FEBRUARY 16, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- DeepSeek fuels $1.3 trillion China stock rally (Bloomberg)

- Corporate America fears profit outlook amid equity rally (Bloomberg)

- Broadcom and TSMC consider splitting Intel's chip business (WSJ)

- New spy unit leads Russia’s shadow war against US (WSJ)

- Amazon union push fails in North Carolina (NY Times)

- Economic uncertainty challenges business leaders (NY Times)

- Michelin reintroduces culture of deference (FT)

- Understanding Elon Musk's influence (FT)

TWO GRAPHS:

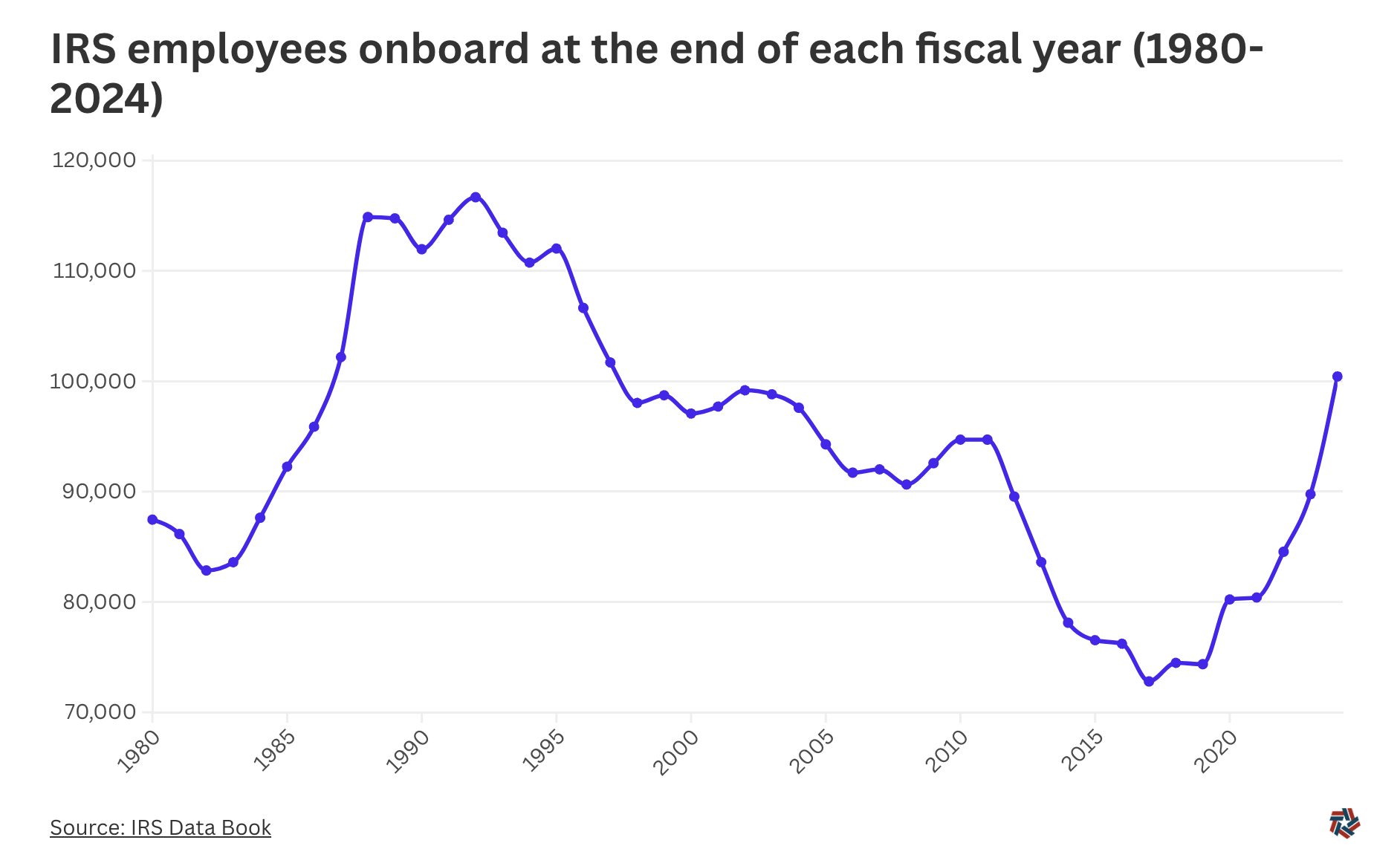

IRS staffing has surged from a low in 2015 to projected levels in 2024 not seen since the early 1990s. This sharp increase of roughly 30,000 employees over a decade could enhance tax enforcement and processing efficiency amidst evolving fiscal demands.

