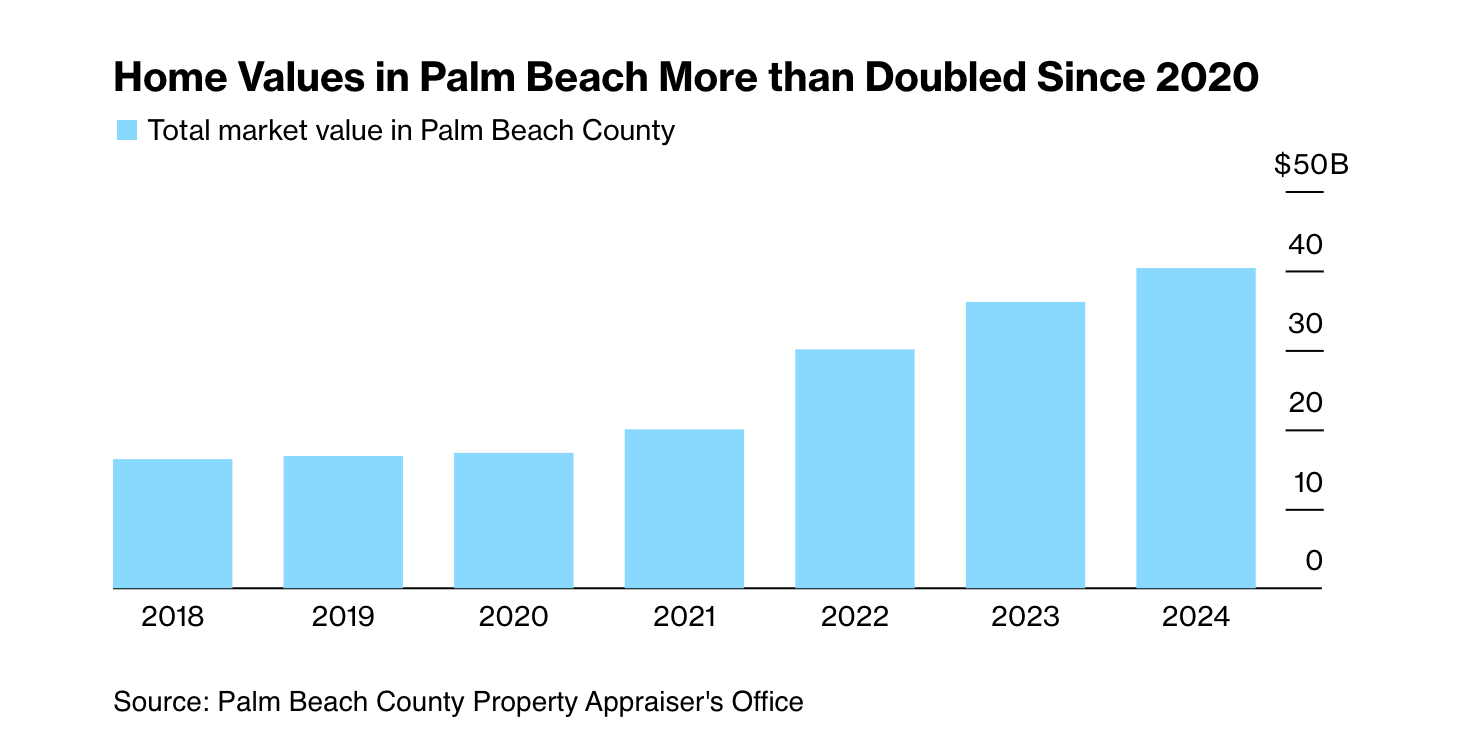

Palm Beach home values surged from $20 billion in 2020 to nearly $50 billion in 2024, over doubling within four years. Such rapid growth impacts affordability, housing availability, and reflects larger economic shifts, potentially driven by migration trends, investment influx, and regional development policies.

