MARCH 09, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Advances in carbon capture technology (Financial Times)

- Wirecard fugitive linked to spy ring (Financial Times)

- India faces challenges post major financial loss (Bloomberg)

- Brush fires impact Long Island Pine Barrens (Bloomberg)

- Walgreens billionaire sees empire unravel (WSJ)

- Scammers take savings, victims face tax issues (NY Times)

TWO GRAPHS:

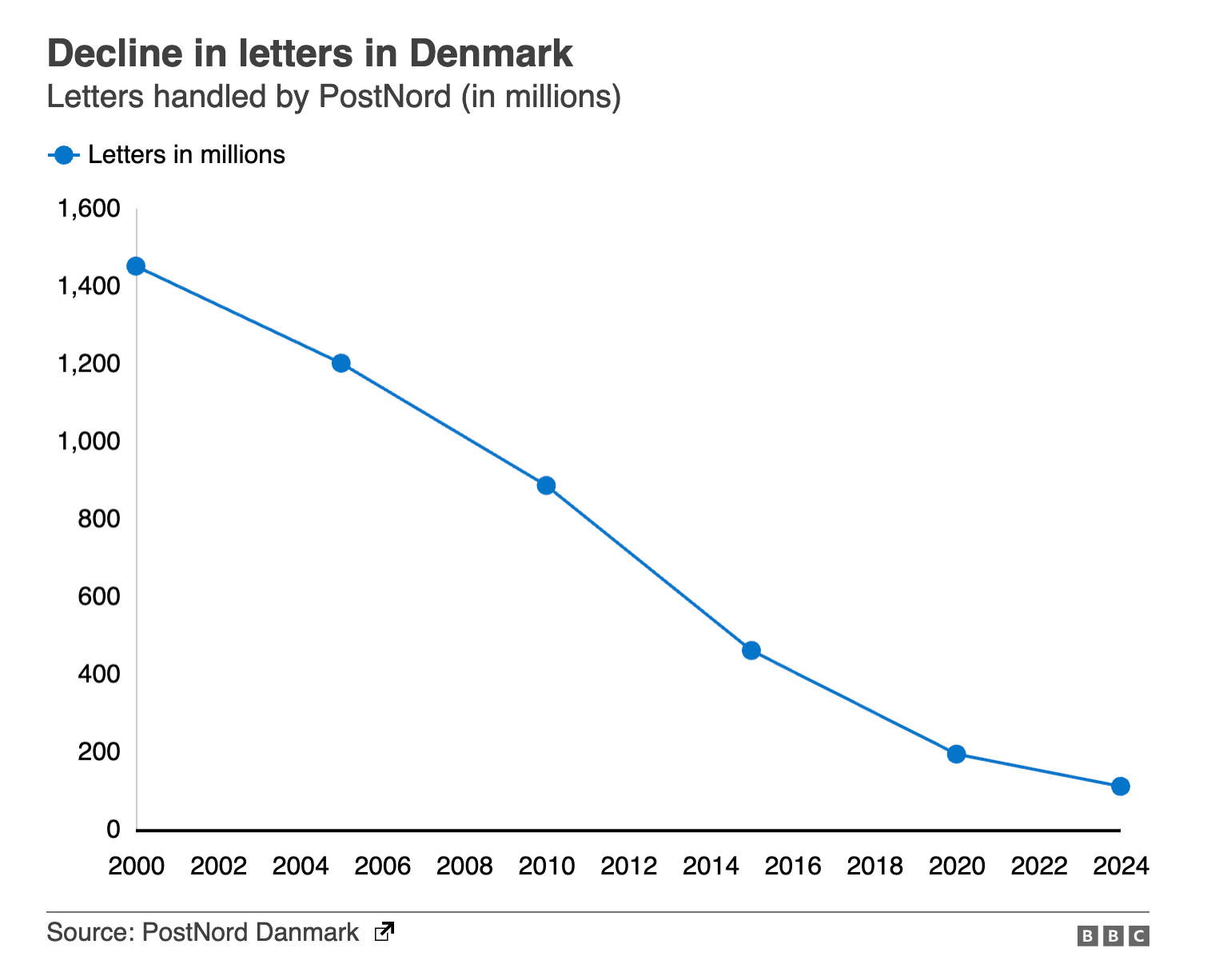

Denmark's letter volume dropped from 1.4 billion in 2000 to under 200 million by 2022, illustrating over an 85% decrease. This sharp decline underscores the significant impact of digital communication on traditional mail, challenging postal services to adapt.

