MARCH 02, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Instagram apologizes for violent video flood (WSJ)

- Mexico extradites 29 drug bosses to U.S. (WSJ)

- Instagram faces backlash for graphic content (Bloomberg)

- Buyout reveals fuzzy math in private equity deals (Bloomberg)

- BP shifts focus to oil and gas (NY Times)

- US economy strained by tariffs and spending cuts (NY Times)

- Stripe rebounds to $90bn valuation amid AI demand (FT)

TWO GRAPHS:

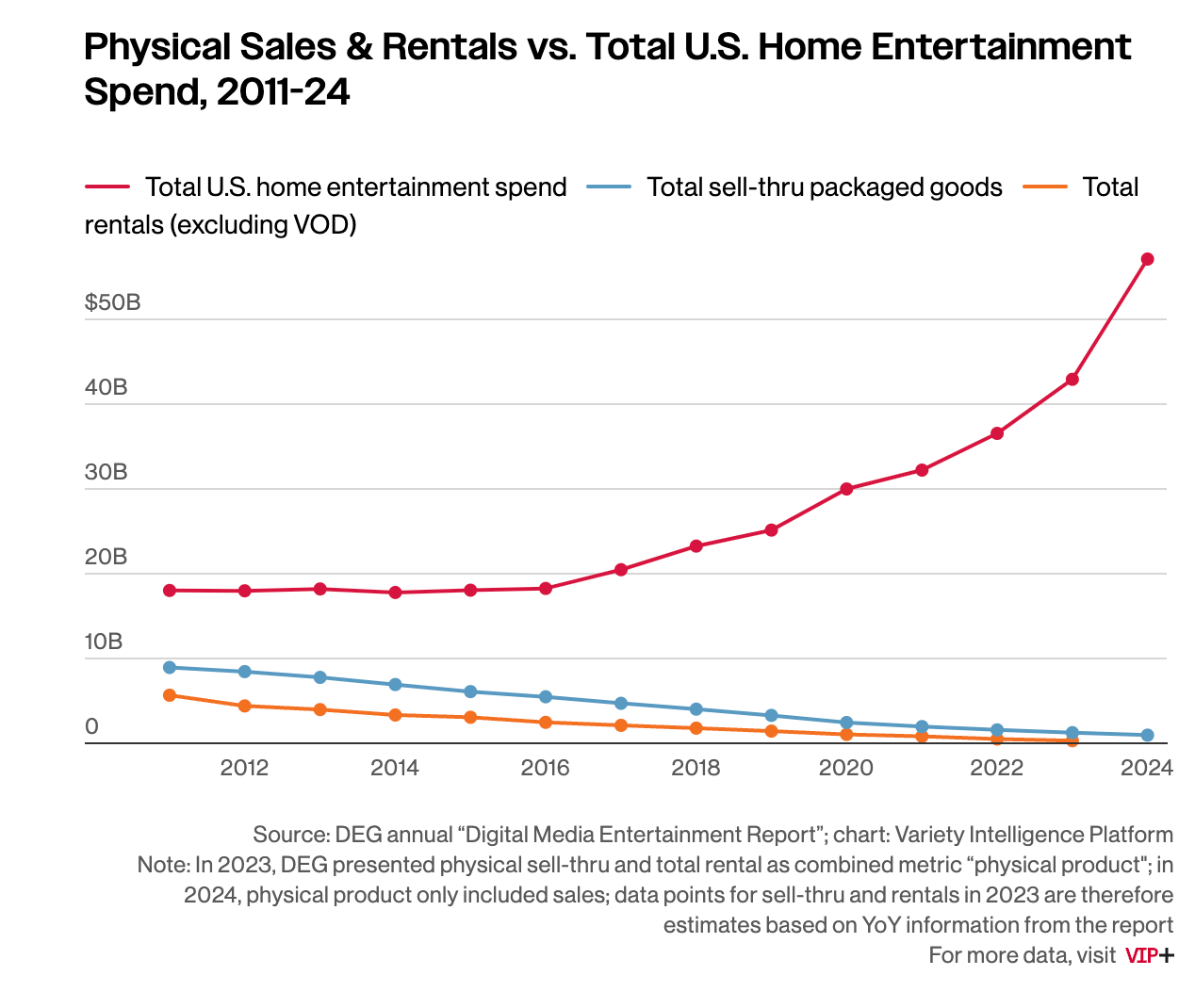

U.S. home entertainment spending is projected to reach nearly $50 billion by 2024, marking a significant increase from around $20 billion in 2011. This contrasts sharply with the decline of physical rentals and sales, highlighting a shift towards digital and streaming formats, reshaping the industry landscape.

