JUNE 08, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- US fiscal policy in disarray, solutions lacking (FT)

- US employment growth trends analyzed (FT)

- ASML navigates trade challenges with advanced tools (NY Times)

- US tourism sector concerned about declining vacationers (NY Times)

- Administration ends ‘Quiet Skies’ surveillance program (WSJ)

- Stocks jump after new jobs data release (WSJ)

- S&P 500 gains as jobs report impacts bonds (Bloomberg)

TWO GRAPHS:

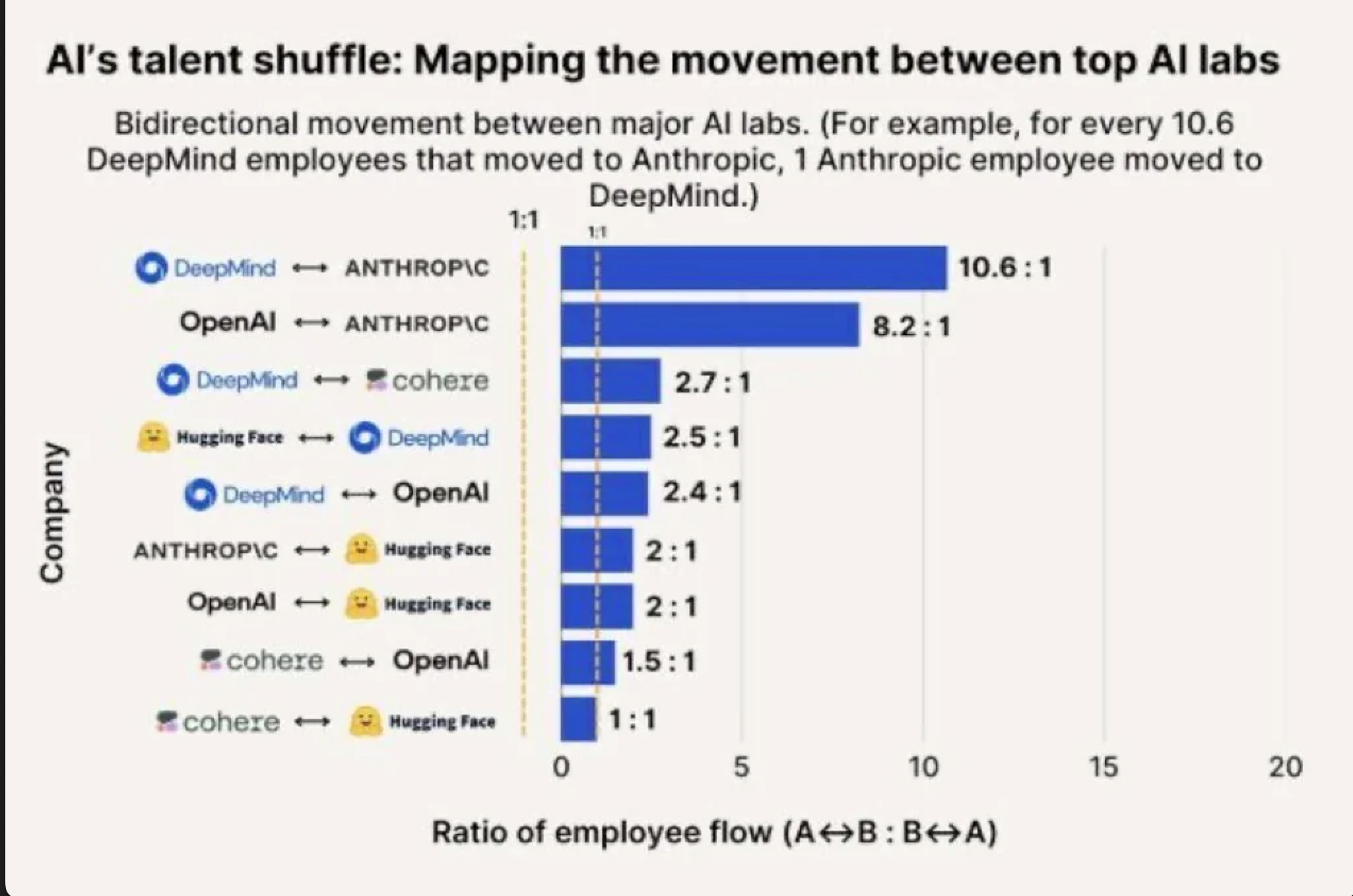

DeepMind loses significantly more talent to Anthropic, with a 10.6:1 ratio, compared to the balanced flow with Hugging Face. This highlights Anthropic's strong pull in the AI talent market, potentially influencing industry innovation and collaboration dynamics.

Stablecoin operators now surpass China in short-term US debt holdings, highlighting crypto's growing role in global finance. This shift signals stablecoins' influence, managing around 50% more US debt compared to China's, raising questions about financial stability and emerging economic dynamics.

THE IDEAS:

Mentions: NASDAQ, REIT, Macrobond, CNBC, Oxford Economics

01. China gains edge via AI in supply chains

Chinese factories are integrating AI technology for cost-cutting and quality control, making them more competitive. This trend could increase China's dominance in global supply chains, impacting importers and exporters worldwide. Over time, this could lead to dependency on Chinese goods, and potentially increase inflation for countries relying on these imports.

Related reading:

02. US exceptionalism persists in market dynamics

Despite changing global economic conditions, US markets remain resilient with AI advancements driving cybersecurity stocks. This trend underlines US economic exceptionalism, suggesting a stable investment climate in the US market. Over the next couple of years, this could preserve investor interest and sustain capital inflow into US equities.

Related reading:

CNBC: A cybersecurity stock to play the AI trend, and why U.S. exceptionalism in markets isn't over

03. Geopolitical realignment reshapes global trade patterns

Countries are increasingly trading within geopolitical blocs, reducing reliance on rivals. This realignment could lead to elevated exports among allies and a shift in global trade balances, impacting markets that depend on rival nations. Over the next year, watch for shifts in trade policies and tariff implementations.

Related reading:

FreightWaves: McKinsey: Geopolitical partners trading more with one another, less with rivals

04. Industrial sector recovery signals broader economic rebound

Following recent stagnation, the industrial sector is showing signs of recovery. Leading indicators suggest increased production and growth, which may culminate in broader economic improvement. As industrial demand rises, this stimulus could lead to enhanced employment and profit margins, benefiting related sectors over the next 18 months.

Related reading:

Oxford Economics: Industry Key Themes 2025: Industrial landscape at a critical juncture