JANUARY 12, 2025—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Marketers brace for potential TikTok ban (NY Times)

- U.S. Steel explores new paths after merger block (NY Times)

- California's insurance crisis worsens with infernos (WSJ)

- Raging wildfires destroy acres in Los Angeles (WSJ)

- World exceeds 1.5C warming target in 2024 (FT)

- BlackRock exits climate group amid green concerns (FT)

- Bonuses soar at major Wall Street banks (Bloomberg)

- New blaze erupts in LA, worsening fire situation (Bloomberg)

TWO GRAPHS:

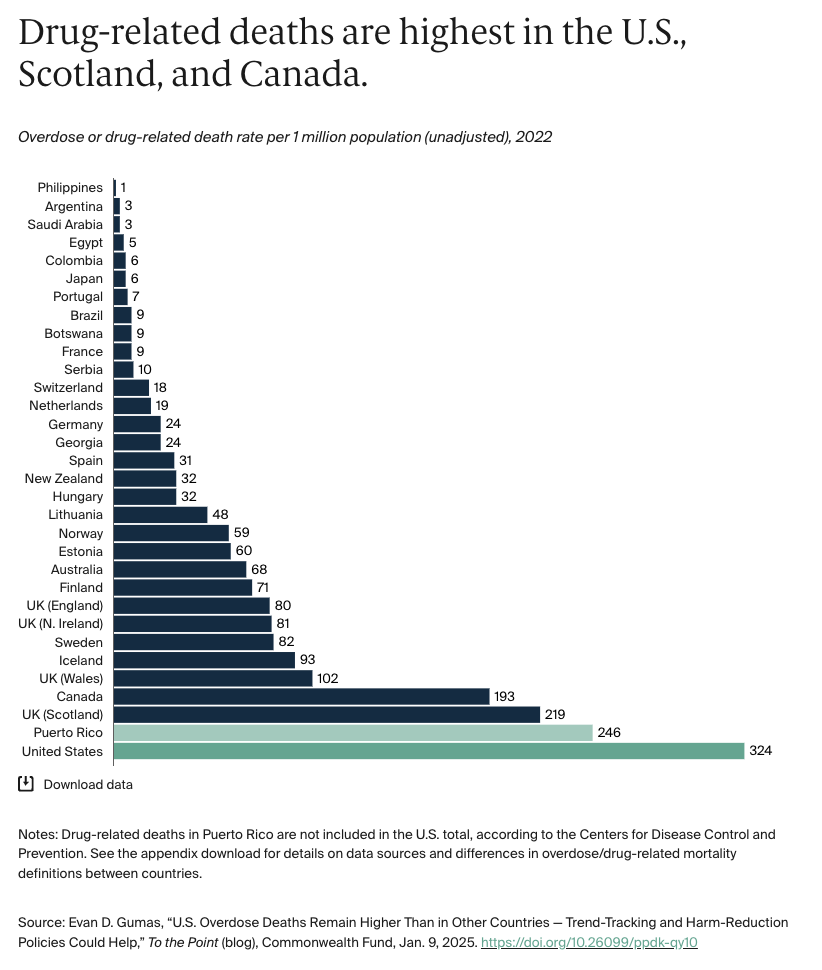

The U.S. has a drug-related death rate of 324 per million, over 300 times higher than the Philippines' rate. This stark contrast highlights the severity of the U.S. drug crisis, emphasizing the need for effective intervention and policy reform.

