DECEMBER 22, 2024—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Record $600bn inflows to global bond funds (FT)

- Valencia floods expose disaster prediction failures (FT)

- ‘God Bless America’ Fund gains 33%, outpacing rivals (Bloomberg)

- Tesla gains $570 billion from Musk's trade (Bloomberg)

- Amazon workers protest in New York City (NY Times)

- Egg prices soar due to bird flu outbreak (NY Times)

TWO GRAPHS:

23andMe Holding Co.'s stock has plunged 98.41% from its peak, dropping from nearly $400 to $3.22. This significant decline signals investor concerns and potential financial instability, impacting market perceptions and investor confidence.

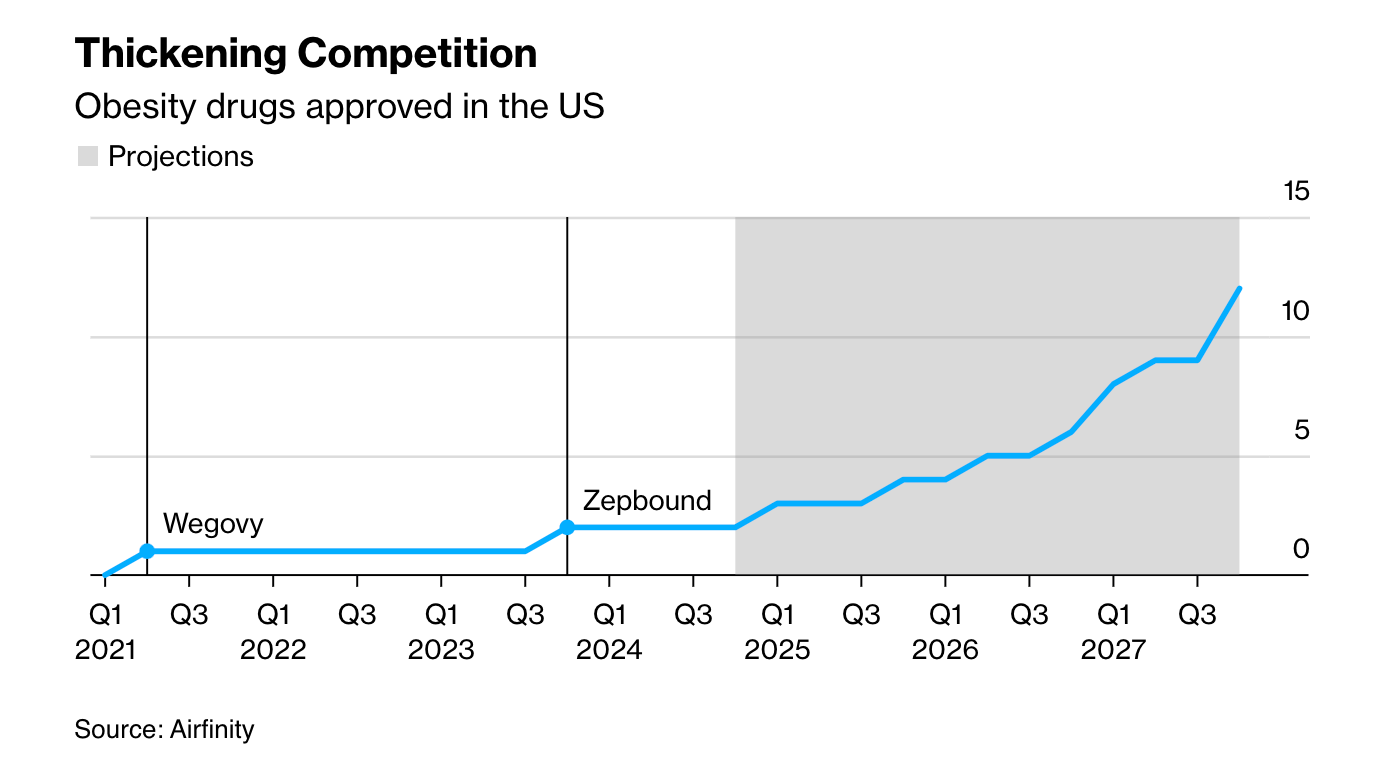

Obesity drug approvals in the US show a sharp rise from 2024, projected to reach over 10 by 2027. This rapid increase signals intensified industry competition and innovation, potentially broadening treatment options and impacting public health strategies significantly.

THE IDEAS:

Mentions: C;HON;NDAQ;REIT;DOCN;DDOG

01. Insurance digital transformation accelerates amid market shifts

Insurance industry is embracing digital improvements due to changing risks and softening market rates, enabling new products and cost efficiency which will transform industry practices and affect players like Hartford and Chubb. The changes impact underwriters and brokers by altering how risk is assessed.

Related reading:

Carrier Management: Soft Market Ahead? The Role of Digital Transformation for E&S Insurers

Insurance Industry Blog: Changing Risks, Rising Costs Drive Insurance Transformation for 2025: Majesco

02. Urban global connectivity boosts economic growth

Research indicates that increased connections between global cities drive up economic performance, enhancing GDP per capita. This trend impacts urban planning and investment strategies, showing potential for infrastructure investments in key cities like New York, Shanghai, and London.

Related reading:

Phys.org: Study reveals how global connections boost city economies

03. Industrial sector recovery signifies economic rebound

Industrials are witnessing a resurgence, as indicated by recent stock performance and analyst predictions for notable growth in companies such as Eaton and Honeywell. This recovery reflects broader economic momentum and may signal investment opportunities across the sector.

Related reading:

Oxford Economics: Industry Key Themes 2025: Industrial landscape at a critical juncture

CNBC: Citi analysts see big jumps ahead for 3 industrial stocks — 1 call really surprised us

04. Macro trends highlight volatility in financial markets

Recent assessments show distinctive trends in financial markets, such as divergent central bank strategies and indicators within the US and China. These macro trends contribute to volatile trading environments, affecting investments in REITs and the NASDAQ.

Related reading:

Macrobond: Insights from China and India’s High Frequency Indicators, US REIT and NASDAQ trends