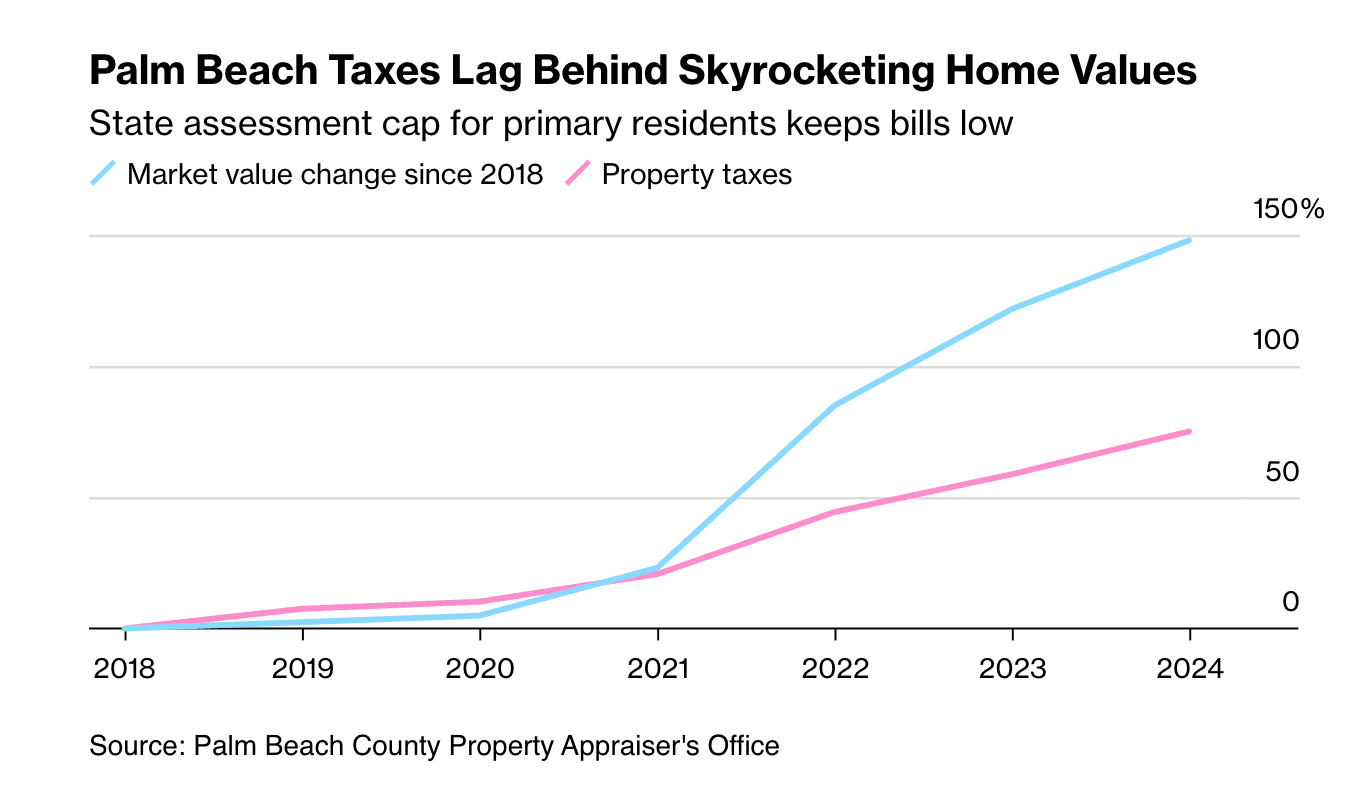

Home market values in Palm Beach have increased nearly threefold compared to property taxes since 2018. This discrepancy, driven by a state assessment cap, highlights a growing gap affecting local tax revenue and housing affordability.

THE IDEAS:

Mentions: GOOGL, ARAMCO, SPG, FT, S&P

01. AI reshapes travel marketing strategy

Google's AI shift is rapidly disrupting travel marketing, shifting focus from traditional to AI-driven models. This transformation can impact how travel businesses allocate marketing budgets and target key demographics, altering competitive dynamics within the industry.

Related reading:

Skift: Google’s AI Shift: Travel Marketing Disruption Is Coming Fast

02. Renewable energy accelerates global transition

The adoption of renewable energy is accelerating globally due to technological advancements and climate change-driven policies. This trend could lead to a decline in fossil fuel dependence and reshape energy markets, benefiting companies in renewable sectors.

Related reading:

PowerMag: The Great Shift: Navigating the Global Energy Transition

PowerMag: 2025’s Energy Crossroads: 6 Trends Redefining the Global Power Sector

03. European bank M&A faces alignment challenges

Despite potential benefits, European banks face significant hurdles in mergers and acquisitions due to regulatory complexities and strategic misalignment. Progress may occur if conditions align, potentially reshaping the financial landscape.

Related reading:

FT: European bank M&A is hard, but sometimes stars align

S&P Global: From Our banking risk experts share insights on key events shaping the #FinancialSector in emerging markets

04. Shifting geopolitical trade partnerships

Geopolitical partners are increasingly trading more with allies and less with rivals. This shift can impact global supply chains, influencing trade policies and economic strategies.

Related reading:

FreightWaves: McKinsey: Geopolitical partners trading more with one another, less with rivals