FEBRUARY 09, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- American prosperity threatened in weekend essay (FT)

- $4bn cuts may harm US medical research (FT)

- Judge blocks Musk's DOGE from treasury system (WSJ)

- Soho House faces billionaire feud and takeover issues (WSJ)

- Elliott builds stake in BP (Bloomberg)

- Musk’s team seeks Treasury data access (Bloomberg)

- N.F.L. network coordinates TV advertising with game pauses (NY Times)

- Business newsletter Feed Me rises in popularity (NY Times)

TWO GRAPHS:

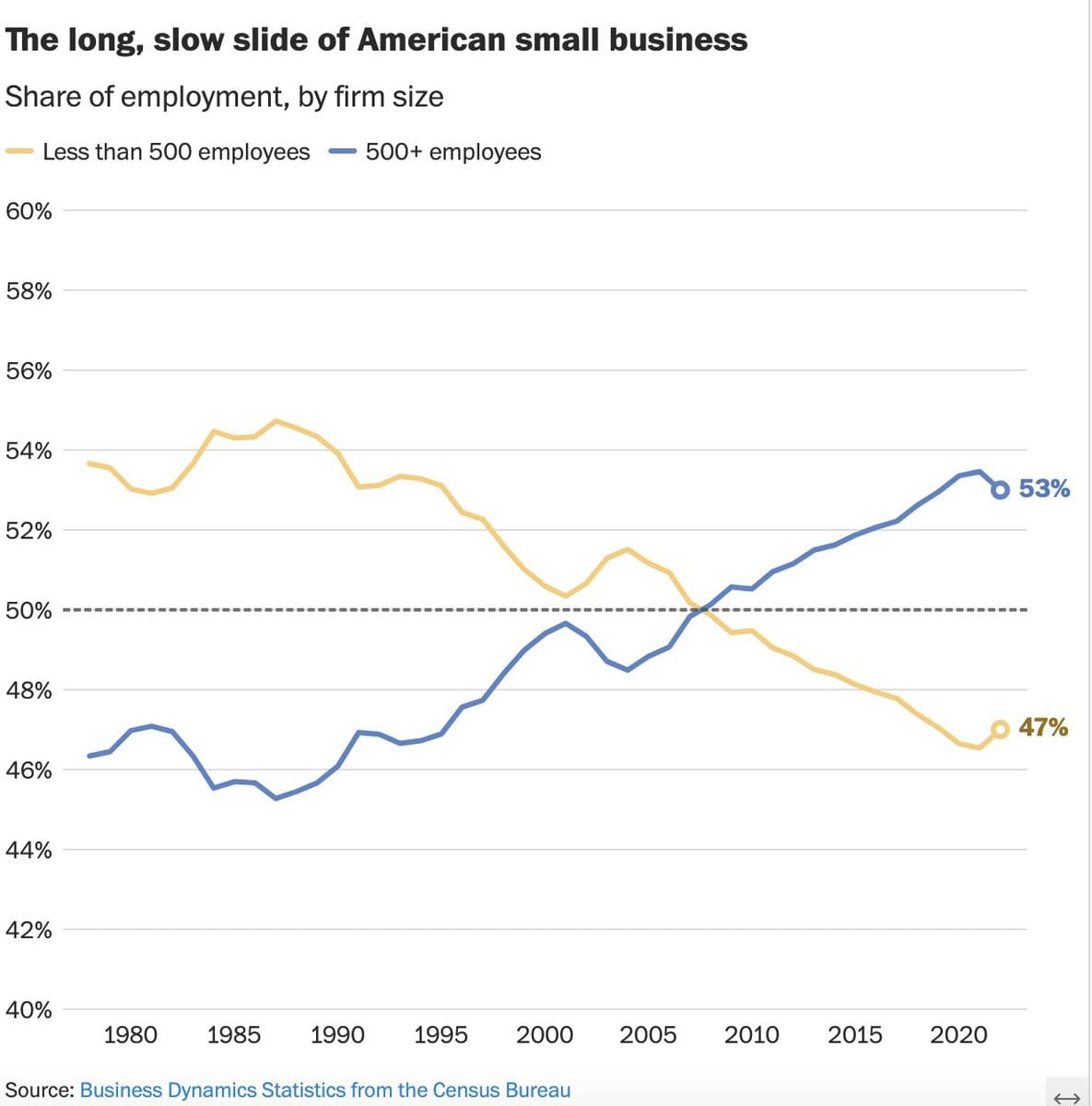

Employment in firms with over 500 employees surpasses those with fewer than 500, reaching 53% compared to 47%. This shift began around 2000, highlighting the growing dominance of larger businesses, which impacts economic dynamics and policy considerations.

