MAY 18, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Crypto attacks involve severed fingers and intense violence (WSJ)

- California explosion kills one, damages fertility center (WSJ)

- Newark faces dire air traffic staffing crisis (NY Times)

- Life savings stolen from mailed paper check (NY Times)

- The 'Taco' factor boosts markets (FT)

- Apollo's plan to remake Wall Street (FT)

- Tariff disruptions worsen economic outlook over earnings (Bloomberg)

- Sailboat with 270 people hits Brooklyn Bridge (Bloomberg)

TWO GRAPHS:

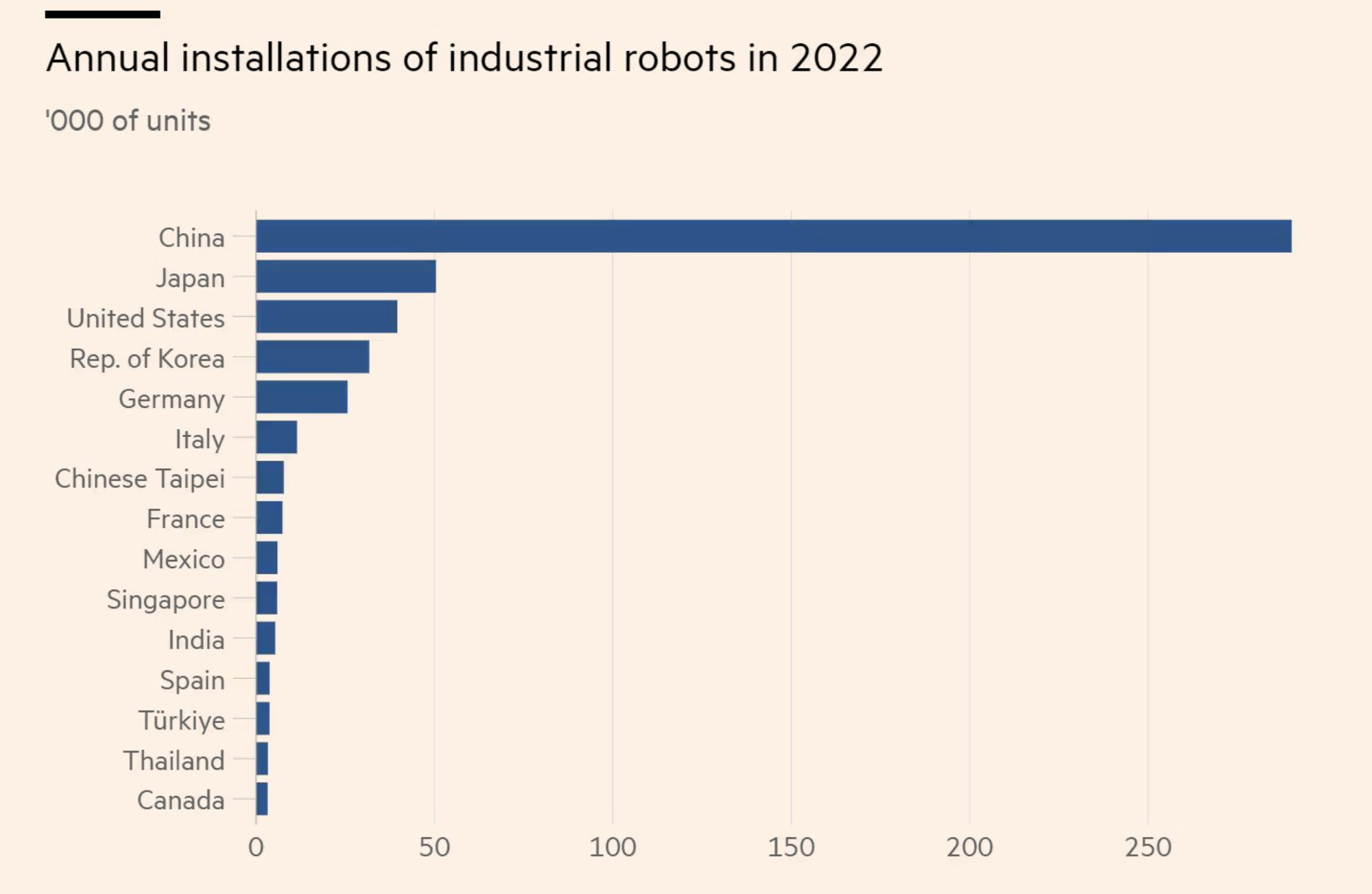

China's industrial robot installations in 2022 vastly surpassed other countries, exceeding Japan's by over three times. This dominance highlights China's rapid automation growth, potentially influencing global manufacturing dynamics and labor markets.

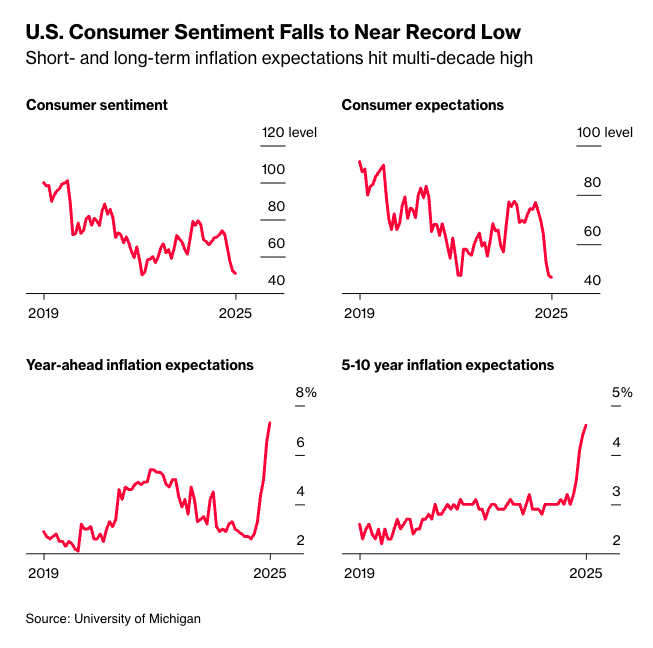

Consumer sentiment has plummeted to near-record lows, contrasting sharply with inflation expectations reaching multi-decade highs of 5% over 5-10 years. This divergence underscores significant economic uncertainty, influencing consumer behavior and economic planning.

THE IDEAS:

Mentions: SPGSustainable1, MDLZ, X, UMass, INTC

01. Geoeconomic shifts redefine global partnerships

The integration of tech, trade, finance, and military policies is reshaping global partnerships. Countries are prioritizing trade with allies over rivals, influencing supply chains and economic strategies. This shift impacts multinational companies navigating geopolitical landscapes.

Related reading:

Financial Times: Welcome to the new age of geoeconomics

Freight Waves: Geopolitical partners trading more with one another, less with rivals

02. Japan's regional industries offer growth potential

Japan's manufacturing sectors show uneven growth across regions, with potential for new hotspots. Investments in these emerging areas can drive job creation and income growth, offering lucrative opportunities for companies like INTC to diversify their investment strategies.

Related reading:

Oxford Economics: Identifying future manufacturing hot spots in Japan and their implications

03. Trade policy chaos favors anecdotal data reliance

With U.S. trade policies causing uncertainty, investors are shifting towards soft data like anecdotal evidence for decision making. This trend highlights the need for dynamic data analysis tools and could influence sectors dependent on swift policy changes.

Related reading:

Reuters: Investors look to soft data for direction amid trade policy chaos

04. AI expands impact on industries, consumer habits

The rapid adoption of generative AI across industries is transforming consumer and business practices. This shift presents opportunities for companies focusing on AI solutions to capture new markets and enhance operational efficiency, as seen in healthcare and tech sectors.

Related reading:

Becker's Hospital Review: UMass Memorial expands AI triage tool to 5 more hospitals

S&P Global: As generative AI sweeps across industries and the consumer landscape