DECEMBER 08, 2024—GENERAL EDITION

This is a weekly free look of our premium daily Four Ideas email. If you're not already a subscriber, sign up for a five-day preview.

HEADLINES:

- Bitcoin reaches $100,000 milestone (NY Times)

- Nvidia's CEO avoids $8 billion in taxes (NY Times)

- Shooting highlights enmity in health insurance industry (Bloomberg)

- China stocks rally on stimulus expectations (Bloomberg)

- Killer's clues spark anger at health insurers (WSJ)

- Stock market not doomed despite overvaluation (WSJ)

TWO GRAPHS:

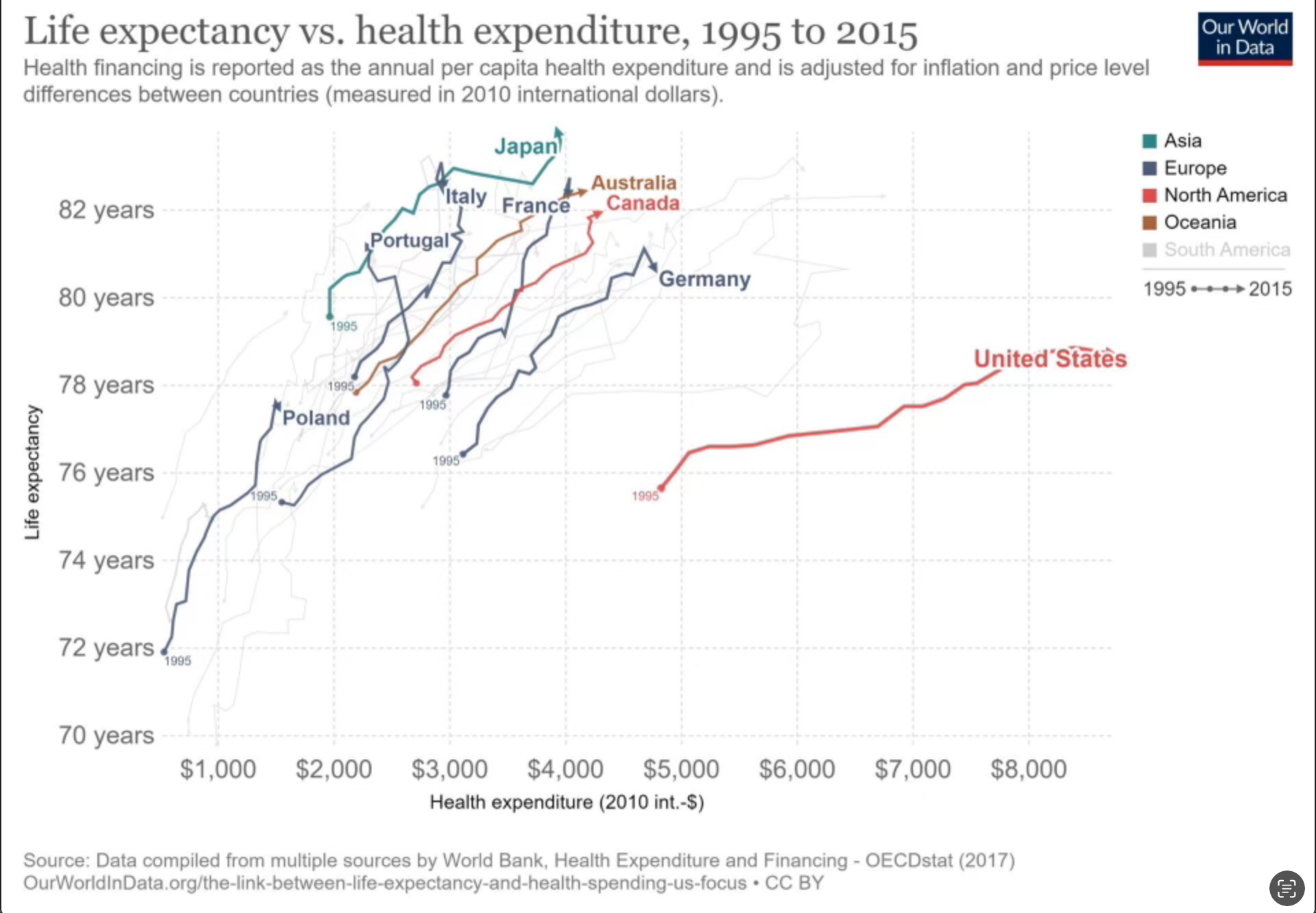

US life expectancy increased far less than other wealthy nations despite significantly higher per capita health spending. This reveals a concerning inefficiency in the US healthcare system, impacting health outcomes despite substantial financial investment.

