DECEMBER 29, 2024—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Tariffs threaten affordable car market (WSJ)

- Sturgis hosts massive biker event, challenges city leaders (WSJ)

- Russia allegedly downs Azerbaijan passenger plane (FT)

- Finland seizes Russian oil tanker after incident (FT)

- Japanese stocks rise on yen weakness (Bloomberg)

- Nidec proposes $1.6 billion bid for Makino (Bloomberg)

- AI reshapes American economic geography (NY Times)

- Hollywood economy suffers post-strike (NY Times)

TWO GRAPHS:

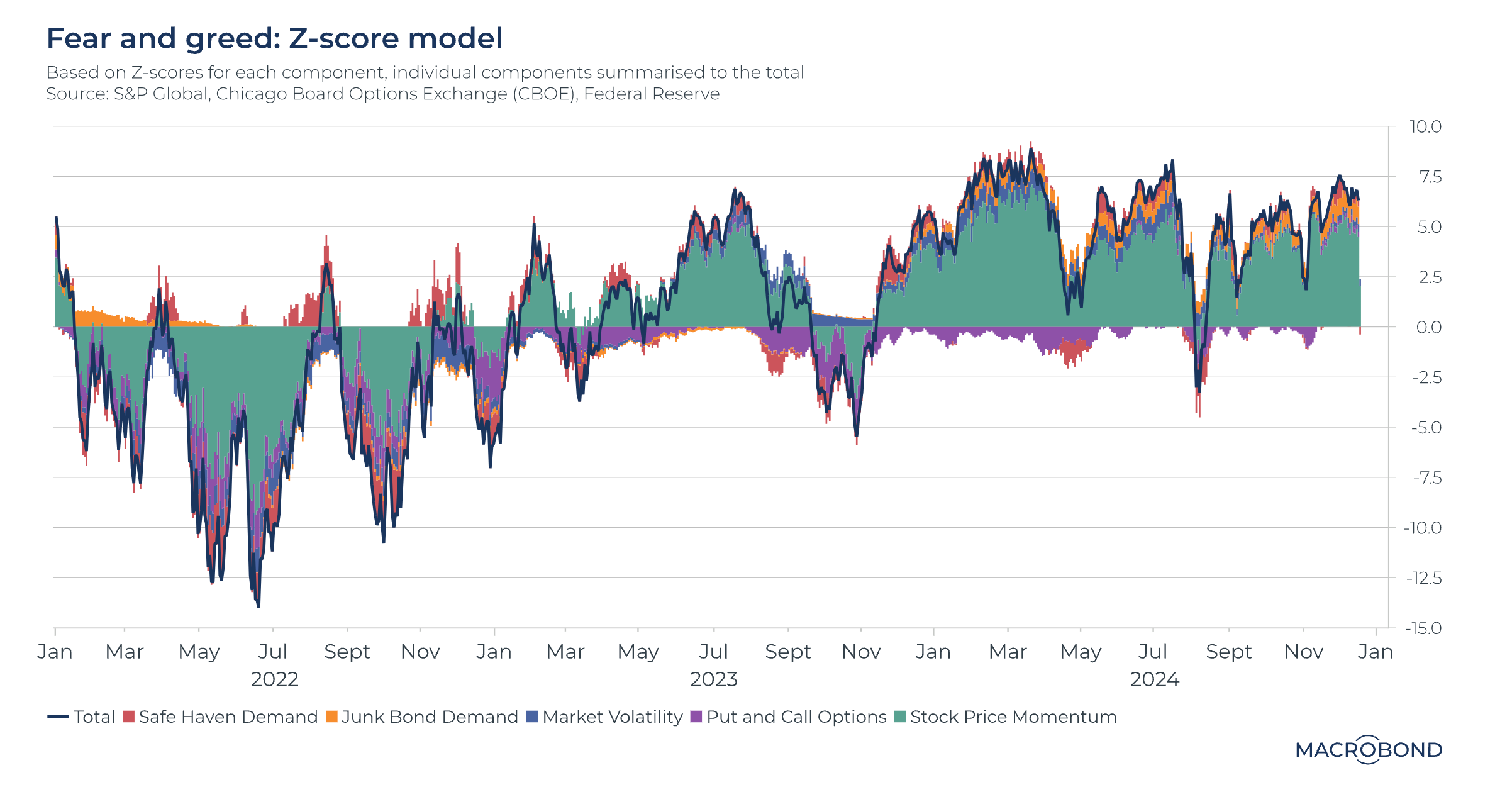

Stock price momentum shows a significant surge post-mid-2022, contrasting with earlier downturns. The 10-point rise indicates improved market sentiment, overshadowing heightened market volatility. This shift matters as it reflects increased investor confidence and potential economic stability, influencing investment strategies and economic forecasts.