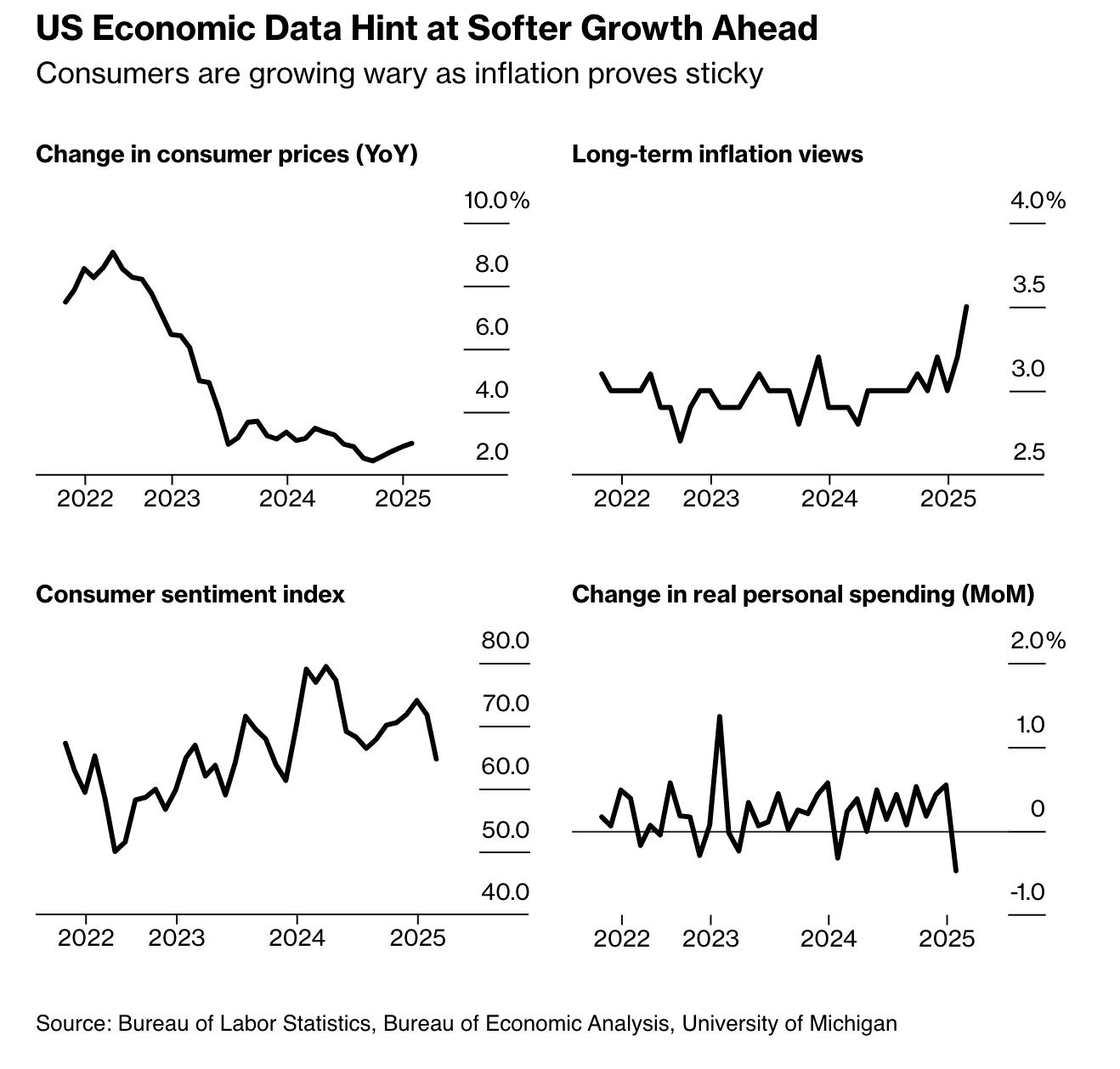

Long-term inflation views surged to the highest in years above 3.5%, despite declining year-over-year consumer price changes since 2022. This shift correlates with falling consumer sentiment, highlighting growing economic concerns and potential impacts on spending and economic stability.

THE IDEAS:

Mentions: PLTR, Goldman, DeepSeek, TikTok, StatNews

01. AI boosts investor interest in China

DeepSeek-led AI adoption is revitalizing global investor interest in Chinese stocks, even amidst economic downturns. Such breakthroughs attract increased international investments, strengthening China's market position over the next 6-24 months.

Related reading:

CNBC: DeepSeek-led AI adoption offers China an opportunity to boost its sputtering growth

CNBC: DeepSeek's AI breakthrough could get global investors interested in China again

02. Embedded insurance central to retail strategy

Embedded insurance is increasingly vital for retailers and brands seeking value-added services, presenting a substantial strategic pivot in customer engagement methods. This trend will reshape retail landscapes within 24 months.

Related reading:

Insurance Journal: Viewpoint: Insurers Risk Losing Out if They Ignore Embedded Insurance Opportunities

03. Geopolitical trade realignment emerging

Geopolitical partners are increasingly prioritizing trade among allies over rivals, signaling significant shifts in global trade dynamics. This realignment will impact global supply chains and economic policies over the next two years.

Related reading:

FreightWaves: McKinsey: Geopolitical partners trading more with one another, less with rivals

04. Tech disrupting traditional sports

Advances in technology are transforming traditional sports sectors, offering new economic models and growth opportunities and challenging old mindsets. These developments will redefine the sports business landscape swiftly over the next two years.

Related reading:

Sportico: The Traditional Sport Mindset Can Be a Trap When Tech Advances