FEBRUARY 23, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Berkshire Hathaway hits record tax bill (Bloomberg)

- Inflation gauge drops to seven-month low (Bloomberg)

- Musk demands federal workers report accomplishments (WSJ)

- DOGE asserts billion-dollar savings, details pending (WSJ)

- Businesses anticipate tax cut extension impacting economy (NY Times)

- Berkshire profits rise through U.S. Treasury investments (NY Times)

- Buffett reassures shareholders on record cash pile (FT)

TWO GRAPHS:

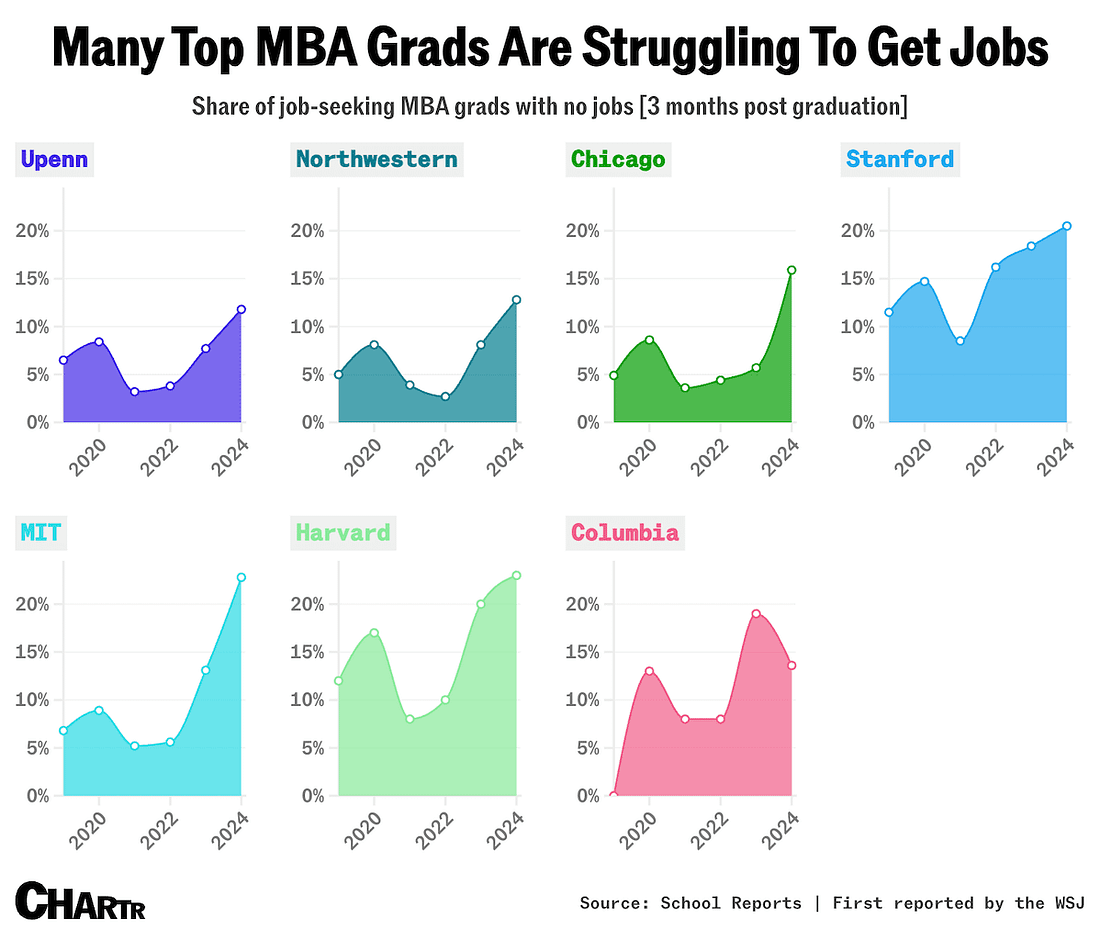

MIT shows a sharp increase in job-seeking MBA grads without jobs, rising to nearly 20% in 2024, the highest among the schools, doubling its 2022 figure. This significant rise highlights potential hurdles in the job market for top-tier graduates, signaling potential economic or industry shifts.

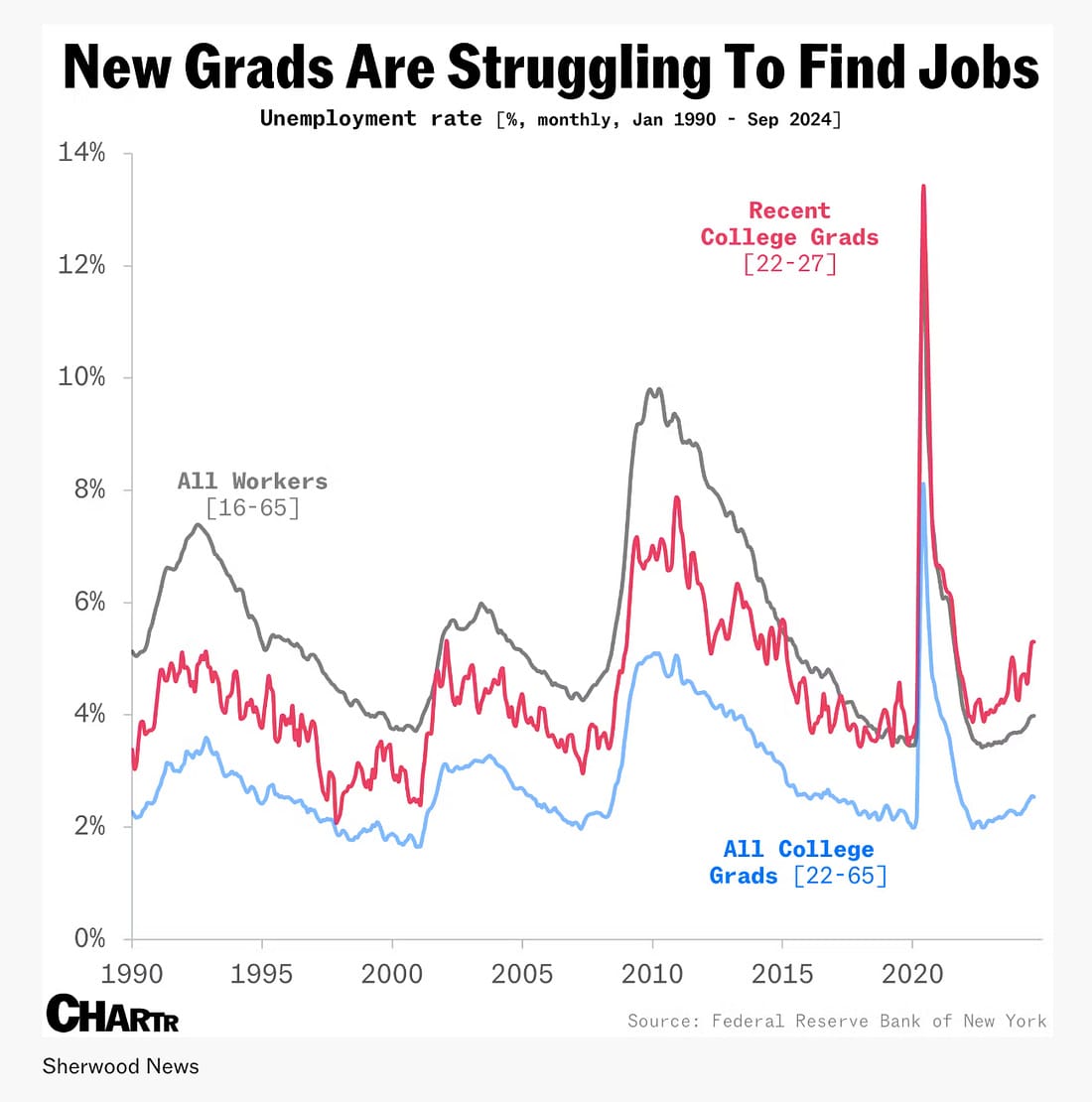

Recent college graduates face the highest unemployment rates in decades, spiking to nearly 14% in 2020, compared to 9% for all workers. This disparity highlights increased vulnerability and economic challenges for new graduates entering the workforce.

THE IDEAS:

Mentions: DeepSeek, AI, China, Insurers, Markets

01. DeepSeek AI revives global interest in China.

DeepSeek's AI achievements present China as a hub for technological advancements, counteracting recent economic gloom and attracting foreign investment. This reinvigorates China's market appeal, facilitating a potential shift in global capital flow back towards Chinese equities and innovation sectors over the next 12-24 months.

Related reading:

CNBC: DeepSeek-led AI adoption offers China an opportunity to boost its sputtering growth

CNBC: DeepSeek's AI breakthrough could get global investors interested in China again

02. Embedded insurance becoming central retail strategy.

Embedded insurance is transforming into a key strategy for retailers, offering bundled insurance products to enhance value propositions. This trend creates new revenue streams and strengthens customer loyalty, which could lead to significant shifts in insurance sales dynamics and retailer-insurer collaborations over the next 1-2 years.

Related reading:

Insurance Journal: Viewpoint: Insurers Risk Losing Out if They Ignore Embedded Insurance Opportunities

03. Geopolitical partners trade more, reducing rival reliance.

Increased trade within geopolitical alliances signifies a shift towards economic insularity, reducing dependency on adversarial nations. This could lead to more targeted economic policies and bilateral trade agreements, affecting global supply chain realignment and diversification strategies over the next couple of years.

Related reading:

FreightWaves: McKinsey: Geopolitical partners trading more with one another, less with rivals

04. AI adoption disrupting labor market dynamics.

AI is fundamentally altering job structures by automating tasks and influencing job competency requirements, leading to a need for reskilling and altering employment patterns across industries. This emerging trend could create significant demand for education services and employment policies to adapt over the next 1-2 years.

Related reading:

Phys.org: Is AI already shaking up the labor market? Four trends point to major change