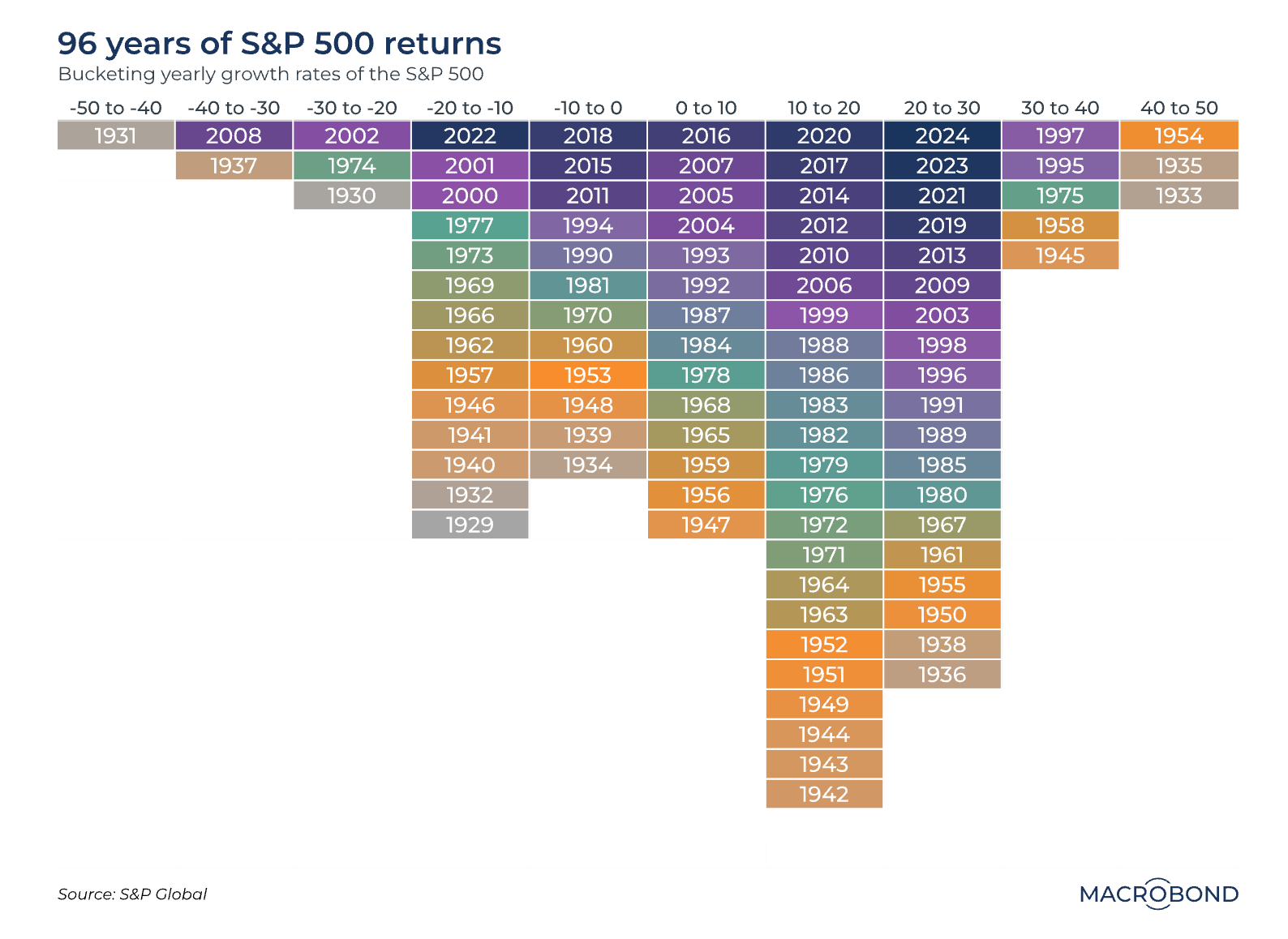

The S&P 500 experienced exceptionally high returns of 40-50% in 1954, contrasting sharply with severe declines of -50 to -40% in 1931. This drastic fluctuation highlights the volatility and potential for both significant gains and losses in historical market performance, underscoring the importance of strategic risk management.

THE IDEAS:

Mentions: SPGI, MCK, OXFD, WSJ, SBI

01. AI Redefines Tech Vendor Opportunities

AI is being leveraged to uncover new tech opportunities, such as system upgrades and digital transformations, offering significant growth potential for tech vendors targeting future RFPs and market niches.

Related reading:

Skift: New Skift Feature: Uncovering Tech Vendor Opportunities Using AI Analysis

02. Localized Consumer Experiences Surge

Consumers increasingly prefer localized and personalized shopping experiences, driving businesses to innovate in retail environments and new consumer engagement strategies through platforms like TikTok.

Related reading:

WSJ: Eating in Designer Stores, Shopping on TikTok: Five Consumer Trends for 2025

Skift: Expedia’s ‘Phenomena Tourism’ Trend: 5 Tips for Destination Marketers

03. Societal Interactions Drive Economic Research

A shift in economic research focuses on societal interactions rather than traditional models, offering new insights and frameworks for understanding economic growth and development.

Related reading:

Phys.org: Civil society: A quiet revolution in economic research

Phys.org: Q&A: How do companies grow? Economics study shows surprising findings on growth strategies

04. Industrial Growth Reaches Critical Juncture

After years of stagnation, the industrial sector is poised for growth, presenting opportunities for investments as sector transformations gain momentum.

Related reading:

Oxford Economics: Industry Key Themes 2025: Industrial landscape at a critical juncture