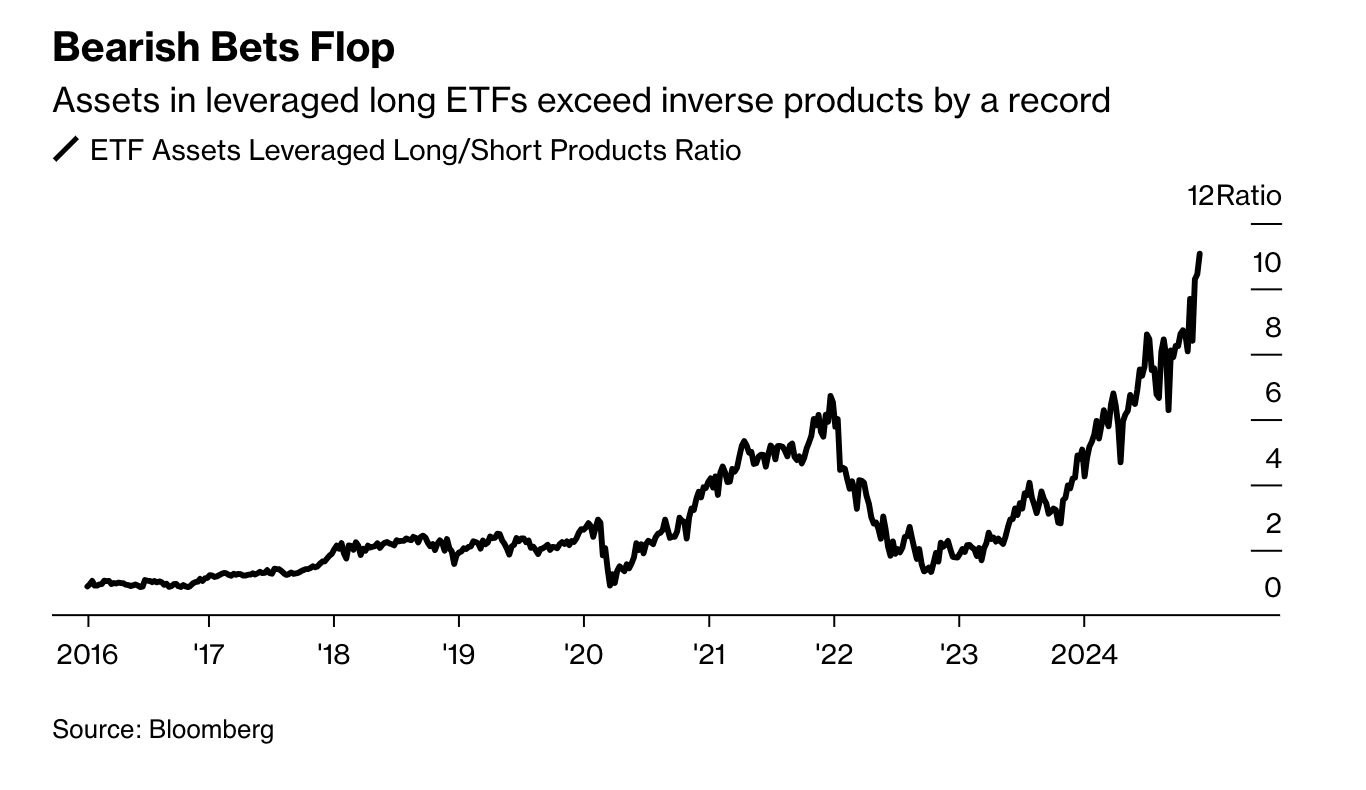

Leveraged long ETF assets drastically outpaced inverse products in 2024, reaching a record high ratio of over 10. This unexpected surge counters bearish market sentiment and reveals a surprising investor preference for long positions despite market volatility.

THE IDEAS:

Mentions: META,NVDA,GM,EFX,CI

01. Insurance embraces digital marketing by 2025

The insurance industry, typically slow in adopting innovations, is expected to fully integrate digital marketing strategies by 2025, driven by technology advancements and evolving customer expectations. This shift will likely enhance customer engagement and operational efficiencies, benefiting firms like Progressive and Nationwide.

Related reading:

Carrier Management: Viewpoint: What's on Tap for Insurance Digital Marketing in 2025?

02. C&I sector diversifies energy sources amid risks

The Commercial & Industrial sector is increasingly required to diversify energy sources due to rising electricity costs and supply chain risks. By investing in renewable and alternative energy options, companies can better manage costs and mitigate risks, impacting firms involved in sustainable energy.

Related reading:

Power Magazine: C&I Sector Must Diversify Power Sources to Lessen Costs, Supply Chain Risks

03. Cracks in US economic exceptionalism appear

Despite its strong performance, US economic exceptionalism shows signs of vulnerability in the global architecture, which could prompt policy changes affecting market dynamics. This evolving situation may influence major firms and sectors reliant on stable US economic output.

Related reading:

04. Generative AI reshapes industries and consumer landscape

Generative AI technology is rapidly transforming various industries by driving innovation and efficiency. This shift creates opportunities for companies in the tech sector, such as NVIDIA, to capitalize on AI implementation, benefiting the IT sector and broader economy.

Related reading: