JANUARY 26, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Wall Street banks to sell billions in loans (WSJ)

- Home sales drop to 30-year low (WSJ)

- KTM's lenders resist debt proposal (Bloomberg)

- BASF earnings drop on impairments, restructuring (Bloomberg)

- US regulator addresses significant securities concerns (FT)

- Venture Global falters in Wall Street debut (FT)

- Inflation fix targets non-existent energy emergency (NY Times)

- Tech's TikTok dilemma on law compliance (NY Times)

TWO GRAPHS:

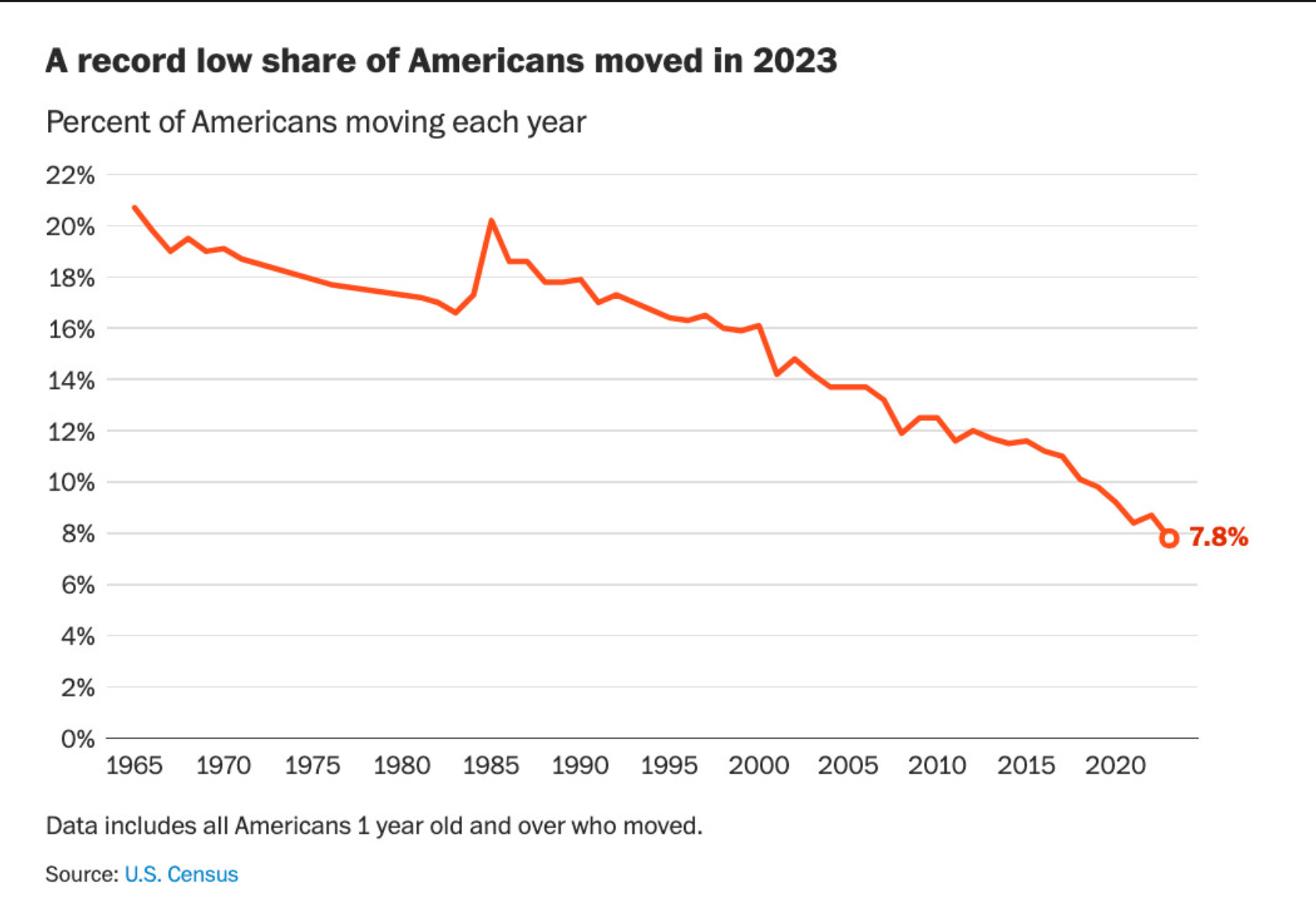

The percentage of Americans moving has reached a record low at 7.8% in 2023, compared to over 20% in the late 1960s. This decline indicates reduced mobility, potentially impacting economic dynamics and regional development.

