Introduction

The rise of artificial intelligence (AI) and robotics isn't just transforming industries and job markets—it is reshaping economic theory and policy. As machines increasingly replace human labor across sectors, from manufacturing to white-collar professions, they're dismantling long-held assumptions.

In particular, this essay looks at how AI and automation are flattening the Phillips curve, a cornerstone of monetary policy that posits an inverse relationship between unemployment and inflation. By severing the traditional link between labor market tightness and wage pressures, AI and robots are challenging central banks' ability to manage inflation and employment, and increasing instability.

We explore the implications of this shift for monetary policy, income inequality, societal stability, and the future of work. We live in a machine age, where robots and AI, riding declining cost curves, and immune to wage negotiations and labor market pressures, are becoming the dominant workforce.

The Phillips Curve Puzzle

The Phillips curve, like many things in economics, generally works better in theory than in practice. Sure, it makes intuitive sense that inflation and unemployment are linked, and that it is an inverse relationship—lower unemployment is associated with faster growth, which is associated with higher inflation—but ... it hasn't always worked that way—and recently it just seems broken.

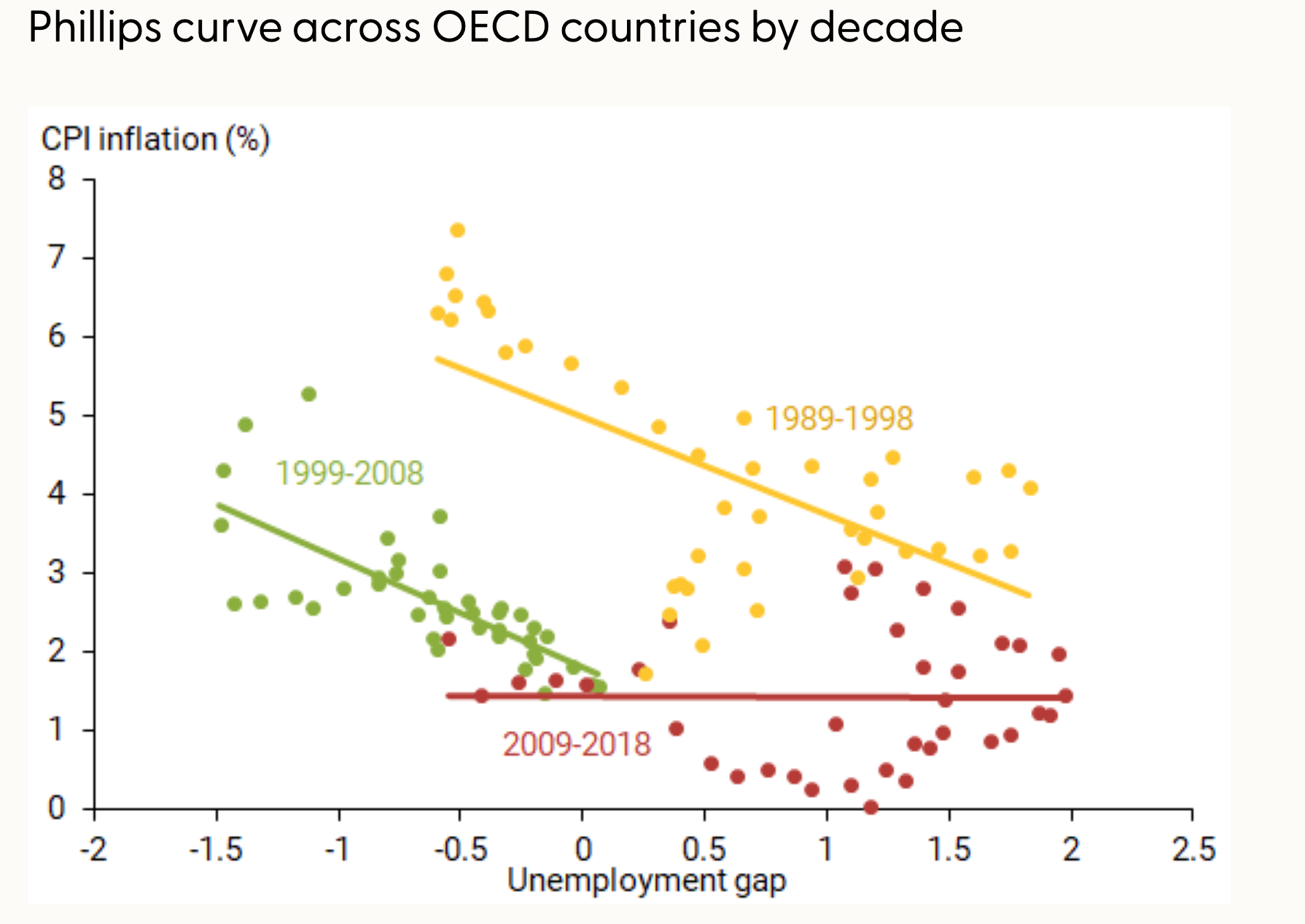

Check the following graph from a 2019 Federal Reserve Bank of San Francisco paper. The curve flattened a little in the 1980s and 1990s, and then basically flat-lined in the 2000s.

The above graphs are for the price Phillips curve, but a similar flattening can be seen in the wage Phillips curve. The difference, of course, is that the former curve relates change in prices to unemployment, while the latter one relates change in wages. Other than that, flattening is flattening.

Economists can't agree on why this is happening, even if most agree that it is important given the central role that an inflation/unemployment tradeoff plays in monetary policy. If there is newly less of a relationship, let alone none, then the understanding the causes matters immensely.

1. The Phillips curve is much flatter than it once was.

2. It is getting flatter yet.

3. It's not clear why.

4. It matters.

Why the Phillips Curve Has Gone ... Flat

There is an entire industry in trying to understand the changing curve, and I will just lay out the main arguments made. They are often made in combination with one another, and none of them satisfy:

- Increased central bank credibility. Banks don't need to take action; they just need to be seen as likely to take action, so inflation never gets a foothold because people think it will take action, which it doesn't need to, because people think that.

- Anchoring of inflation expectations. If people think inflation will stay low, it stays low, even if it should go high given economic growth or rates. Similarly, if inflation gets high, will anchor there, and think it will stay high, no matter what you do.

- Price and wage stickiness in low inflation. There is something special about low inflation that causes people to make a semi-stable state. It is not clear what that is, but low inflation is surprisingly sticky.

- Globalization. Increased pressure from emerging markets, especially China and India, has driven prices down and kept them there, exerting a similar effect on wages via outsourcing and offshoring.

- Bad measurements. Some argue that it is really just a measurement problem, and that conventional measures of unemployment do not accurately reflect the real labor market. They underemployment and hidden unemployment, for example, which causes measures to miss slack, which makes the curve look flatter than it really is.

- The curve is ... complicated. The curve is actually highly non-linear, is this argument, perhaps convex.

- Downward wage rigidity. Wages don't respond to higher levels of unemployment because employers find it too much trouble when dealing with white-collar workers. They may leave, or they may be hard to find again in future.

All of these have some explanatory power, but they are all missing something. And that something is how the world is changing, how the nature of employment and even work are changing in a labor market with a rising role for automation and AI. There needs to be new thinking.

The Rise of the Robots

When workers' bargaining power is reduced—when they can get even less of what they want than usual—employers have options. For example, companies react to changes in their market by changing the number of workers rather than changing their hours, leading to smaller wage adjustments when output fluctuates.

Why is bargaining power changing? In a word, automation. It can replace human tasks and reduce the relevance of job vacancies, making workers less essential. The decline in unionization rates and labor’s share of income have been linked to higher automation levels. Automation also boosts productivity, however, which makes it even more of a positive. Wages become even less responsive to employment changes, even though job volatility remains unchanged.