MARCH 30, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Climate-resilient chickens help fight poverty in Zambia (NY Times)

- Auto tariffs prompt car buying rush (NY Times)

- Khosla sees best investment opportunity in a decade (Bloomberg)

- Quake impacts Thai tourism, heightens safety concerns (Bloomberg)

- Home buyers act despite high rates and prices (WSJ)

- Elon Musk aims to dominate NASA missions to Mars (WSJ)

- EU capitals push to soften tariff retaliation (FT)

- Columbia president resigns after yielding to demands (FT)

TWO GRAPHS:

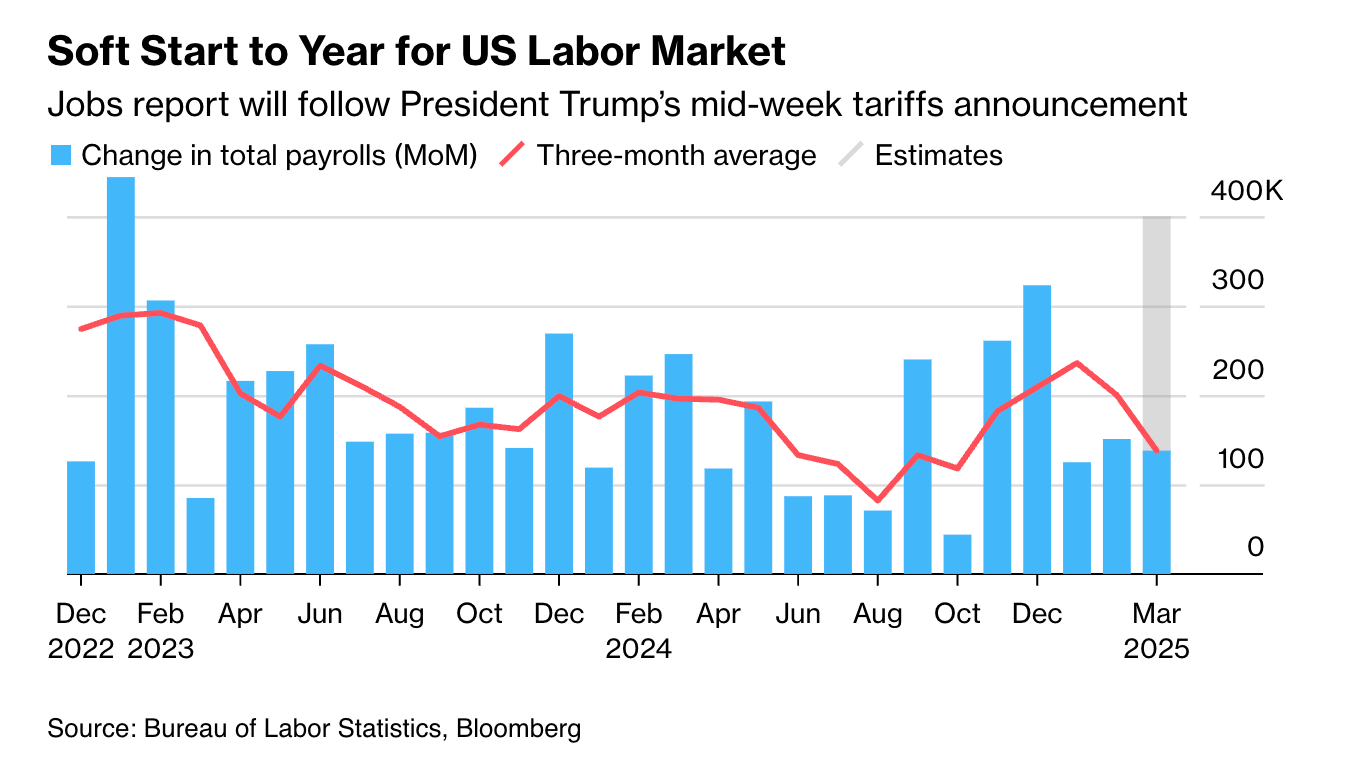

US labor market faces a marked contraction as three-month average payroll growth plummets from nearly 300K to below 100K within two years. This decline signifies weakening economic momentum and raises concerns over potential impacts from policy changes related to tariff announcements.