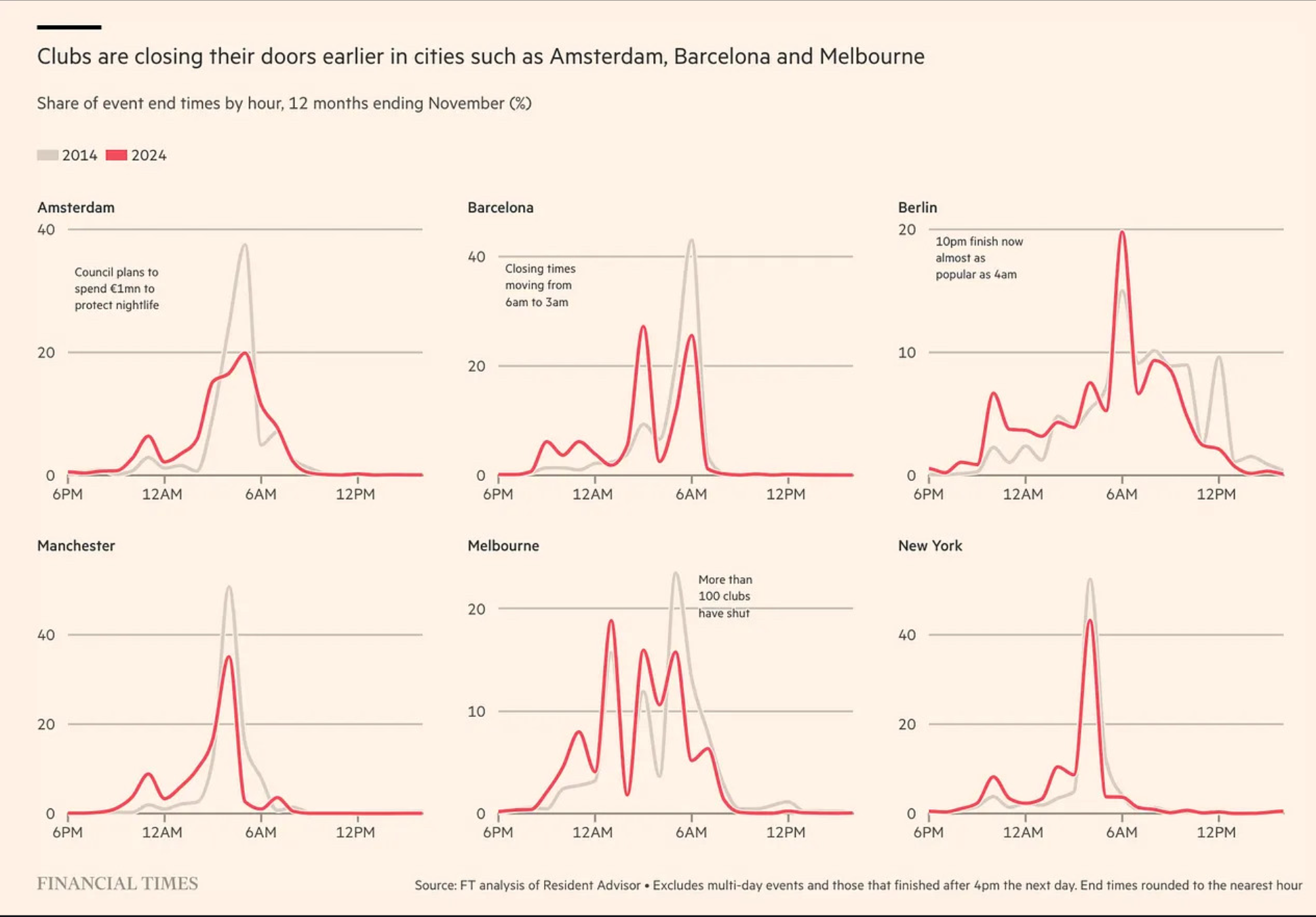

Barcelona's nightlife now ends significantly earlier, with club closing times shifting from 6 AM to 3 AM. This three-hour change highlights a major cultural shift and potentially impacts the local economy and nightlife culture.

THE IDEAS:

Mentions: MSFT, NVDA, DEEP, MCK, JD.V

01. AI to rejuvenate interest in China

DeepSeek's AI breakthrough is invigorating global investor interest in Chinese markets, potentially reversing the trend of economic skepticism. By showcasing innovation, it adds appeal to previously hesitant investors, which may revitalize Chinese stocks.

Related reading:

CNBC: DeepSeek's AI breakthrough could get global investors interested in China again

02. Trump tariffs heighten trade uncertainty

With Trump revealing plans for new tariffs, there is significant potential for volatility in global trade. This development introduces uncertainty for industries relying on the global supply chain, particularly affecting manufacturing and trade-dependent sectors.

Related reading:

YouTube: Indian Carmaker Gears Up for Trump Tariff Uncertainty

03. Energy shift towards sustainability and integration

Key trends indicate a major pivot towards sustainable energy, driven by geopolitical needs for security and infrastructure upgrading. As regions focus on interconnected networks, energy efficiency and renewables become attractive growth sectors.

Related reading:

Financial Times: The investment trends shaping the global energy transition

POWER Magazine: 2025’s Energy Crossroads: 6 Trends Redefining the Global Power Sector

04. Geopolitical partners prefer mutual trade

A study by McKinsey indicates a shift where countries are increasingly opting to trade within alliances and reduce reliance on geopolitical rivals. This trend suggests a strategic decoupling and realignment of global trade dynamics.

Related reading:

FreightWaves: McKinsey: Geopolitical partners trading more with one another, less with rivals