MARCH 23, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Unexpected home sales rise as buyers return (WSJ)

- Tesla recalls majority of Cybertrucks (WSJ)

- Accenture reports revenue hit from Musk’s spending cuts (FT)

- Jeff Bezos reconciles with Maga (FT)

- Office market recovery signals worst is over (NY Times)

- Elon Musk’s top DOGE overseer revealed (NY Times)

- Stocks rally halted by trade fears (Bloomberg)

- UBS may move HQ unless Swiss cut capital demands (Bloomberg)

TWO GRAPHS:

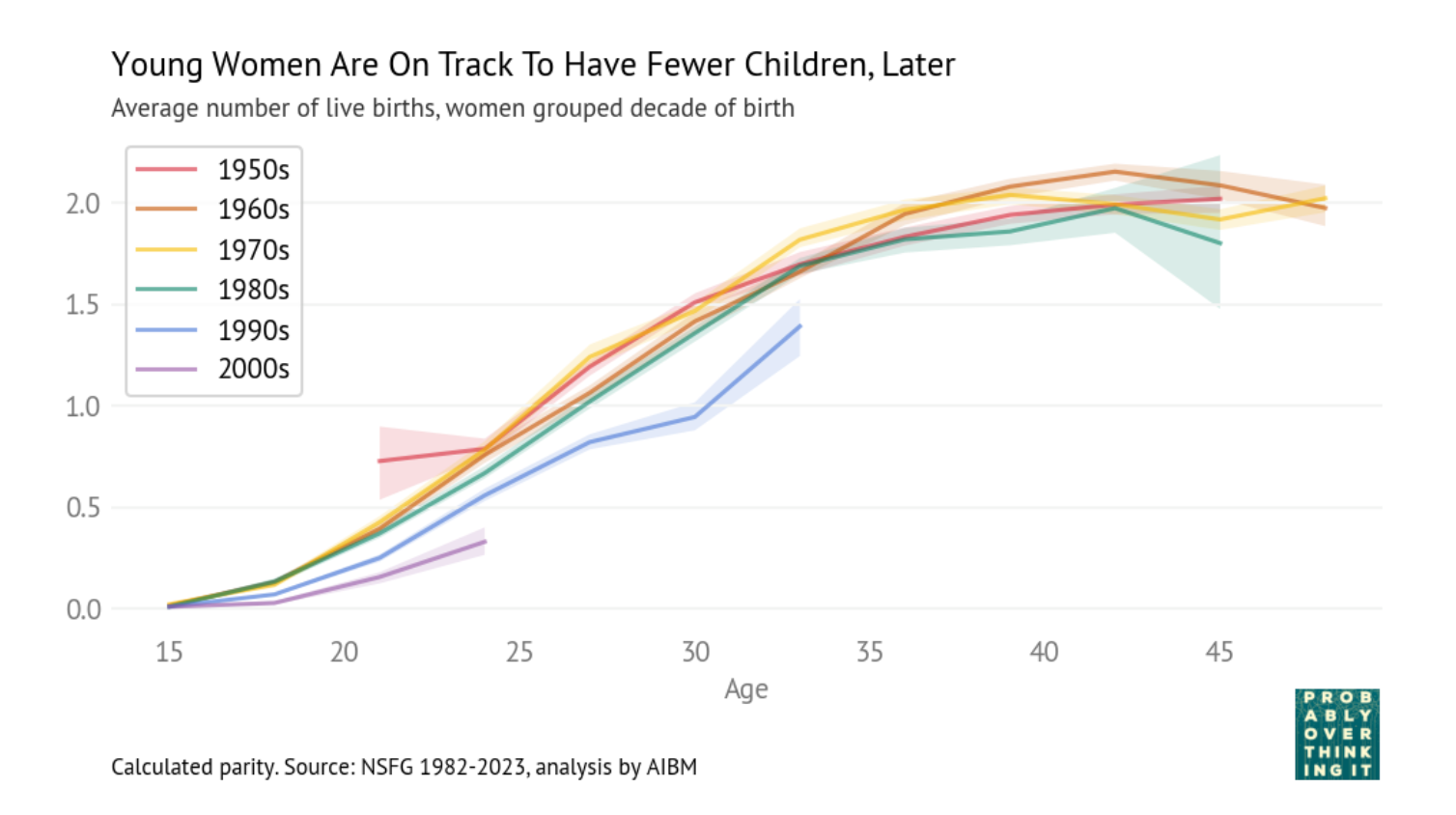

Women born in the 1990s have fewer children by age 30 compared to previous generations, with about 1.5 fewer than those from the 1960s. This significant decline highlights a societal shift toward delayed parenthood, impacting demographics and economic planning.

Gold's price increased by 40.99%, outperforming Bitcoin's 24.81% rise over the same period. This is significant as Bitcoin often leads in volatility and growth in uncertain times. The reversal highlights a stronger preference for traditional assets despite digital currency popularity.

THE IDEAS:

Mentions: AAPL, S&P 500, NASDAQ, EU, China

01. AI reshapes China's economic strategy

DeepSeek's AI breakthroughs provide China a path to revitalize its economic growth amidst a prolonged slowdown and trade tensions with the U.S. This positions China's tech sector for growth, catching global investor interest, despite broader economic challenges.

Related reading:

CNBC: DeepSeek-led AI adoption offers China an opportunity to boost its sputtering growth

02. Tariffs disrupt global supply chains

The ongoing uncertainty and impact of tariffs are throwing global supply chains into 'uncharted territory,' leading to shifts in trading patterns and manufacturing decisions globally.

Related reading:

YouTube: Global #economy in "uncharted territory" from #tariff impact

Financial Times: Clarity on tariffs can’t come soon enough

03. Financial markets undergo regime shift

Investment gains on 'Mag 7' stocks in 2024 match the German Dax, signaling a significant regime shift in financial markets. This indicates the strong influence of tech stocks in evolving market dynamics.

Related reading:

04. Geopolitical shifts alter trade partnerships

Countries are increasingly trading with geopolitical allies rather than rivals, indicating a shift in global trade dynamics that could affect investment strategies and geopolitical stability.

Related reading:

Freight Waves: McKinsey: Geopolitical partners trading more with one another, less with rivals