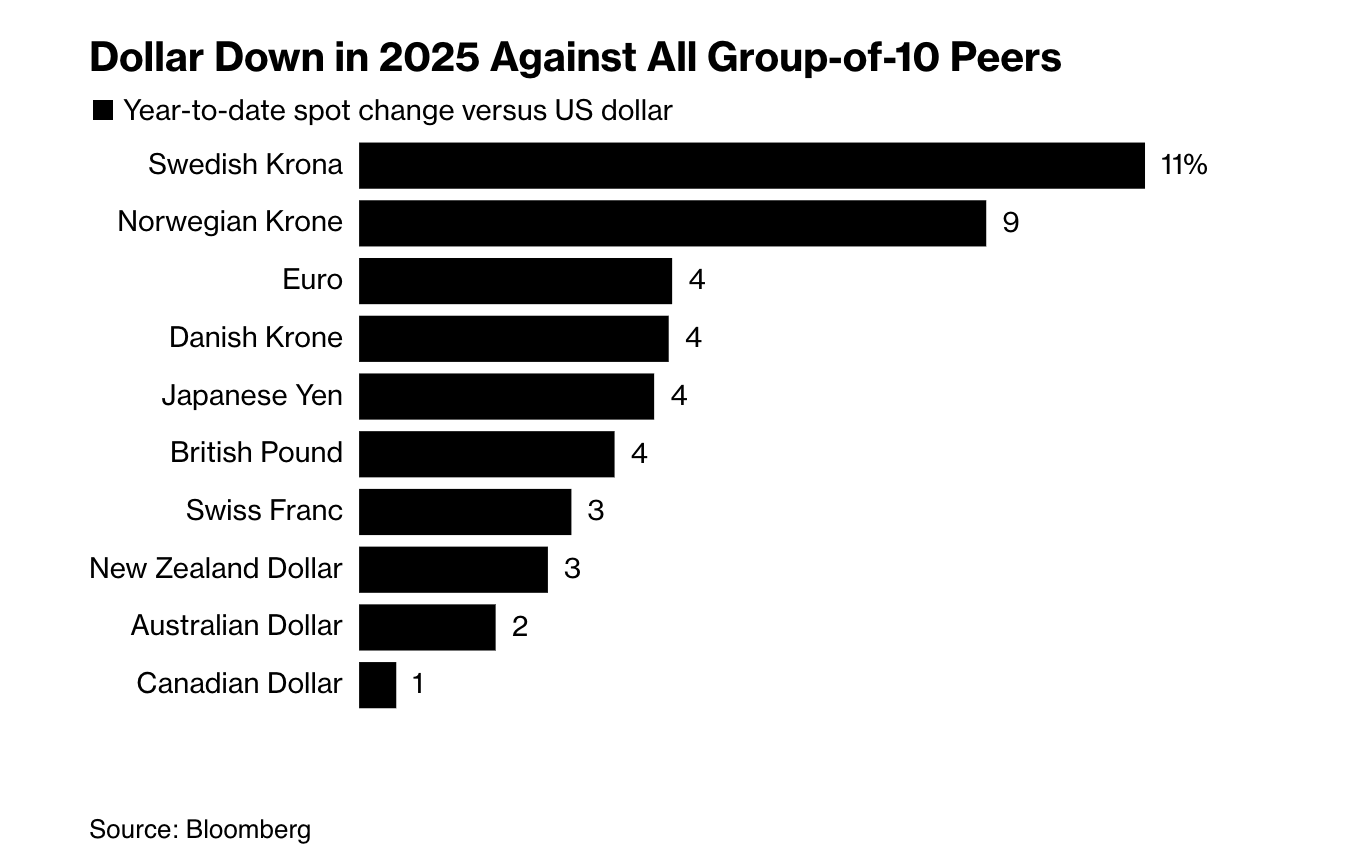

The Swedish Krona's 11% rise against the US dollar is significant, contrasting sharply with the Canadian Dollar's 1% increase. Such a disparity underscores potential shifts in economic policies and investor confidence, influencing global trade dynamics and currency market strategies.

THE IDEAS:

Mentions: META, TSLA, Honeywell, DeepSeek, S&P 500

01. AI-driven compliance in healthcare advances rapidly

AI platforms are transforming healthcare compliance by automating workflows and enhancing efficiency and data security. This trend will drive investment in digital health technologies impacting companies developing compliance solutions. As regulatory scrutiny intensifies, the healthcare sector should prepare for AI-driven innovation in compliance amid rising data privacy concerns.

Related reading:

Healthcare Dive: Balancing innovation and compliance: A risk-smart approach to digital evolution

02. Trade wars elevate stagflation risk globally

The escalation of tariff wars is sparking fears of stagflation as economies face rising costs and slowing growth. This could impact sensitive sectors by elevating input prices and restricting supply chains. Monitoring tariff developments is crucial for global industries, particularly manufacturing and consumer goods.

Related reading:

YouTube: Stagflation Fears Rise as Tariff War Escalates | Full Episode| Insight with Haslinda Amin 3/28/2025

Financial Times: Clarity on tariffs can’t come soon enough

03. mRNA technology faces policy-induced uncertainty

Ongoing regulatory uncertainties are casting a shadow over mRNA technology development. If governments reduce support or impose stricter regulations, biotech companies may face challenges in innovation and funding. This could influence investment strategies in pharmaceutical and biotechnology sectors, affecting long-term advancements in medical technology.

Related reading:

Financial Times: An ominous shadow falls over mRNA technology

04. Geopolitical shifts redefine global trade partnerships

Geopolitical dynamics are prompting countries to trade more with allies and less with rivals, driven by strategic alliances. This trend impacts global supply chains and trade patterns, influencing companies dependent on international markets. Continued monitoring will be key as geopolitical tensions and collaborations evolve.

Related reading:

FreightWaves: McKinsey: Geopolitical partners trading more with one another, less with rivals