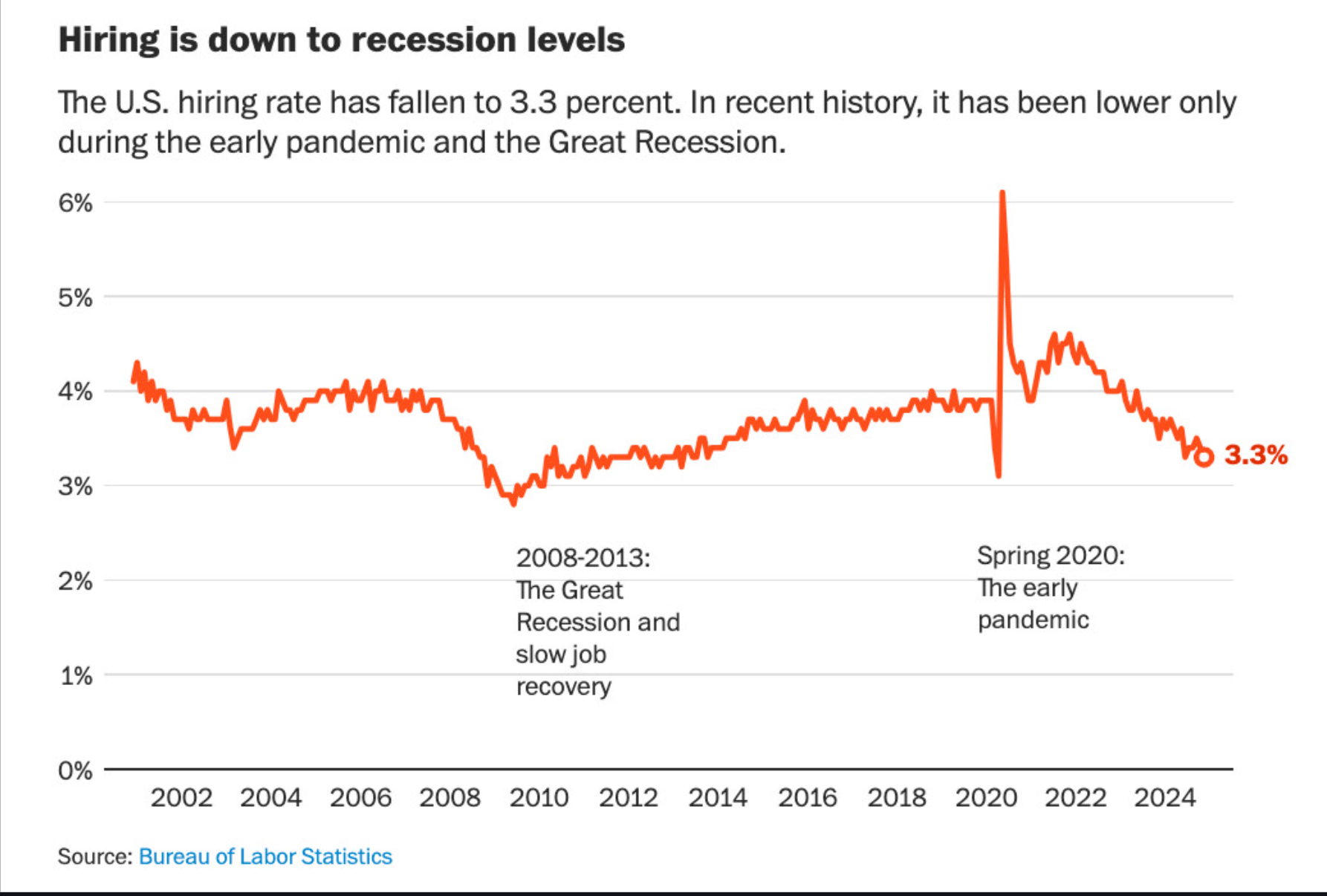

The hiring rate has dropped to 3.3%, matching levels seen only during severe economic downturns like the early pandemic and Great Recession. This decline signifies potential economic instability, highlighting challenges in job market recovery amidst current conditions.

THE IDEAS:

Mentions: XOM, TSLA, MASTERCARD, MSFT, VISA

01. Geopolitical tensions driving energy innovation

Amidst rising geopolitical tensions, calls for scientific 'safe zones' indicate a global push for neutral grounds fostering international collaboration, potentially leading to innovations like IIASA in energy sectors as countries seek energy self-sufficiency.

Related reading:

Phys.org: Amid rising geopolitical tensions, researchers call for 'safe zones' for scientific collaboration

Power Magazine: 5 Trends Shaping the EMIA Power Industry in 2025

02. AI adoption reshapes consumer business models

The widespread adoption of generative AI across industries is transforming consumer engagement and business operations. Companies are focusing on how AI tools are applied, altering marketing strategies and product offerings.

Related reading:

SPGlobal: As generative AI sweeps across industries and the consumer landscape...

Skift: New Skift Feature: Uncovering Tech Vendor Opportunities Using AI Analysis

03. Diversifying energy investments amid market shifts

Energy sectors are transforming, with data centers impacting energy generation. Investments in power by tech firms signal a shift in energy landscape, with Morgan Stanley predicting a 40% rise in stocks within the power sector.

Related reading:

Power Magazine: Generational Shift—Data Centers Bring Change to Energy Landscape

CNBC: The power sector is 'transforming,' Morgan Stanley says, naming global stocks set to rise 40%

04. India's power demand bolstered by economic growth

India's booming economy is intensifying demand for power, driven by AI, electric vehicles, and technology adoption, which is impacting energy strategies and attracting investments in these sectors.

Related reading:

Twitter: RT 1. AI. 2. EVs.. 3. Bitcoin.... 4. India....... = Power Demand

CNBC: CNBC's Inside India newsletter: India's deepening ties with natural gas