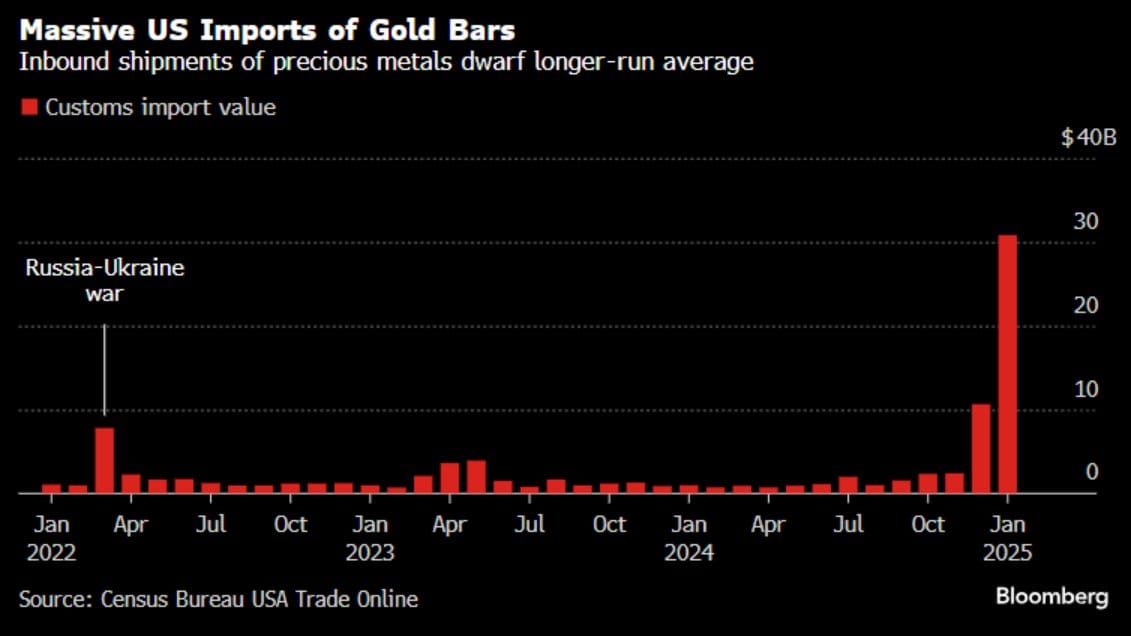

U.S. gold bar imports surged to nearly $40 billion by early 2025, a dramatic increase compared to previous years. This spike may indicate economic uncertainty or strategic financial adjustments, especially after the Russia-Ukraine conflict, reflecting significant shifts in global trade dynamics and investment strategies.

THE IDEAS:

Mentions: DEEP, CLF, TSLA, SPGI, GS

01. Data centers amplify energy demand growth

The expansion of AI and technology demands increasingly large data centers, driving substantial growth in energy consumption. This trend can stress power grids but also create opportunities in the renewable energy sector. Over 6-24 months, expect higher investments in energy infrastructure.

Related reading:

Power Magazine: AI Boom Reshapes Power Landscape as Data Centers Drive Historic Demand Growth

02. Tariff impacts create global economic uncertainty

The imposition of tariffs has placed the global economy in 'uncharted territory', potentially disrupting trade patterns and creating uncertainty. This requires businesses to rethink supply chains and investments. In the next 6-24 months, expect shifts towards localized production.

Related reading:

YouTube: Global #economy in 'uncharted territory' from #tariff impact

03. US market shift towards previously lagging sectors

There is a noticeable rotation in stock markets, with investments moving away from winners to previously underperforming sectors. This trend may create opportunities in undervalued markets and resources over the next 6-24 months.

Related reading:

Morningstar: A Stock Market Rotation Is Underway. Will It Last?

04. China's AI efforts bolster its economic stance

China's AI advancement led by companies like DeepSeek could reinvigorate its economic landscape, attracting global investment despite current economic challenges. Expect renewed interest from investors in Chinese tech stocks within 6-24 months.

Related reading:

CNBC: DeepSeek-led AI adoption offers China an opportunity to boost its sputtering growth

CNBC: DeepSeek's AI breakthrough could get global investors interested in China again