MARCH 16, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Economic fear prompts consumer, business distress signals (WSJ)

- Virgin Atlantic plans UK air-taxi service with Joby (Bloomberg)

- Canada reviews F-35 order amid US rift (Bloomberg)

- C.F.P.B. revives after court orders (NY Times)

- Tariffs threaten France's champagne industry (NY Times)

- German army struggles recruiting Gen Z for war (FT)

- Free speech history evolves from ideal to politics (FT)

TWO GRAPHS:

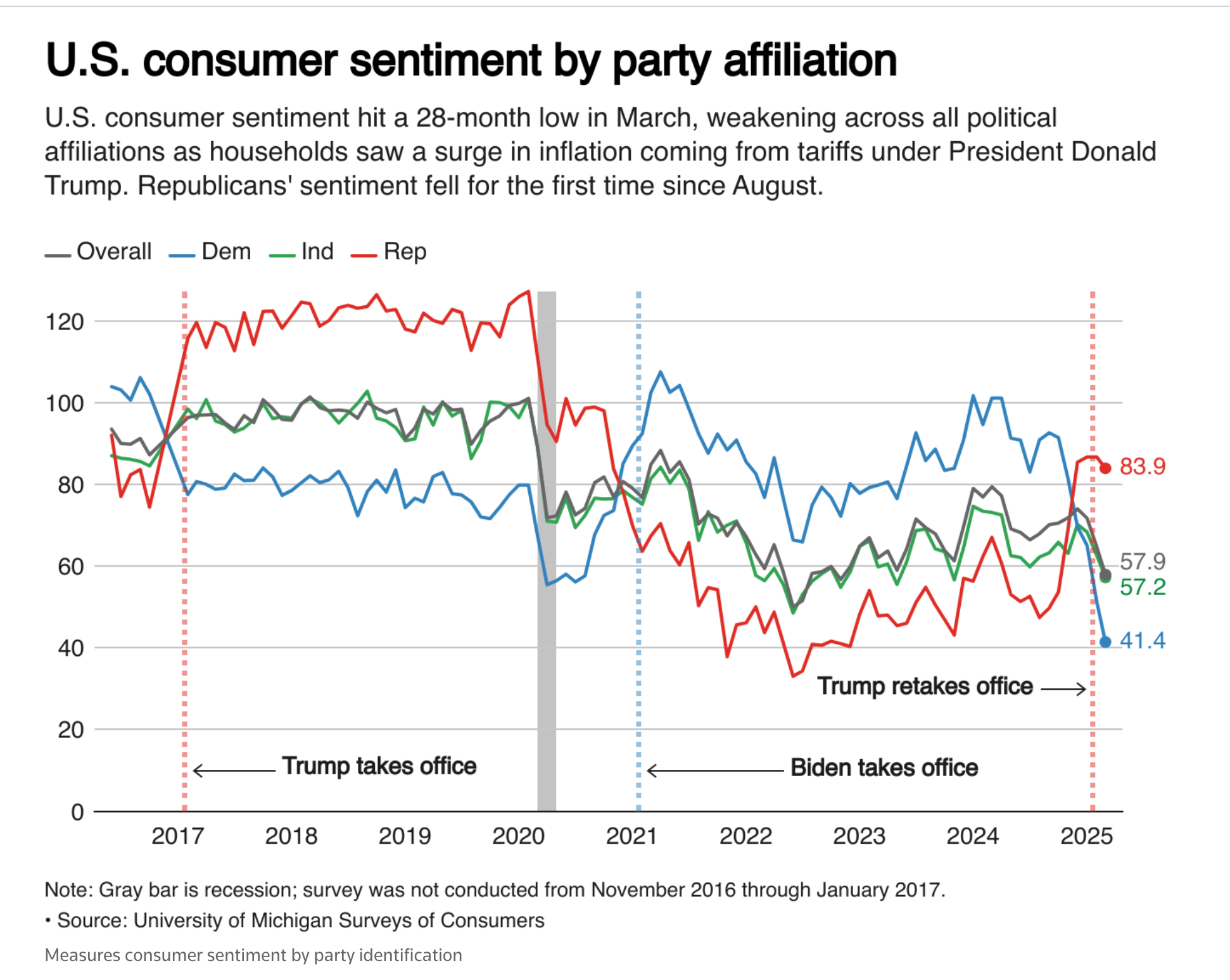

Republicans’ consumer sentiment dropped below Democrats’ for the first time since Trump's 2025 re-election, illustrating a significant shift. Their sentiment declined to 83.9, while Democrats’ fell to 41.4. This reversal indicates changing economic perceptions across party lines, highlighting varied responses to political and economic developments.