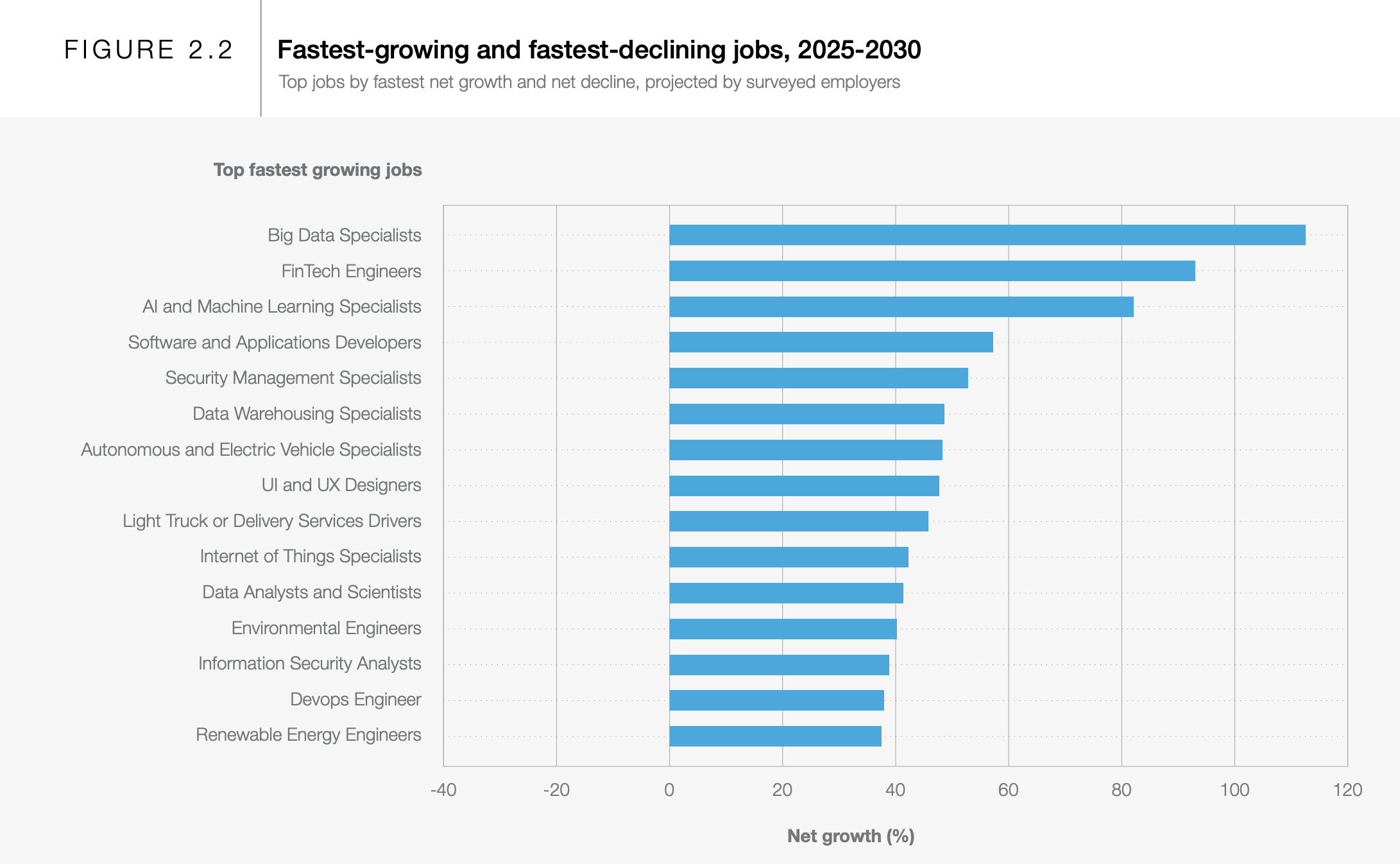

Big Data Specialists lead with over 110% growth, outpacing FinTech Engineers. This highlights the critical role of big data in driving technological advancement and decision-making, underscoring a shift towards data-centric industries.

THE IDEAS:

Mentions: $LMND, $TSLA, TCS, Skift, POWER Magazine

01. Tech-driven data centers reshape energy landscape

Tech companies are heavily investing in power generation to meet the massive energy demands of data centers. This shift is creating substantial changes in the global energy landscape. Over the next 6-24 months, this trend could impact energy sector investments and foster new technology advancements.

Related reading:

POWER Magazine: Generational Shift—Data Centers Bring Change to Energy Landscape

02. Agricultural disruption from climate and policy shifts

The agriculture sector is facing disruptions due to anticipated low commodity prices, extreme weather events, and changes in food policy. These factors will reshape industry priorities and impact supply chains, influencing food prices and farming practices globally over the next couple of years.

Related reading:

Agriculture Dive: 5 agriculture trends to watch in 2025

03. ESG risks demand more nuanced investor strategies

Investors are increasingly integrating ESG scores into decision-making to mitigate scandal risk. This nuanced understanding of ESG factors is crucial for smarter investment strategies. The evolving landscape of ESG investing will influence corporate transparency and investor relations.

Related reading:

Phys.org: ESG scores and scandal risk: How can investors make smarter choices?

Macrobond: US unemployment trend signals potential recession; revival in ESG investing and a shift in IT

04. Travel industry pivots towards experiential and sustainable

The travel industry is seeing a major shift towards offering unique experiences and focusing on sustainability. This trend is driven by changing consumer behavior and technological advancements, reshaping marketing strategies and travel services over the next two years.

Related reading:

Skift: What the Skift Travel Health Index Signals for 2025

Skift: Skift Global Forum Video: The Evolving Role of Experiences in Travel