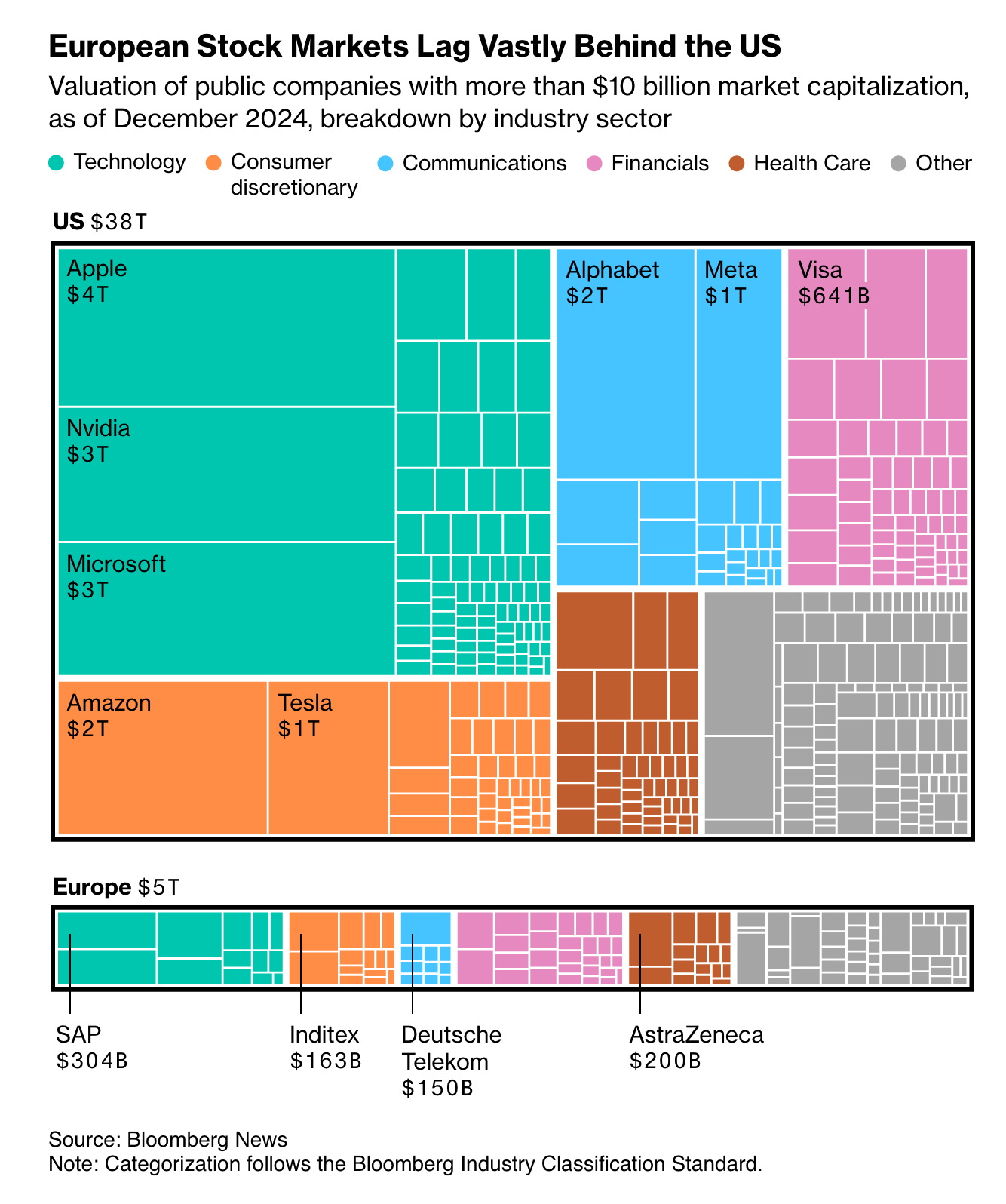

U.S. tech giants Apple, Nvidia, and Microsoft alone surpass Europe's entire market capitalization by $5 trillion. Europe's leading firms are dwarfed, with SAP at $304 billion. This stark contrast highlights the dominance of U.S. technology in global markets, potentially influencing economic power dynamics and investment trends.

THE IDEAS:

Mentions: TCS, META, MSFT, NVDA, SLB

01. AI breakthrough drives renewed China interest

DeepSeek's AI advancements spark global investors to reconsider allocations to China despite ongoing economic concerns. This technological progress could revive foreign interest in Chinese markets and lead to increased investment flows, impacting the country's tech sector over the next 24 months.

Related reading:

CNBC: DeepSeek's AI breakthrough could get global investors interested in China again

YouTube: Nouriel Roubini on DeepSeek, AI's Impact on Jobs, Health, Stocks

02. Energy transition bolsters infrastructure investment

Increasing demand for large battery storage is reshaping energy generation and infrastructure investment. This trend highlights a shift towards sustainable energy solutions, creating opportunities for sectors involved in energy generation, transmission, and distribution over the next two years.

Related reading:

Financial Times: The investment trends shaping the global energy transition

POWER Magazine: Four Energy Trends to Watch in 2025

03. Climate risks prompt strategic business adjustments

As climate risks top risk manager concerns, businesses are adjusting strategies and investing in sustainability. This shift could lead to a surge in demand for green technologies and services, altering corporate priorities and operational frameworks.

Related reading:

Insurance Journal: Climate Risks Again Top List of Risk Manager Worries

Phys.org: Building a circular future: Study reveals key organizational capabilities for sustainability

04. Southeast Asia benefits amid US-China tensions

Southeast Asia is becoming a focal point for investors due to geopolitical tension between the US and China. The influx of investment into this region is generating potential opportunities despite challenges in extracting value from investments.

Related reading:

Financial Times: South-east Asia calculates its next move as US and China face off

Eurasia Group: Cutting USAID creates a vacuum – and says that creates opportunity for the US’ adversaries, like China.