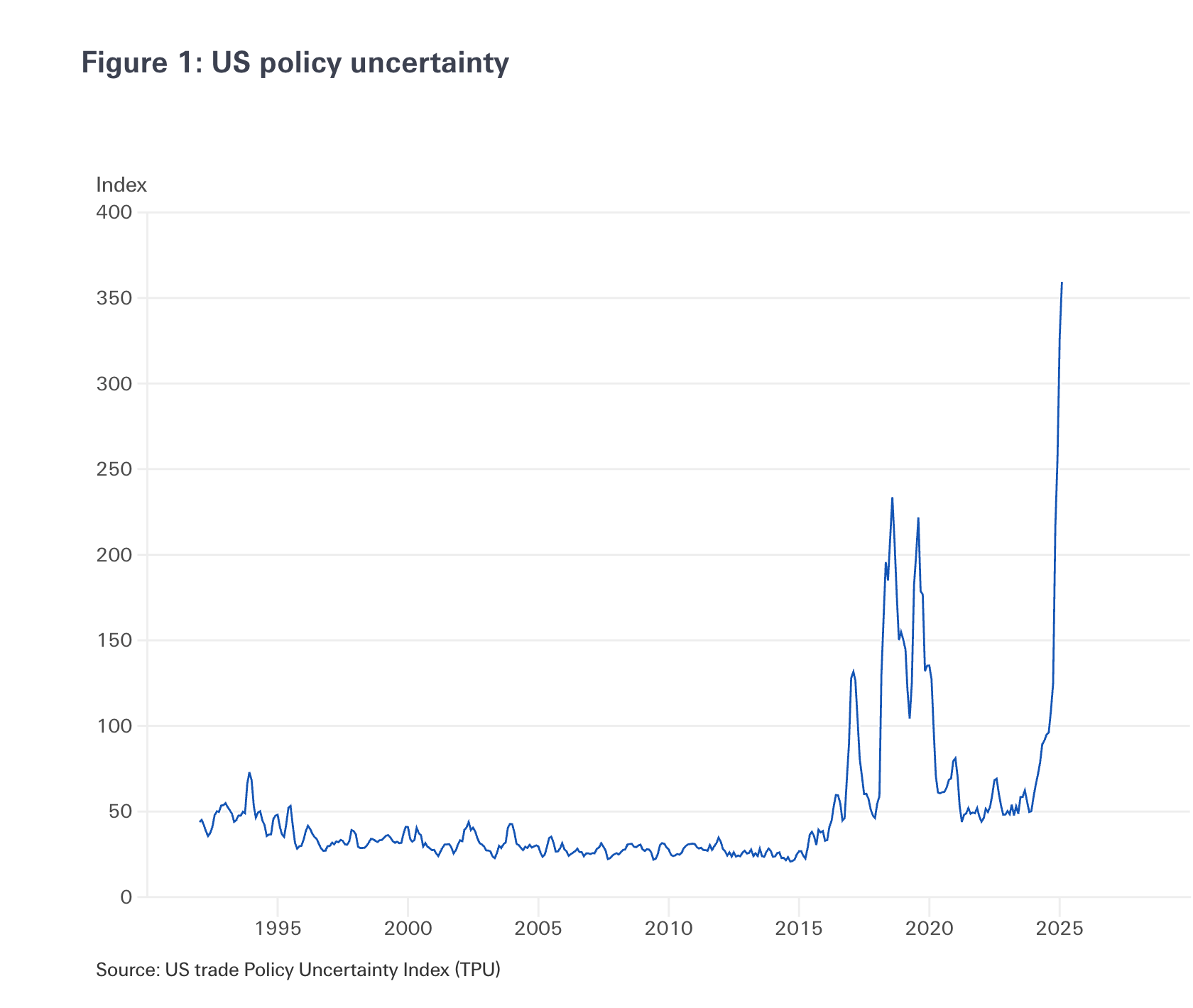

US policy uncertainty skyrocketed in recent years, peaking at a record 350, nearly five times the pre-2016 average. This unprecedented surge signifies substantial economic instability, potentially impacting investor confidence, market volatility, and decision-making for businesses and policymakers.

THE IDEAS:

Mentions: AAPL, SPG, MSFT, TSLA, BX

01. AI drives massive data center power demand

The AI boom is revolutionizing the power sector by significantly increasing electricity demand, due to the growth of data centers. This shift pushes the energy industry to adapt quickly, offering opportunities for investment in power supply and infrastructure enhancements.

Related reading:

Power Magazine: AI Boom Reshapes Power Landscape as Data Centers Drive Historic Demand Growth

02. Trade deviates to geopolitical partners

Global trading patterns are shifting as geopolitical allies increasingly trade more with each other and less with rivals. This trend has implications for supply chains and sectors dependent on international trade, such as technology and consumer goods.

Related reading:

Freight Waves: McKinsey: Geopolitical partners trading more with one another, less with rivals

YouTube: Global #economy in "uncharted territory" from #tariff impact

03. Investment rotating from US to global markets

Investors are starting to shift capital from US markets to global opportunities due to various geopolitical and economic changes. This realignment may affect US stock valuations and boost emerging markets.

Related reading:

Reuters: Investors spy the dawn of a tectonic shift away from US markets

04. Tariff policies reshape global economic outlook

Tariff-driven economic changes are significantly impacting global trade dynamics, affecting growth projections and encouraging strategic adjustments in multinational corporations. This trend poses risks to dependent industries, requiring adaptation and new strategic approaches.

Related reading:

NBER: Trade and Structural Change: Focusing on the Specifics -- by Andrew Greenland, John Lopresti

Financial Times: It's a growth scare first and a tariff scare second